Deal Abstract

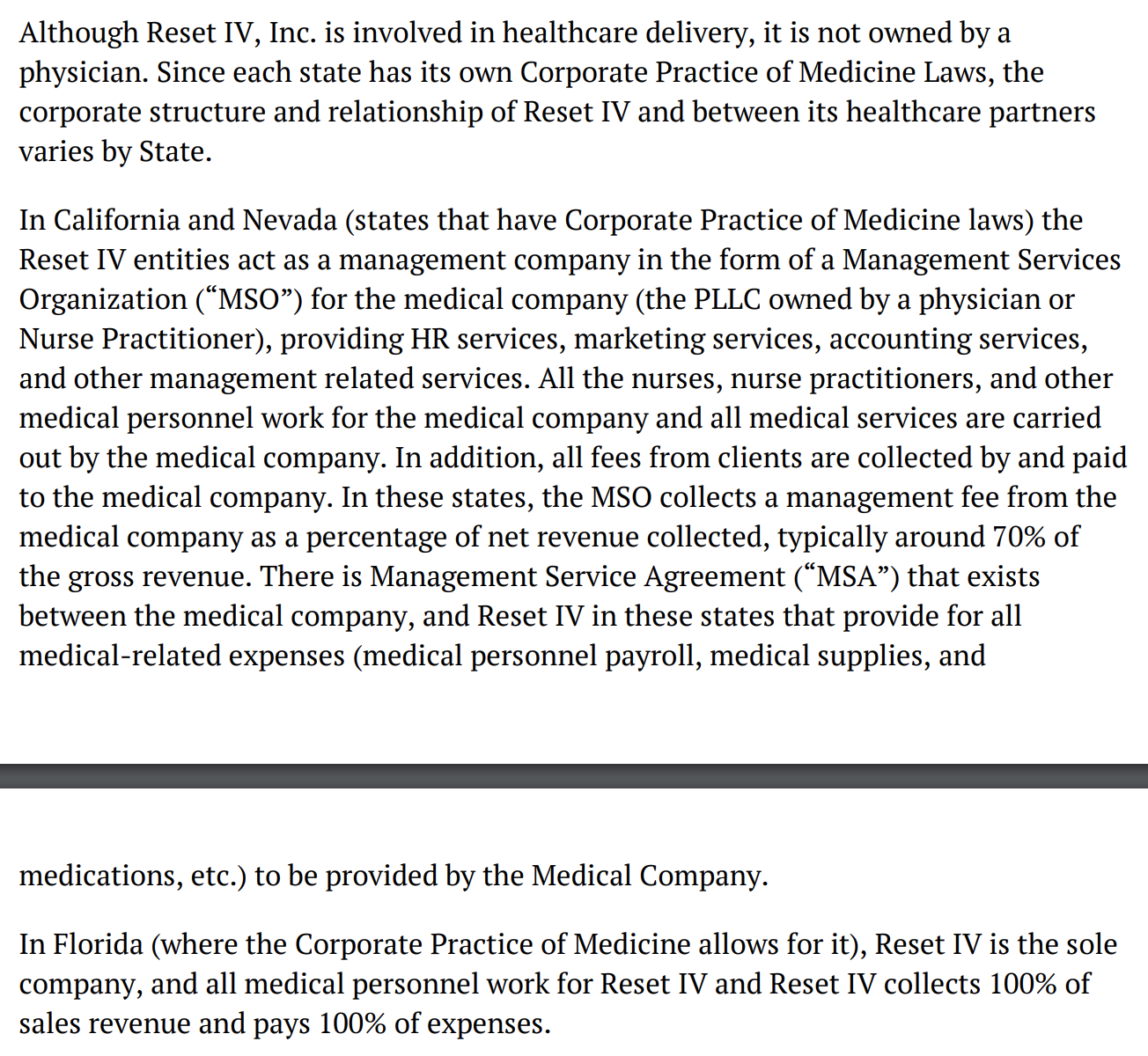

Uber for IV treatments. Generated $1.3m (but allegedly $2.3m, maybe some CA/NV magic) in 2019 and raising on a $10m valuation. Clearly a luxury product, but makes one think of whether on-demand IV treatments will be like Ubers (which started with black cars,) or personal computers (which now everyone has to have in some sense, even if in the form of a smartphone.)

