Deal Abstract

Helping startups incorporate from anywhere in the world. Building business-in-a-box solution that allows startups to focus less on legal stuff and more on the building the product.

Financials (VRB)

| Question | Notes |

|---|---|

| 1. Fundraising Target? | $5000000 |

| 2. Fundraised So Far? | $545000 |

| 3. Pre-Money Valuation? | $40000000 |

| 4. Previous Year's Annual Revenue | $2400000 |

| 5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) | ~$ |

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: New York, New York |

| 2. Has at least 2 founders? | True: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: 20% MoM, $200K+ in monthly revenue |

| 5. Notable investors? | True: Y Combinator, Earnest Capital, Amino Capital |

| 6. Post-funding, will have 18 months of runway? | False: No financials on burn |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Seems fine, but is a YC startup version of Stripe Atlas |

| 2. Timing? | 3 | Good time for remote work |

| 3. Monopoly? | 3 | Good revenue but the fact that there is still no burn comments after a month of upload is concerning |

| 4. People? | 3 | Team seem fine but pretty standard bunch of YC Bros |

| 5. Distribution? | 2 | How will this company beat the competition on distribution? I've never heard of them |

| 6. Durability? | 2 | Platform for regulation and filing |

| 7. Secret? | 1 | Firstbase can beat Stripe Atlas and all the other US-Incorporation-As-A-Service companies |

What has to go right for the startup to return money on investment:

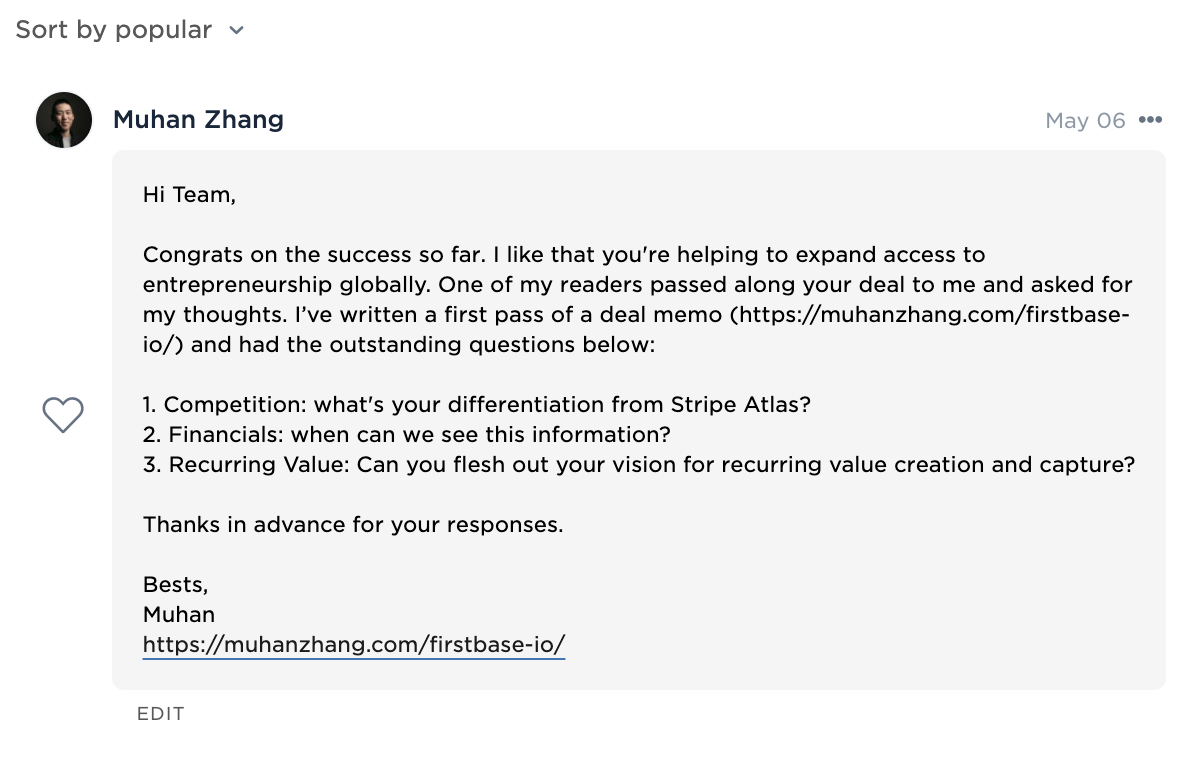

1. Upload financials so we can dive into the heart of the business; 2. Address a niche in intl registration that Atlas does not do; 3. Drive recurring value for recurring revenue platform

What the Risks Are

1. Copy-cat competition; 2. No meaningful differentiation; 3. Leadership has not addressed financials or answered questions on WeFunder.

Bonus Muhan's Notes

Need to see financials. $$$$$$$$$$$. Originally submitted on 4/6/21.

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.