Ever wondered how real estate could be the key to unlocking fulfillment in your life?

Hey everyone,

It's been a while, but I've got some exciting news to share: I'm launching a real estate investment fund, with a focus on multifamily investments right in the heart of Cleveland, Ohio.

Courtyard Sihe Partners: Unifying Cultures and Directions

The name "Courtyard Sihe Partners" holds a special meaning for me. A courtyard, a nostalgic architectural space, entirely enclosed by the walls of a building, symbolizes unity. "Sihe" in Chinese represents the four cardinal directions—north, south, east, and west. For me, Courtyard Sihe Partners embodies a meeting point for investors from different cultures, generations, enclosed by the enduring asset that is real estate.

For those who want to know how I landed on this next evolution of my work, read on...

From Startups to Politics to Media: A Journey of Fulfillment

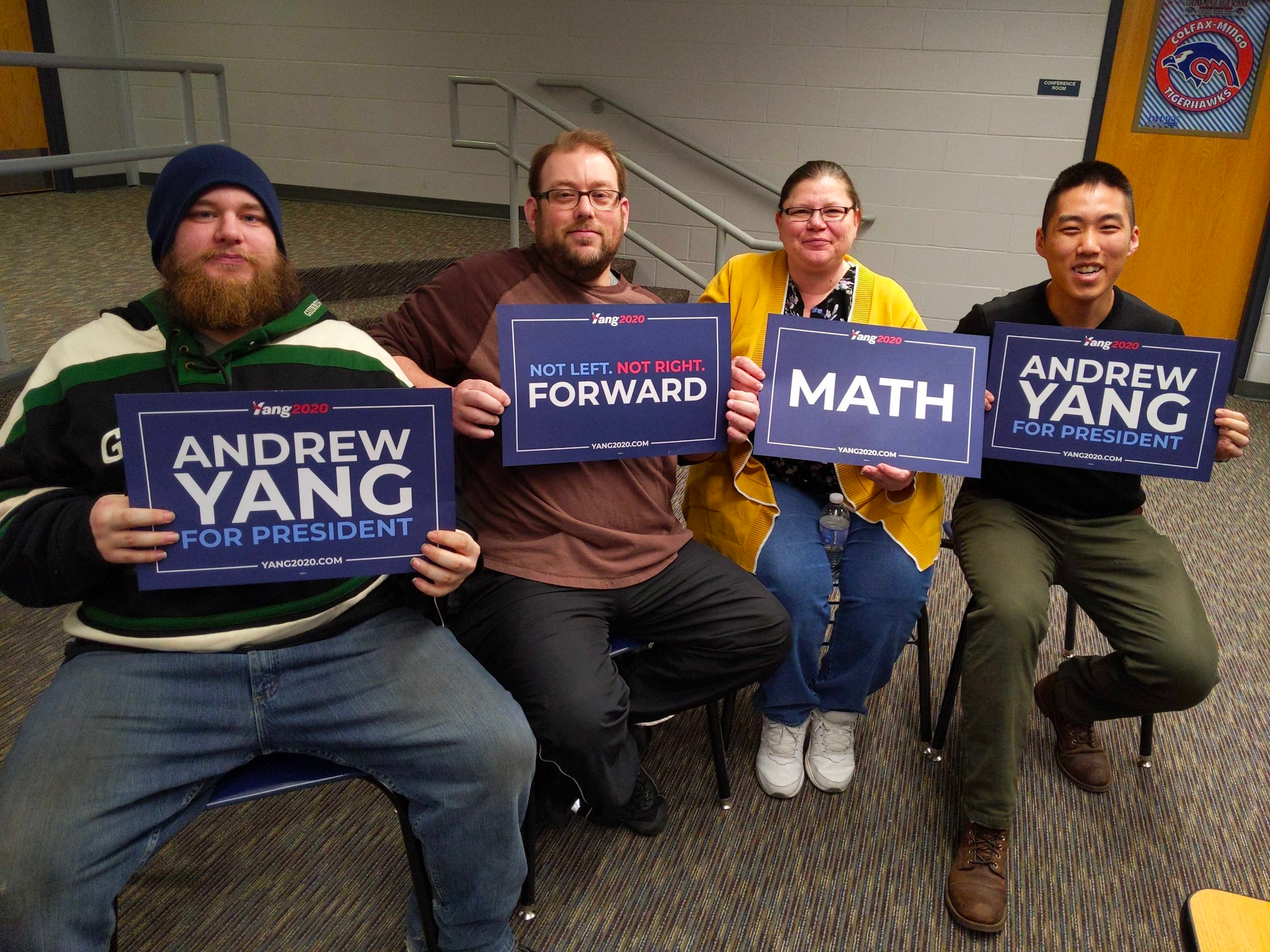

Throughout my career, I've been on a quest to discover how individuals can fund fulfillment in their lives. Starting in the dynamic world of early-stage entrepreneurship, where impact is crafted through businesses, and moving into political spheres, advocating for universal basic income to provide Americans with an economic foundation for meaningful lives. Investments, whether in venture or real estate, have always been a vehicle for funding fulfillment—for me, initially through my newsletter and blog, and now in the form of a new film and TV career in the vibrant city of New York.

Startup Investing: A Change in Narrative

Blogging about startup investments since 2018 was aligned with the theme of funding fulfillment through entrepreneurship. In 2020, though, I faced hard questions. Full-time blogging about venture capital felt limiting; it confined me to specific content, hindering my exploration of fiction narrative and performance. More significantly, it became apparent that venture capital, as an asset class, wasn't transformative for the average citizen. This realization led me to shelve the newsletter as I sought to reignite my creative spark.

Real Estate & Film/TV

Over the last three years, my real estate portfolio supported me as I ventured deeper into my media, film, and TV career. The idea of applying my successful Rhode Island investment thesis to Cleveland with outsider investor funds took root. After scouting online and a business trip to Cleveland, meeting local real estate players, my vision began to crystallize.

