Deal Abstract

Husband/wife duo are teaming up to build a marketplace and business management platform for nail salonz. B2B SaaS marketplace, but can they scale fast enough to be venture backable?

Financials (VRB)

| Question | Notes |

|---|---|

| 1. Fundraising Target? | $1070000 |

| 2. Fundraised So Far? | $193931 |

| 3. Pre-Money Valuation? | $10000000 |

| 4. Previous Year's Annual Revenue | $69932 |

| 5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) | ~$-889968 |

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: New York, NY |

| 2. Has at least 2 founders? | False: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: Revenue more than doubled from $28k to $69k |

| 5. Notable investors? | False: No one I recognize |

| 6. Post-funding, will have 18 months of runway? | True: If they raised $1mm, but it doesn't look likely at present |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Better than nothing, but is it 10x better than Booksy or HellaBella? |

| 2. Timing? | 2 | Good time to make marketplaces |

| 3. Monopoly? | 4 | Credit where credit is due, has gone deep on Manhattan and has 20% of market |

| 4. People? | 3 | Husband and wife together, harder to get incentives more aligned :) |

| 5. Distribution? | 2 | No clear advantage to onboarding new customers, though the quantity is impressive |

| 6. Durability? | 3 | If they can build it, I could see this being the Grubhub of nails for the East Coast (Grubhub vs Eat24 vs the reset of the food wars) |

| 7. Secret? | 2 | Millennial beauty customers are expecting a digital first booking and reservation system, and Snailz is going to build that marketplace |

What has to go right for the startup to return money on investment:

1. Control spend and scale more efficiently, I believe it's at 176k in revenue for 2020 but need to see costs; 2. Grow more rapidly, the business has been around since June 2017, has 350 salons for 1.3m in bookings (20% of Manhattan network,) 3. Take learnings from Manhattan expertise and bundle it up in a faster go to market strategy

What the Risks Are

1. Fragmented marketplace, Booksy is already tackling this market and has Series C funding; 2. Adoption speed not fast, uncertain how ready nail salons are in adopting SaaS (though to be fair, as owners turn younger, I'm sure this will change,) 3. Pricing structure, 13% is not cheap for a small business and services industry at this level already have a lot of costs

Bonus Muhan's Notes

Very cool to see this; I know nails and salons are an industry but have not had personal experience with them.

Updates

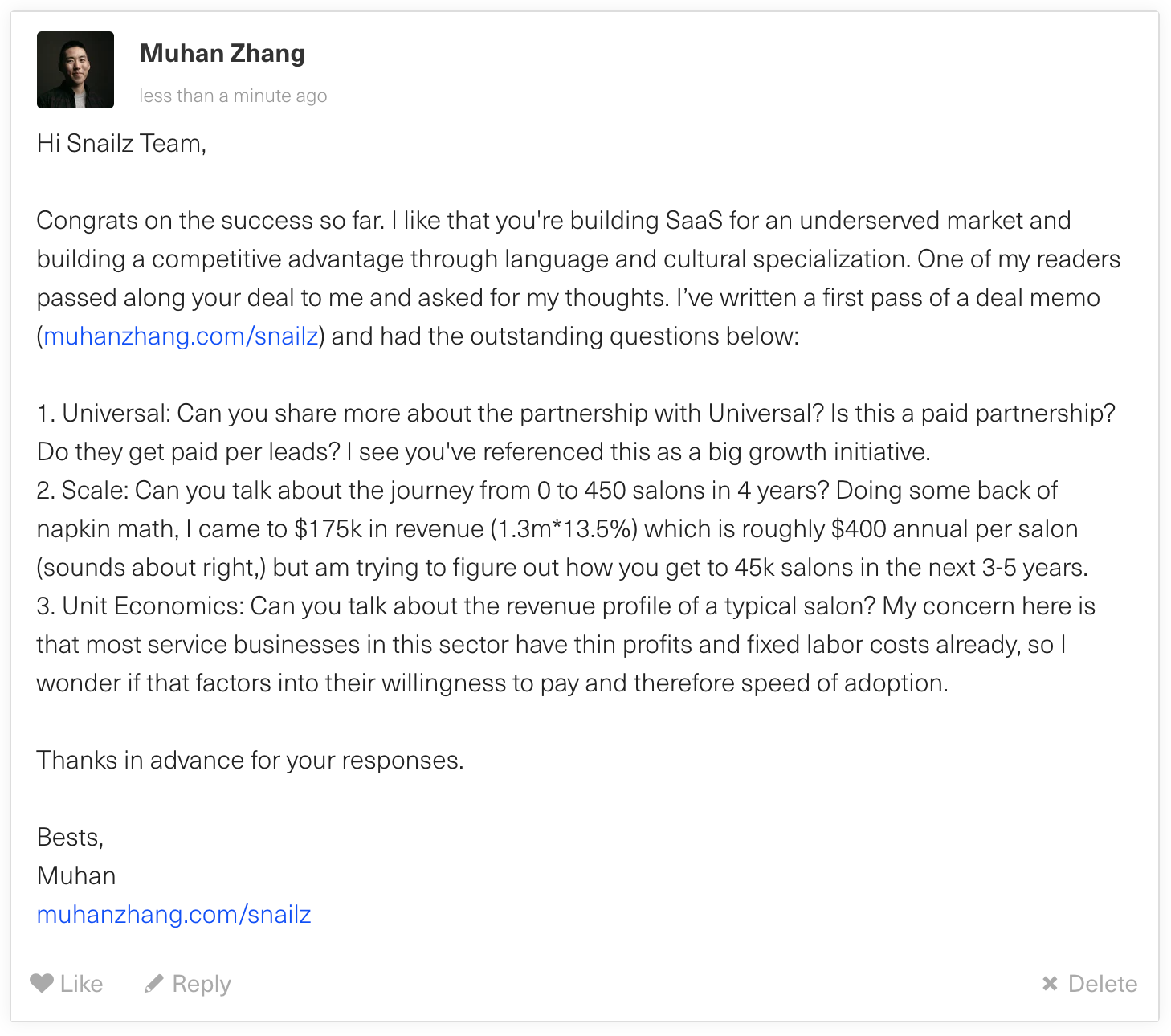

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.