Thank you to Bob for sending me the deal!

Financials (VRB)

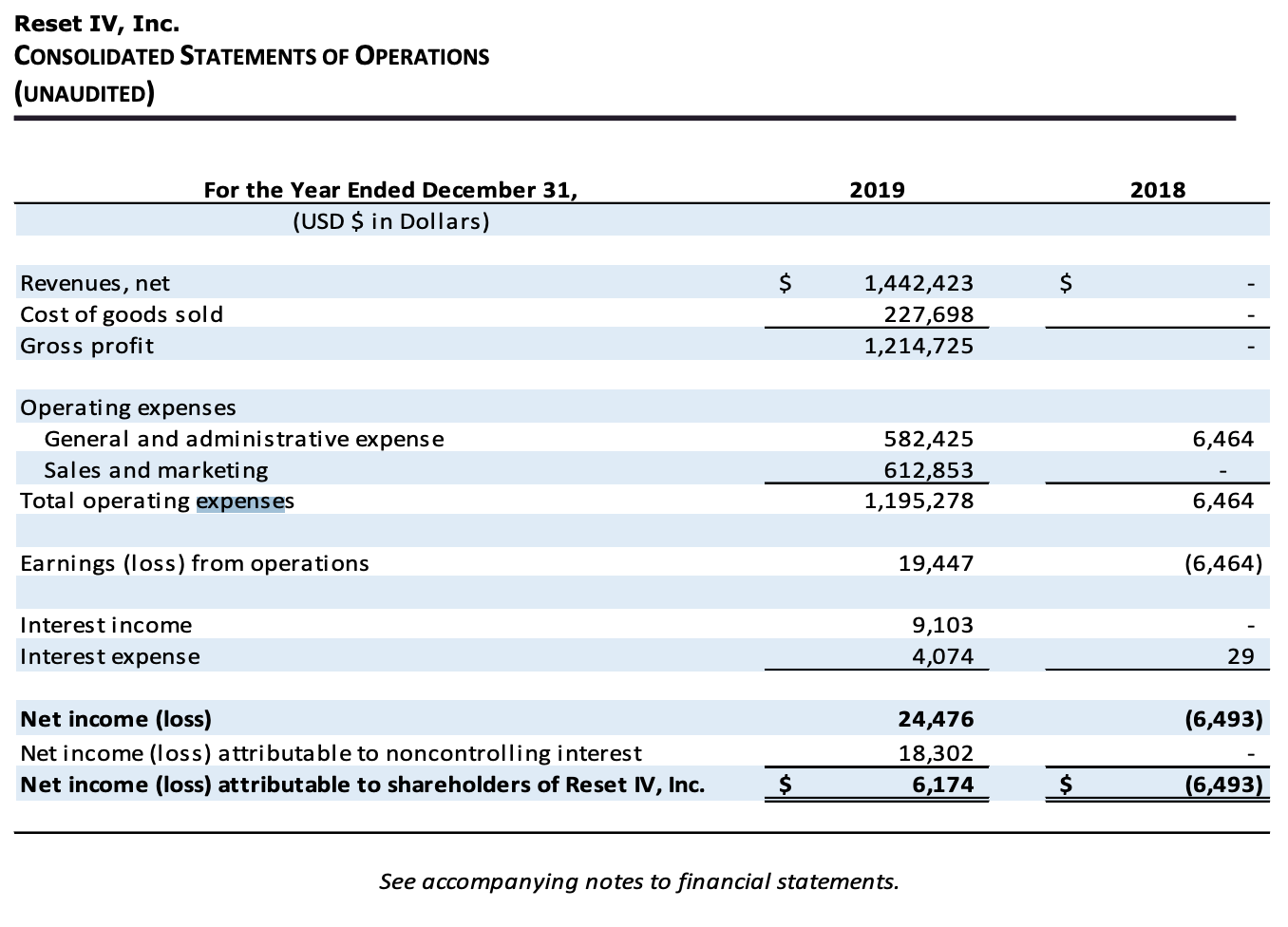

| Question | Notes |

|---|---|

| 1. Fundraising Target? | $25k-$1070k |

| 2. Fundraised So Far? | $714k |

| 3. Pre-Money Valuation? | $10m |

| 4. Previous Year's Annual Revenue | $1.3m |

| 5. Previous Year's Annual Burn | ~$24k |

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | No: Las Vegas, NV |

| 2. Has at least 2 founders? | No: One CEO who bootstrapped |

| 3. Has product in the market? | Yes |

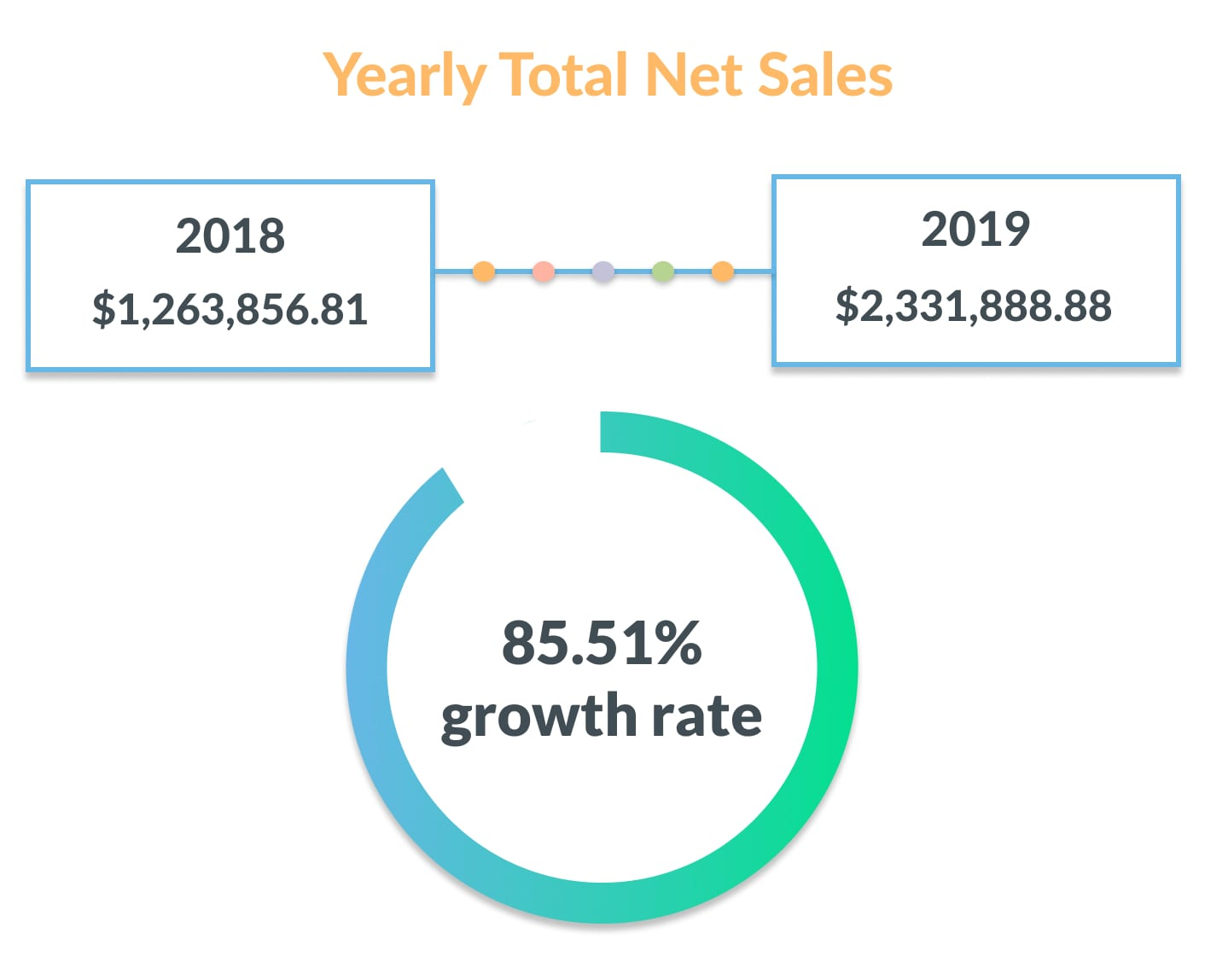

| 4. 6 months of continuous user growth or 6 months of revenue? | Yes: 2018 revenue to 2019 revenue increased from $1.2m to $2.3m. |

| 5. Notable investors? | No: Don't see any. |

| 6. Post-funding, will have 18 months of runway? | Yes: Revenue of $2.3m stated and whats on the sheets doesn't look consistent. That said, using sheet, it seems the company is sustainable, since they "lost 24k" in 2019 and have already raised $714k. |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Not an engineering play, more of a distribution play |

| 2. Timing? | 2 | Health and wellness is good, as is on-demand. But I'm uncertain if this is the time where IVs take off. |

