Deal Abstract

https://www.startengine.com/piestro

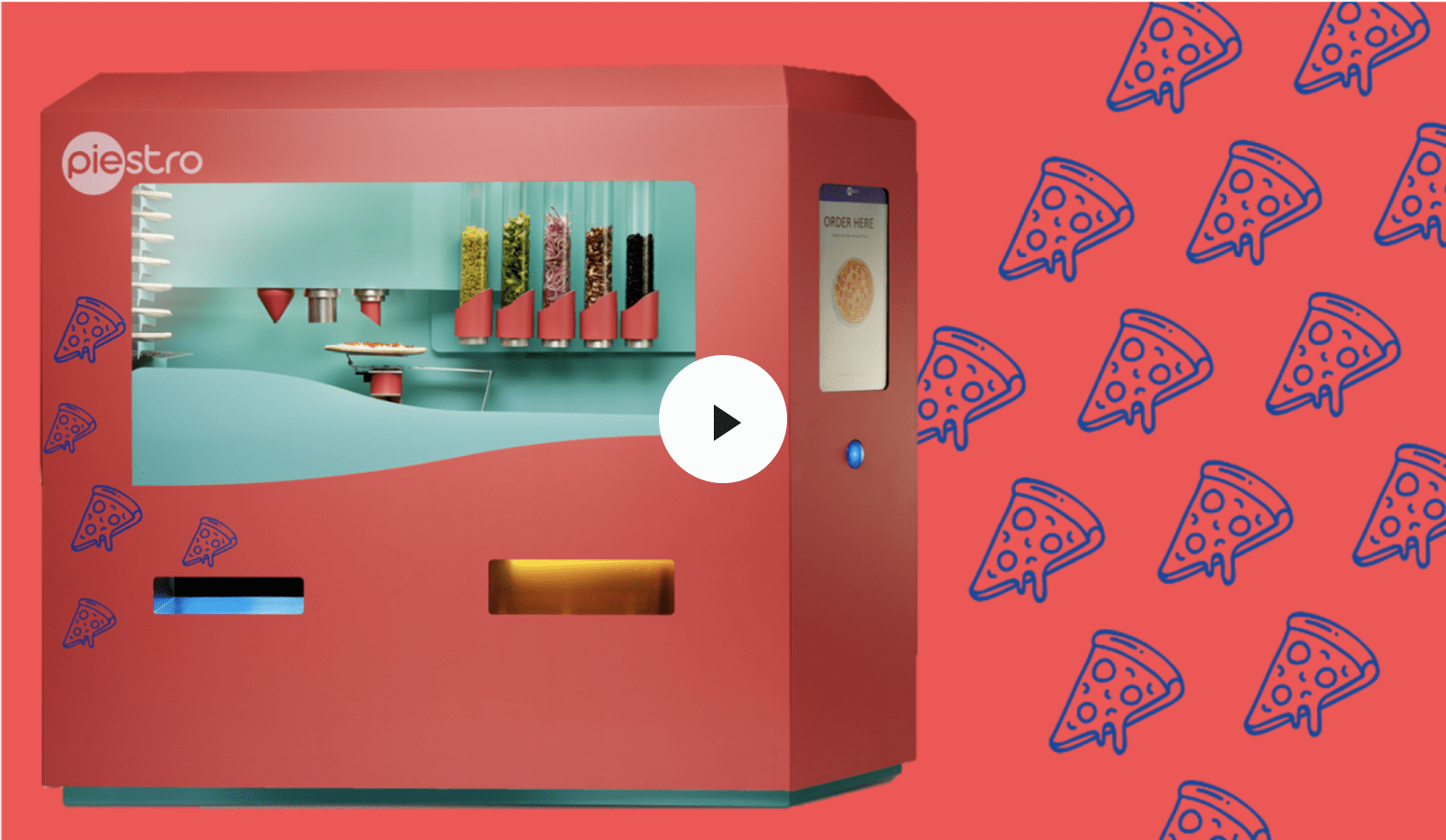

Pre-revenue pizza making in a box. Plans to sell both B2B and B2C. Curious what they’ve learned from the competition: Zume, Basil St, Picnic, and Smart Pizza. Go-to-market strategy will be pivotal, and also more financials needed.

Shoutout to J.V. for the tip!

Decision

Pass.

Why Investing/Passing

- Pre-Revenue: I don’t fund anything pre-revenue. Bringing things to market has a great deal of uncertainties that normally are quite expensive.

- Pizza Drama: What happened to Zume and Picnic for pizza automation? Why has no one cracked the code yet?

- Uncertain Financials: I saw %’s but not $$$ for unit economics of Piestro machines, nor a go-to market for how many units they want to sell in the first year, profits, growth trajectory, etc.

The 6 Calacanis Characteristics (91 161 18)

| Check | Pass/Fail |

| 1. A startup that is based in SV | Fail: Los Angeles, CA |

| 2. Has at least 2 founders | Fail: (1), but has a team |

| 3. Has product in the market | Fail |

| 4. 6 months of continuous user growth or 6 months of revenue. | Fail |

| 5. Notable investors? | Pass: Wavemaker Labs has Miso and Graze, with strong track record. |

| 6. Post-funding, will have 18 months of runway | Pass: $605k raised, burn is $30k/mth, so 20 months raised. That said, a burn of $20k per month means $240k a year, so maybe 4 teammates full-time, which means this is a lean time for taking a product to market. |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Good: Pizza vending machine.

- The Timing question:

- Uncertain: Good time for automation but not sure if this is the time that the technology will be able to solve this problem.

- The monopoly question:

- Good: If they can build and sell, then the technology is certainly scalable.

- The people question:

- Good: Team is small but seems fine. I’m concerned that everyone on the team has been part-time, but appreciate the honesty. Part of the funding this time must be to hire sales people.

- The distribution question:

- Good: CEO has experience with cloud kitchens and should have good experience selling B2B.

- The durability question:

- *What is the hopeful secret?:

- The technology and capital costs to deliver pizza-shops-in-a-box is now.

What has to go right for the startup to return money on investment:

- Learn from others mistakes: Overcome the challenges Zume and Picnic had.

- Produce Piestro Machines at Scale: What is the production for the first year?

- Unit Economics and Selling at Scale: Whether it’s deploying Piestro or “Powered by Piestro”.

What the Risks Are

- Go to market risk: underestimating how much it costs to produce X units, or sell to Y companies.

- What’s the Core Growth: Is it B2B partnerships, or is it B2C?

- Growing Too Slow: Not sure I see Piestro growing from 100 to 1000 to 10000 to 100000, whether that requires more capital cost for planting Piestros or salespeople for selling Piestros to B2B.

Muhan’s Bonus Notes

The company seems like a fine portfolio for someone building a robotics portfolio. Would be critical to learn how much it costs to build one, unit economics on selling a Piestro machine, versus how much it costs to plant a Piestro machine, and the go to market plan. Not to mention learning from competitors: Zume. Smart Pizza, Picnic, Basil St.

Financials (References)

- Current Fundraised: $605k

- Valuation: 6.02MM

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page. Also, somewhat of a dearth of materials (whose the team? where are the comments? why are the financials so opaque?)