Deal Abstract

Alternative IRA that is built to invest in alternative assets such as cryptocurrency, startups, and loans. Has revenue but very tepid. Been in business for 5 years. Compare to CodeCombat, which raising at a lower valuation and had higher annual recurring revenue selling to extremely defensible base.

Want to invest alongside me? Subscribe to my premium newsletter, Startup Investing, to receive my exclusive recommendations on deals.

The 6 Calacanis Characteristics (91 161 18)

| Check | Yes/No |

| 1. A startup that is based in SV | No: Nashville, TN |

| 2. Has at least 2 founders | No (1) |

| 3. Has product in the market | Yes |

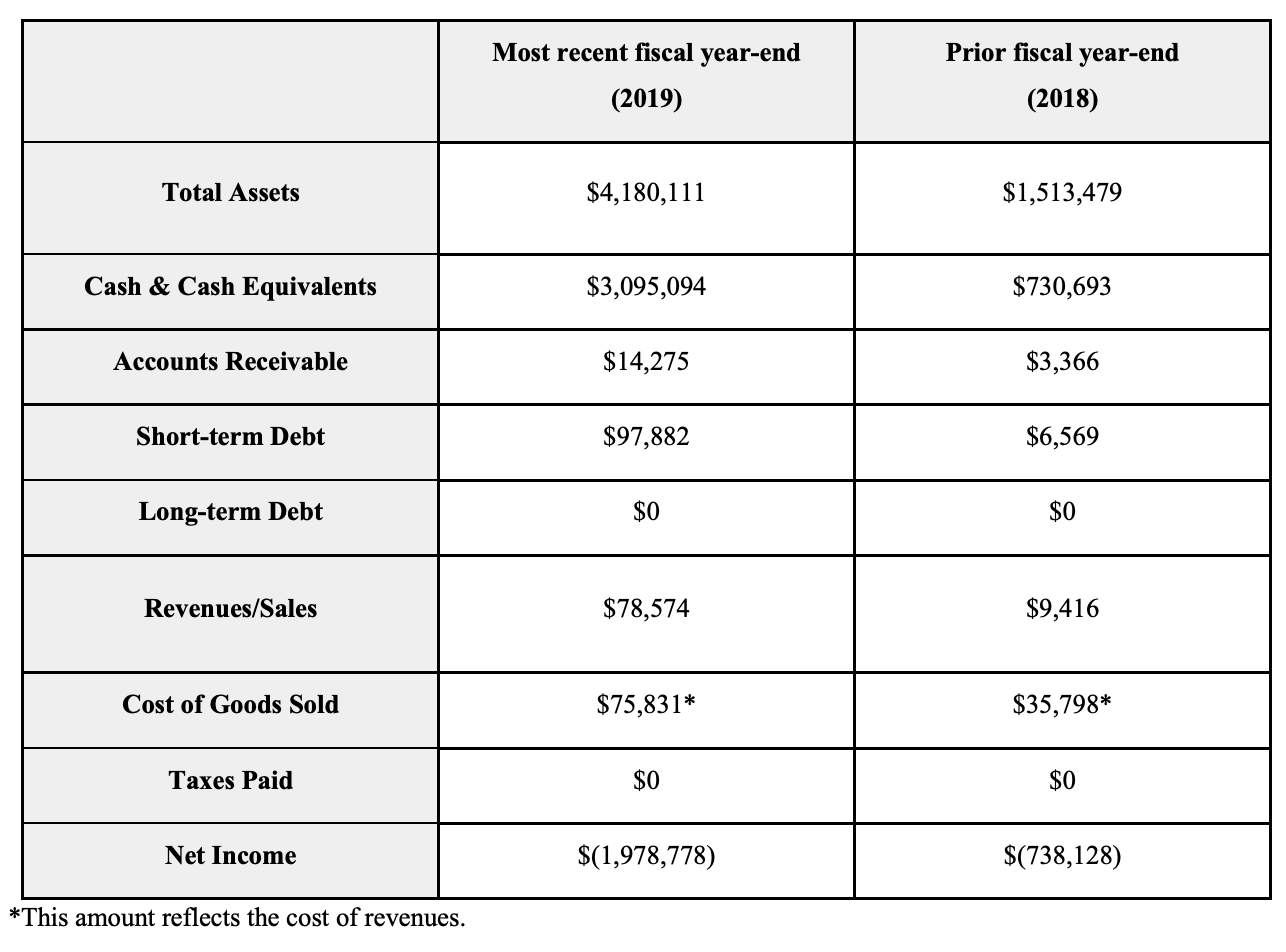

| 4. 6 months of continuous user growth or 6 months of revenue. | Yes: 2018 to 2019, revenue went from $9k to $74k. |

| 5. Notable investors? | No: “We’ve secured over $9.8M in funding to date from prominent investors like Moment Ventures, Jefferson River Capital (Vice-Chair of Blackstone Tony James’s Family Office), T.H. Lee, Sequoia Scout, Foundation Capital, Amplify LA, and Alumni Venture Group.” |

| 6. Post-funding, will have 18 months of runway | No: Burned $1.9m in in 2019 and raised only $470k at present. |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question (Can you create breakthrough technology instead of incremental improvements?):

- Average: Yes, people are interested in alternative investments more than ever, and retirement funds will help. But not seeing this as that venture backable of a company. It’s been around for 5 years and only has $78k in revenue.

- The Timing question (Is now the right time to start your particular business?):

- Average: See point 1.

- The monopoly question (No?):

- Bad: Never heard of this company before today.

- The people question (Do you have the right team?):

- Average: Founder Eric Satz seemed convincing, but not seeing any high profile exits in the same space.

- The distribution question (Do you have a way to deliver your product?):

- Average: Few people think about IRAs, but I guess digital distribution is fine.

- The durability question (Will your market position be defensible 10 and 20 years into the future?):

- Bad: Betterment/any of the fintech startups make their IRAs available to invest in alternative investments and boom. What if SeedInvest gives an IRA option?

- *What is the hopeful secret? (Have you identified an unique opportunity that others don’t see?):

- The number of people who want to invest in alternative investments, using their retirement accounts, is much larger than we expect.

What has to go right for the startup to return money on investment:

- At $30m, I’m skeptical of the firms ability to return money. To put this into perspective, CodeCombat (part of my portfolio) raised at a $25m valuation with revenues of ~$1.2M selling to a very defensible customer base.

What the Risks Are

- No market

- Vitamin not painkiller

- Non-venture growth

Muhan’s Bonus Notes

Hope they prove me wrong but not holding my breathe.

Financials (References)

- Current Fundraised: $470k

- Valuation: ~$30MM

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Eric Satz@muhan-zhang hi muhan. thanks for your questions. it’s not my goal to convince people to invest in alto. i think it’s important that investors do due diligence and come to their own conclusion. not every investment is for every investor at every stage of development. we all have our biases and that’s okay.

From CEO

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

Want to invest alongside me? Subscribe to my premium newsletter, Startup Investing, to receive my exclusive recommendations on deals.

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.