| 3. Monopoly? | 3 | Seems like they've definitely got a high market share of the IV to your door market. But will this grow? Also, what will make IV costs go down like Uber went Uber Black to XL to X to Pool, etc.? |

| 4. People? | 3 | One cofounder is in good position to start this company. |

| 5. Distribution? | 3 | Good. |

| 6. Durability? | 3 | Possibly good since people who want at-home IVs possibly are mobile/partying in LA/SoFla, and would trust Reset IV's brand rather than a different clinic in every state. |

| 7. Secret? | 2 | The interest in healthcare is strong enough that what seems extreme today, like regular IV's for health, is going to be normalized. The bet is that IVs will be similar to yoga, or meditation, or sushi, all of which are fairly recent major acceptances by the market. Also, that at home IV delivery will become cheaper. |

What has to go right for the startup to return money on investment:

- Costs Go Down: Call me an economic determinist—it's true! Unit economics to me make/break many businesses. For this to go mass market, I think it has to become cheaper.

- Not Just a Rich Person Problem: I get why models will want IVs to improve their skin, and why bachelors will want to rest up. But for these pain points, are normal hydration/diet/lifestyle improvement that much of an inferior solution?

- Painkiller not Vitamin: Fundamentally, how do I know this works? Is it just a feeling better? Can they start to fund studies to show that regular recipients of IV supplements get better outcomes on XYZ metric?

What the Risks Are

- Solid but not venture backable: Very cool and fun business, but despite great performance, this looks more like a fast growing small business than a startup. The distinction is whether this is fundamentally a technology innovation (marketplaces, credentialing, insurance, etc.) or a distribution innovation (still having all the costs of a traditional provider, just having an app.)

- Porter's Five Forces: who are more negotiating power, Reset IV's network or the provider's themselves? Look at the gap between the $2.3m in revenue generated and $1.2m in revenue they got to keep.

- Core Thesis: The Uber/PC/Yoga/Meditation/Sushi analogies make sense, but those are all things that got cheaper. How does Reset address the cheaper market?

Bonus Muhan's Notes

When trying to interpret between the optimistic or the pessimistic number for a company, 9 times out of 10 it's safer to assume it's the pessimistic number.

Will ask question in StartEngine to verify.

Updates

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.