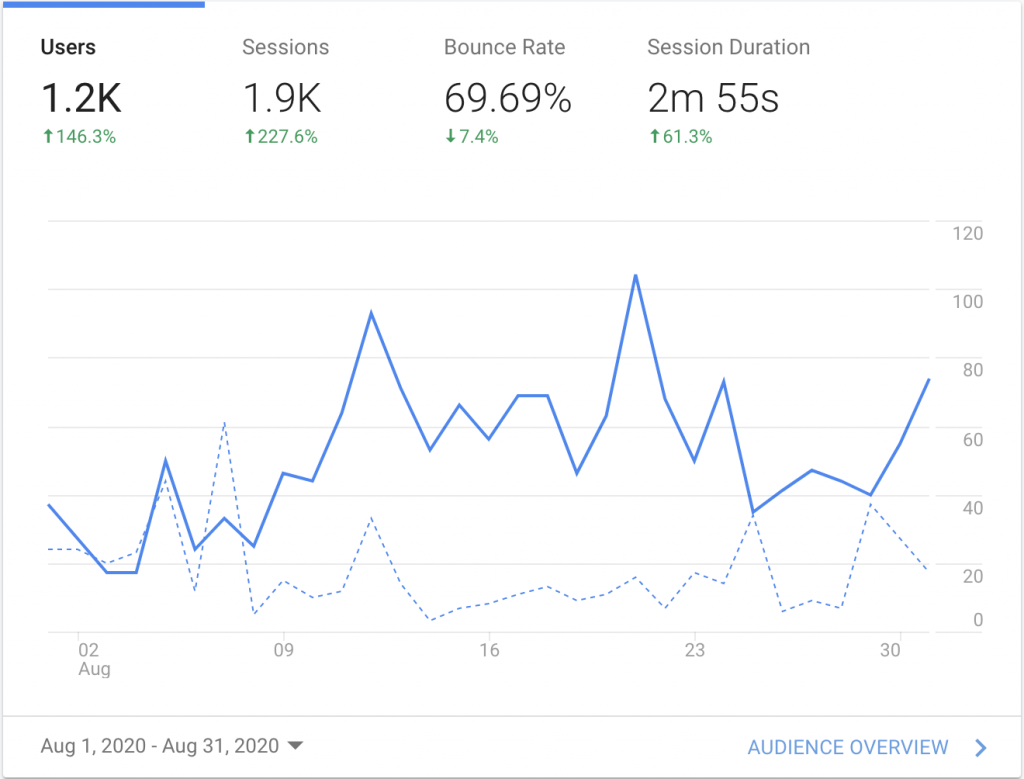

I’m now totaling 63 deal memos with >40% published just in August 2020. In the last 31 days I published 26 pieces, nearly one every day. Users, sessions, bounce rates, and session duration have all improved, and inbound email has doubled from July to August. I’ve started a paid subscription newsletter for startup investors to support each other and received my first subscriber within 48 hours of launch. Most promisingly, I’m getting inbound emails almost once every other day.

I went on a prolific tear of content in August sort of like an amateur jogger on runner’s high: I published every day simply because I could. This was the first month where I felt my writing feedback loop was tight enough that I was effortlessly motivated to write every day. My apologies to those who may have been overwhelmed with the deluge of content—this will be corrected in the coming month.

Starting in September, I will be capping deal memo publishing to three times a week. At the same time, I thought I’d summarize and share some unsolicited $0.02 from the month that’s been.

Three Takeaways

1. Takeaway for Startup Investors

Common sense and experience made me a good startup investor, but patience and discipline will make me great.

I was recently asked whether SapientX, one of my portfolio companies from late 2018, was still worth investing in its 2020 round. This lead me down an exercise of calculating my returns.

Executive summary: According to the numbers, and using fairly conservative estimates, I am a better-than-average startup investor and venture capitalist, but still on a journey to enter the top quintile.

Detailed Summary: Of the investments that have had follow-up raises, I’ve experienced 76.46% on average over 7 investments since 2017. (Of note, 4 investments have not had follow-up funding so they are not included in return calculations.) This averages to >20% IRR every year, compounded (1.2^3=1.728.) Compare to:

- Compare to median VC industry of 11.7%.

- Compare to SeedInvest’s 18% IRR paper in 2018.

- Compare to Benchmark Capital’s fund returns targets. 130% (IRR ~7%, barely in business because low-fee index funds achieve the same IRR) to 250% (IRR ~30%, top tier fund.)

This means my portfolio is growing nearly ~2x faster than the median venture capital firm, 11% faster than the average SeedInvest portfolio, but still falling short of the top 10% of SeedInvest investors (77% IRR!!!) and a full-time venture capitalist (30% IRR.)

