Dear Investors,

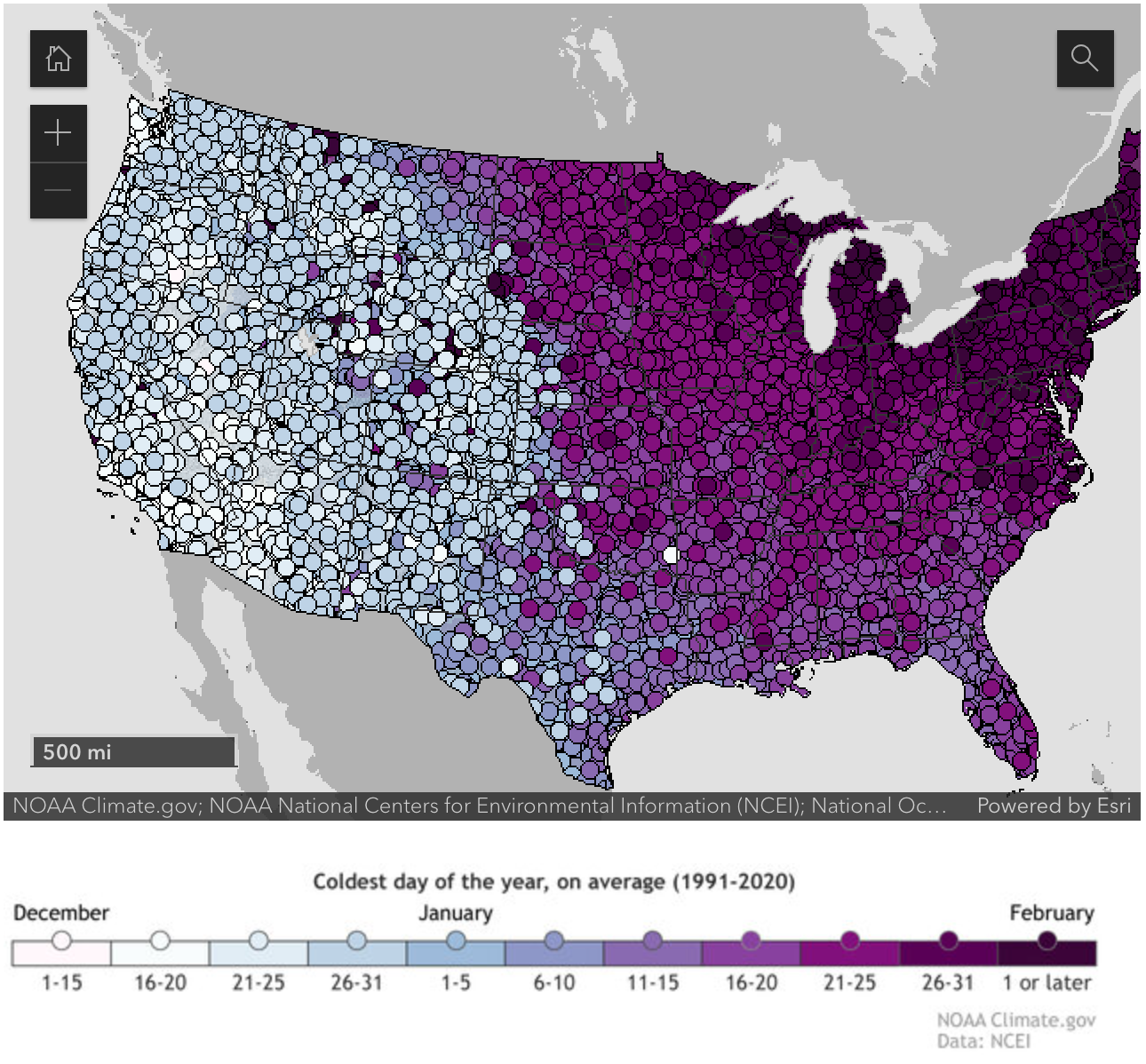

Happy Lunar New Year! I hope you're keeping warm amidst the fluctuating temperatures this winter. As we navigate through this season, it's fascinating to note the coldest days by geography, adding context to our current weather patterns.

All of which is to say things have gotten cold and that context frames the three major updates since closing on Folsom over two months ago.

Furnaces

Winter maintenance means frozen pipes and boiler issues, and our property management has been swiftly addressing furnace issues in Folsom. Despite challenges, we've successfully replaced four aging furnaces (over 50 years old), showcasing the value of modernizing fundamental mechanical components.

Financing

Significant progress has been made in securing financing, with contracts signed by early investors and funds arriving. Clarity on the corporate structure needed for future refinancing has been gained, implying a smooth process in summer. Additionally, inquiries into financial subsidies for weatherization have been made, albeit with some programs temporarily unavailable.

Eviction

Rent collection and tenant updates have been a focus. While most tenants have been cooperative, one unit requires eviction proceedings due to non-payment. This underscores the complex challenges of property management and the importance of maintaining open communication channels.

Reflections on Housing & Closing Notes

When I first started real estate investing, I coincidentally read Matthew Desmond's Evicted: Poverty and Profit in the American City. The book shook me to my core with its anecdotes, statistics, and explanation of a complex system of cause and effect that coordinated multiple parties in cycles of poverty and housing instability. At the time, I had just bought my first triplex, with two units vacant and one unit occupied. The one unit that was occupied was rented by a single mother on the lease, living with at least half a dozen other people including family and kids, in a three bedroom one bath. What was most heartbreaking was that they had not been paying their heating bill, so they were using their oven and opening the front door as a means of heating the apartment. All this caused grave reflection in me: was I the villain Desmond was writing about in his book?

It breaks my heart to see human beings struggling like this in such a wealthy country. The first home I lived in when I came to America was actually an old multifamily home in Boston—it's a big reason I'm such a believer in the asset class as a stepping stone to the working and middle class on their wealth journey. But I've also come to accept that systemic poverty is a bigger problem that individual investors simply cannot solve. For comparison, New York City spends $33,000 per unhoused person every year, or the equivalent of 2 years of the apartment's annual rent. With a current rental price of $1325/mth, my apartment represents only 21.3% of rent burden to the median 2022 household income ($74,580, or $6215/mth, so $1325/$6215) whereas the majority of New York City is defined as rent-burdened, or spending at least 30% of their income on rent.

This tenant I inherited from the previous seller lived free for six months in the apartment, while I still had to pay property tax, insurance, utilities, maintenance, and all the costs that are incurred to house them. After the tenant moved out, we had to invest ~$13,000 to throw out the discarded possessions, renovate the apartment, and increase the then rental price from $700/mth to $900/mth for a three bed, one bath. While I have compassion for that renter and anyone who has experienced housing insecurity, I also accept that the private sector cannot fix homelessness and that this problem has no good solution besides government and public action.

Bringing it back to the property in Cleveland: we can use this rule of thumb to estimate the time it'll take to stabilize this last unit with a qualified tenant and yearlong lease. Since we purchased in Dec 2023, assuming the worst and that the tenant has no intention to pay, they'll live for free until end of May upon which they will likely move on. While we cannot change larger macroeconomic factors, we can do our job ethically and with compassion. At that point it'll take us a month to renovate and market the new apartment, secure a year long lease with a qualified tenant, upon which all four units will be stabilized and we'll be in a position to get a 30 year mortgage and cash out the majority of one's investment in Fund 1.

If you have any questions feel free to respond or comment. Grateful for the opportunity to do meaningful work including engaging with meaningful challenges. Otherwise I'll write the next time we have updates on the tenant or financing.

Bests,

Muhan