Why Cleveland?

People often ask me why I chose Cleveland, and my reasons are multilayered:

- Value: Purchasing a quadplex for $150k is unparalleled. In many parts of the country, you can't even get a single-family home for that price.

- People: Cleveland stands out as a community where residents consistently highlight its wonderful family-friendly environment. The concept of 'boomerangs'—young Clevelanders leaving for big city jobs but returning to start families—resonates.

- History: Once a top U.S. city by population, Cleveland's rich history includes the development of cultural institutions like Case Western University and the Cleveland Clinic. Despite depopulation and white flight, the city's robust physical and societal infrastructure positions it well for investment in affordable housing, especially in the era of increased remote work.

What's Next?

Today, I'm closing on my first property, kicking off the fundraising from my network. The plan? Complete renovations, enhance management, and execute a cash-out refinance mortgage in March/April to return investor money. Successful execution sets the stage for a larger fund in Q2, aiming to scale renovations and increase affordable housing stock in Cleveland.

What does that mean for the blog and website? I'll be using my blog as a place to share updates, particularly the human interest elements to a general audience. Greater financial detail and breakdowns will be available for premium subscribers. This allows me to tier the level of content to the level of interest that readers self segregate. In addition, although I'm keeping Fund 1 closed to my personal friends and family, as I build out the model and business, maybe some of you will join me for Fund 2 and beyond :)

Exciting times lie ahead, and I'm so grateful to you, my readership, for sticking by me all these years. I couldn't have possibly imagined it going here, but I'm eager to share this exciting journey with all of you in the new year!

Muhan

P.S. To reward you for making it to the end of a long post, here's videos from another property I'm scouting next: https://photos.app.goo.gl/VjGkpdJTq8e2xeBB7

Hey there premium subscribers, as promised, more of the financial deets below: