Deal Abstract

https://www.seedinvest.com/trust.stamp/series.a

B2B crypto powered security company selling most notably to financial companies. In the (hypothesized) age of companies bundling their security to security companies (think LastPass, 1Password, etc.) Trust Stamp wants to be the company that stores your customers credentials as a derivative of their biometrics. (That way even if/when they get hacked, your customers aren’t screwed.) Achieved 2.1MM in revenue in 2019, growing 1.5x from 2018, with big customers Synchrony and MasterCard.

Decision

No

Why Investing/Passing

- Seems like a solid business, but raising at $6.8MM on $25MM valuation is not my wheelhouse.

- Although the financials are impressive, I didn’t see the heavyweight technologists I was expecting.

- Something about this company seems off. I’ve implemented off-site security solutions, but even then, I don’t believe this company explained it as clearly as I’d expect. Something like “We have a database solution for enterprise developers to store biometric-derivative credentials” would have been clearer. Lack of something like this tells me they’re not talking to engineers, which is both impressive and concerning for being a blockchain company.

The 6 Calacanis Characteristics (91 161 18)

| Check | Pass/Fail |

| 1. A startup that is based in SV | Fail: (Atlanta, GA) or remote? |

| 2. Has at least 2 founders | Pass (2) |

| 3. Has product in the market | Pass |

| 4. 6 months of continuous user growth or 6 months of revenue. | Pass: (2019 revenue was 2109k, 2018 revenue was 834k.) |

| 5. Notable investors? | Fail |

| 6. Post-funding, will have 18 months of runway | Pass: 2019 burn was 2.1M and targeting 6.875M was raised, giving 39 months of burn. |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Uncertain: if they have the platform for making digital credentials from biometric derivative, then that the might genuinely be 10x better than anything the finance companies could build themselves. But to me, the engineering might be good enough, it’s the fact that they can sell that is this company’s unfair advantage.

- The Timing question:

- Uncertain: I still don’t personally know a crypto/hash/blockchain company that has made it yet. That said, there’ll always be a first, but will it be this team?

- The monopoly question:

- Good: if they solve a really hard technical problem and at scale, it’s very likely they will be the one company to solve biometric credential at scale. AWS and co may come in but just like Google Drive didn’t kill Dropbox, so too this would be a valuable defensible position to get.

- The people question:

- Uncertain: Honestly looking at this time, this is not whom I imagine using blockchain to solve fintech problems. That being said, because they probably don’t resemble the deep techies I imagine, so they have had more traction actually selling a solution instead of just making a pet project.

- The distribution question:

- Good: Evidently good, selling to credit card processors and having those relationships.

- The durability question:

- Good: Plaid (https://plaid.com/company/) it up.

- *What is the hopeful secret?:

- Fintech loses a lot of money to fraud, and that because of blockchain derivative storage and computation, Trust Stamp can solve this problem at scale in a very cheap and secure way.

- Fintech loses a lot of money to fraud, and that because of blockchain derivative storage and computation, Trust Stamp can solve this problem at scale in a very cheap and secure way.

What has to go right for the startup to return money on investment:

- Continue rinse-lather-repeating with credit card companies as a fintech targeted company.

- After delivering on cash cow of fintech company, probably go the Plaid route and become vital to the ecosystem for reducing fraud, ultimately getting acquired by one of the largest companies.

- Somehow lobby power for biometric trust from the FAANGs and AppFaceAmaGooSoft of the world. At present, the only companies I trust with my biometrics are Google and Apple, the former via Android and the latter because I know they make money off of overpriced hardware and premium software ecosystem. Facebook is too creepy. If you sign in to your credit card app to allow for a spending, why would you verify with Trust Stamp vs Apple’s fingerprint scanner/Face ID?

What the Risks Are

- I’ll call this Goldilocks problem: if this problem is so existential, why would a company trust a startup to solve it? Conversely, if you concede that the technology is hard, why would AWS, Google, Apple (who also have password management in a sense,) not come in and steal for this marketshare?

- Reducing fraud for fintech via biometric-derivative credentialing seems profitable, but how translateable is this to other markets?

- Are they a security company or a blockchain company? If the former, why wouldn’t 1Password/LastPass/cybersecurity company that stores hashed credentials for enterprise come in first? If the latter, why are the financial institutions willing to take this bet on this company? (Maybe unfair advantage.)

