Question: “I have heard folks mention that Republic and SeedInvest are the best in the industry with thorough due diligence. Have you seen any stats on this? Or do you have any opinion contrary to this given your experience?”

Muhan’s Short Answer: SeedInvest and Republic have claimed to accept 1% and 3% of all applications, respectively. I have more investments on the former than the latter, though one of my investments notably went to Republic for a follow-up round of fundraising. Ultimately, while platforms can have nice bells and whistles, I wouldn’t sweat which platform is the ‘best’. An analogy: real estate agents are measured by their ability to get you a good house and price, so equity crowdfunding platforms are measured by their investment opportunities and ease for both the founders and investors.

More data and depth following:

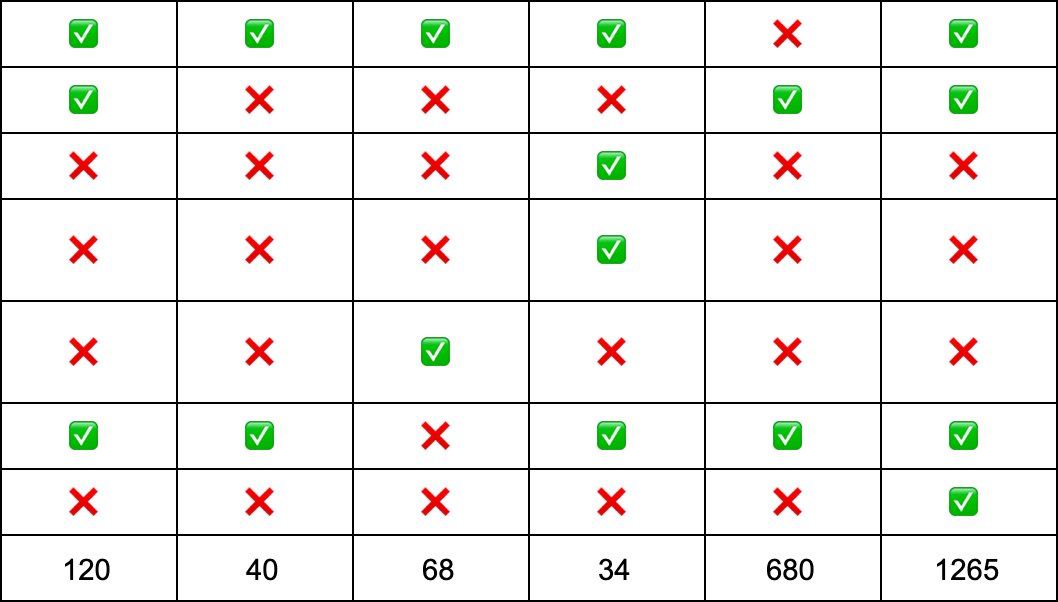

I have experience with the following platforms:

- AngelList, Founders Club (21% IRR for Angel published in 2019, 23% IRR Since March 2020 for FC, 2020): The original startup investing sites, but from what I know, only open to accredited investors/rich people. FundersClub has the most transparency and up to date data. AngelList claimed 21% IRR in 2019.

- SeedInvest (17% IRR published in 2017): One of the first movers. Has published results of achieving 17% median net unrealized Internal Rate of Return (IRR.) Claims a 1% acceptance rate of 25,000 companies who apply to fundraise on the platform. Launched Auto Invest, acquired by Circle in 2019. The platform that provided me with most of my investments. I personally love the thoroughness of the financial documents, including for calculating burn, revenues, disclosures, etc. Going for the “gold standard of crowdfunding” in my opinion.

- WeFunder (31% IRR published in 2016): One of the fast followers in my experience. Brags that “the $110 million in investments its funneled have gone on to get $2.2 billion in investments, larger than all its competitors combined (StartEngine, SeedInvest, and Republic.)” Source. I don’t see that much dealflow coming in from readers, so it’s possible that this is going for the “bazaar” in the “bazaar vs. cathedral” spectrum, more quantity of small businesses, less startups. Claims a 31% IRR for 2013-2016 Regulation D investments.

- Republic (No IRR Data): I found some interesting dealflow from Republic, with people sending in interesting companies. In addition, my first investment WhereBy.Us started on SeedInvest in 2017 and moved to Republic in April 2020 (tripling its valuation from when I invested.) I believe they’re trying to differentiate via Republic Note, Republic Real Estate, turning investors into advocates via reviews, etc. I find the financials to be lacking compared to SeedInvest. Co-invests in deals with readers. Source. No data of returns from a quick Google search. Accepts 3% of applciations.

- StartEngine (No IRR Data): I found the financial documents somewhat lacking. They seem to be attempting to differentiate with their 10% bonus gamification mechanism, which gives economies of scale to investing more companies on their platform. They are also trying to build out an ATS so that people can get their investment back earlier if someone is willing to buy their stock before the company goes public. No data of returns from a quick Google search, except the generic legalese for “we don’t know.”