What’s interesting is if I remove my worst known investment, HyperSciences (0% growth in 2 years,) my IRR immediately jumps from 20% to 23%. Even at the time of investment, I knew I was expanding beyond my “wheelhouse”, namely, software companies that were either SaaS or marketplace business models. Contrast with WhereBy.Us, the very first startup investment that started my startup investing journey, has tripled their valuation from my investment and performed the best out of all companies. Again, in retrospect, if you look at my deal memos, this is not terribly surprising. More times than less, my deal memos have confirmed my intuitive knowledge and helped me refine where I over/under value certain factors.

Venture capital is an industry with heavy power law distributions. The top 20% of funds and investors, along with the top 20% of companies and founders, will create 80% of all value and returns in the startup industry. As an angel investor, although I don’t need to be absolutely aggressive in achieving 10x return on every investment, but it’s worth considering the lens of only investing in companies that can return your entire portfolio, as Thiel writes.

As an investor who will be evaluated based on my returns, however, obtaining the highest IRR and return multiple is the only metric people will judge me by. This is the reason I’ll pass on fine companies such as Graze, Piestro, and Miso Robotics, because, while they’re fine companies, the reality is they’d likely bring my IRR down due to capital inefficiency and large valuations. Concretely for me, this means being even stricter looking for software companies sub $10M in valuation where I could concretely envision scaling to $250MM in annual revenue within 5-10 years.

2. Takeaway for Aspiring Writers

Product-market fit in writing (author-reader fit?) for me is the certainty of knowing someone will read and respond when I publish.

Friends, peers, and readers often express admiration for how I can be so prolific in my writing. The answer in my reflection, is really simple: strong feedback loops.

The single highest leverage thing I did with this blog in 2018, back when I had no clear writing topic, was put in an email subscription box and ask new subscribers to tell me why they subscribed.

It took 9 months for my first reader to find me by Google for my HyperSciences deal memo. From there, it took another year for Monogram Othorpaedics to raise an unfathomable amount of money and drive thousands of readers to my site. All-in-all, from publishing my first post to this feeling of “product-market fit,” it took me 2+ years of what Nicholas Nassim Taleb calls stochastic tinkering to find this audience and niche.

For me concretely, whenever I start my next writing topic, my action steps will remain the same: implementing a feedback loop via the conversion funnel, writing about specific events vs. broad concepts (e.g. specific deal memos vs. generic investing principles,) and thinking strategically about where to share content after its publication (e.g. posting deal memos and comments to startup investing pages.)

3. Takeaway for Pre-Product/Pre-Revenue Entrepreneurs

If I’m creating a new product and struggling with monetization, start by shamelessly copying a competitor’s offering and business model.

Despite working in startups, I’ve almost always hated the product ideation/customer discovery/lean startup stage of a startup. Give me a boring business with established market, clear unit economics, LTV > CAC, and I’m happy as a clam. Increasingly, I’ve even pondered proposing the following curriculum for the education of an entrepreneur:

After I started feeling author-reader fit from the second takeaway, however, I had the two-edged sword of an audience but no customers e.g. back in the “ideating and selling” phase of the entrepreneurship matrix. Although I had succeeded in entrepreneurship in a variety of other ways, I had never succeeded in ideating and selling a new product. It wasn’t until one of my readers mentioned seeing startup investing ads in a newsletter that I had an idea.

My startup investing content and deal memos are deep and niche, a form of content written almost exclusively by and for practicing venture capitalists. Making money by selling ads would never work, as this is not a mass market product. But what if I could find 1000 true fans to pay for a premium newsletter, instead of writing a free newsletter that monetized off ads, that would be enough to support a full-time career exploring ideas, how to build the future through startups, and serving my audience full-time.

From there, I launched a reader survey Google Form the next day to ask 20 readers I’d emailed back-and-forth if they would be interested in a premium product. I got 8 results within a week and half responded “Sign Me Up,” launched a week after sending the survey out, then had my first paid subscriber within 48 hours of launch.

As I hope I’ve demonstrated, the mindsets of an angel investor, creative, and entrepreneur are each radically different. For me, if I find growth stalling, my concrete action steps will be to see how my peers (in this case, business content creators) are monetizing their audiences (paid webinars? books? podcast ads?) and systematically testing each of their monetization strategies. If none of those work for me, then switch into a different market (e.g. real estate content creation, political content creation, etc.) and rinse-lather-repeat until I find creative-product-market fit.

Thanks for making it to the end of that longer reflection on investing, creative work, and entrepreneurship. Eager to get back to deeper analyses on startup investing? Subscribe to my premium newsletter, Startup Investing, to receive weekly content, exclusively tailored to accompany investors in their venture journey.