Financials (References)

Total Amount Raised: US $1,205,892

Total Investors: 620

Total Round Size: US $6,875,000

Raise Description: Series A

Minimum Investment: US $997 per investor

Security Type: Preferred Equity

Pre-Money valuation : US $25,000,000

Updates

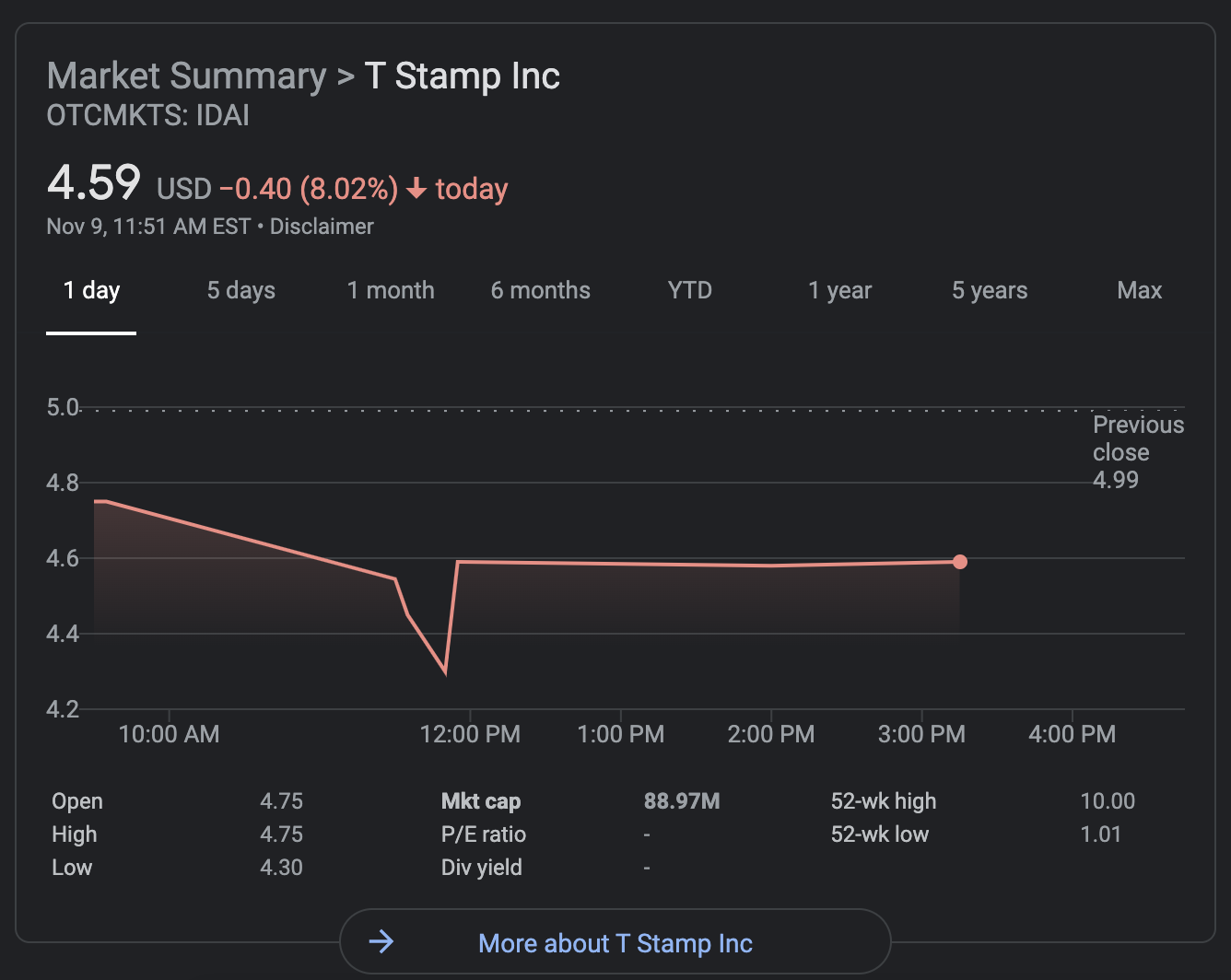

Went public and made 3x money for investors! Woohoo~