Deal Abstract

https://www.seedinvest.com/gatsby/series.a

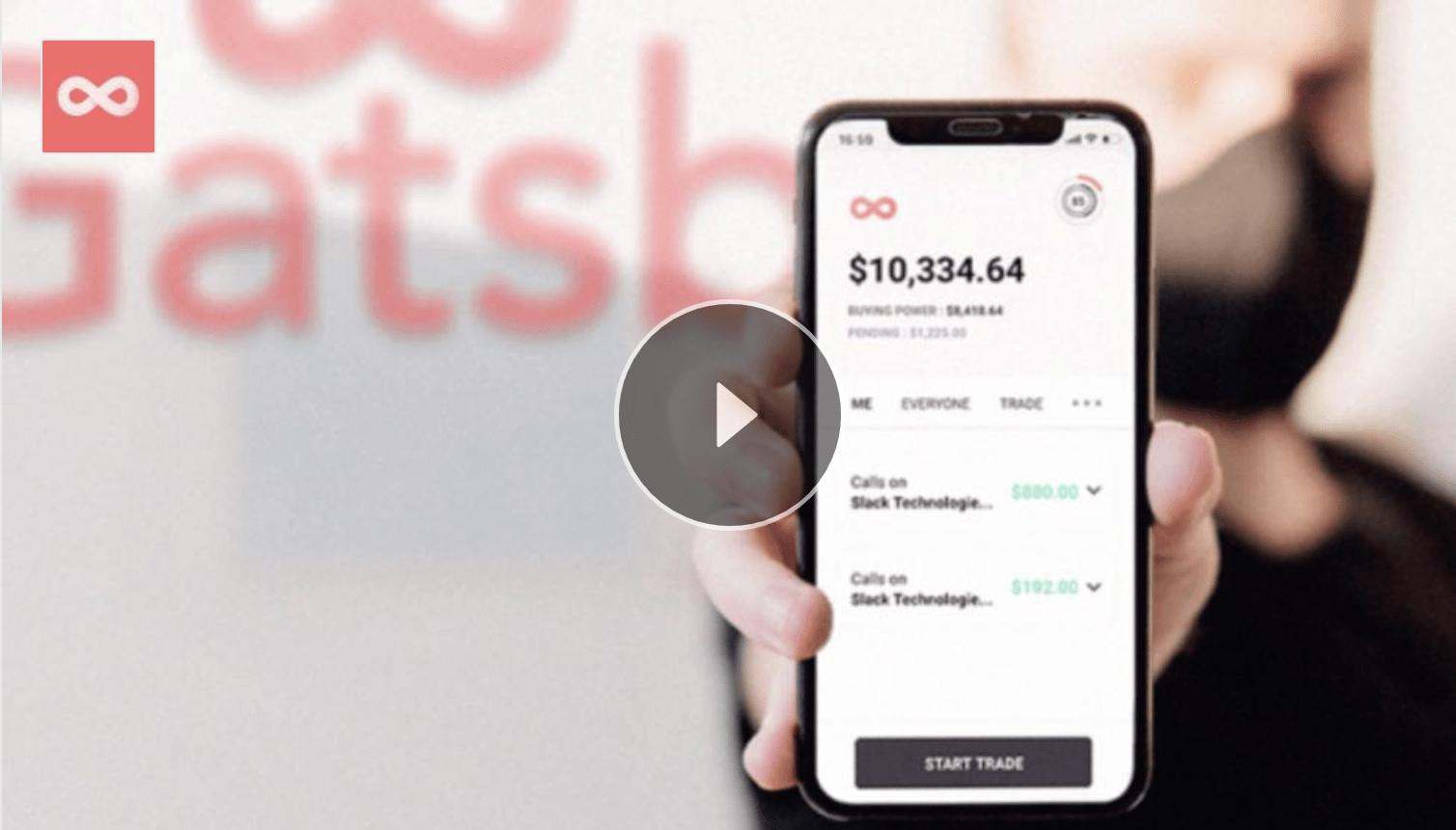

Robinhood for options trading. Has lots of brand name investors, but raising on a $25MM valuation with no revenue. Uncertain what the defensible secret is.

Shout out to reader DK for forwarding me the deal!

Interested in startup investing? Subscribe to my premium newsletter, Startup Investing, to receive exclusively weekly content, tailored for the startup investor.

The 6 Calacanis Characteristics (91 161 18)

| Check | Yes/No |

| 1. A startup that is based in SV | No: New York, NY. |

| 2. Has at least 2 founders | Yes: Two. |

| 3. Has product in the market | Yes |

| 4. 6 months of continuous user growth or 6 months of revenue. | Yes: growing at 10%/week in usage. Acquired over 7,000 accounts since launch with an average funded account balance of over $1,100 |

| 5. Notable investors? | Yes: Barclays, Techstars, Rosecliff Ventures, SWS Ventures, Irish Angels and Plug & Play Ventures |

| 6. Post-funding, will have 18 months of runway | Yes: 2019 burn was $1.1M, targeting $5MM in funding so coming in right around 60 months. |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Bad: Not seeing how it’s 10x better than Robinhood.

- The Timing question:

- Good: Robinhood has proven the appeal of commission-free trading among millennials.

- The monopoly question:

- Good: Can scale quickly.

- The people question:

- Fine: Team seems fine, but no experience in options startups or fintech businesses.

- The distribution question:

- Good: Direct to consumer.

- The durability question:

- Bad: This is my perennial concern: what’s to stop Robinhood doing to Gatsby what Facebook does to any of its competitors? (Instagram Stories for Snapchat, Reels for TikTok, etc.)

- *What is the hopeful secret?:

- There is a superior business model that Gatsby will have that can make it more lucrative and successful at offering free options trading than Robinhood.

What has to go right for the startup to return money on investment:

- N/A

What the Risks Are

- N/A

Muhan’s Bonus Notes

Financials (References)

- Current Fundraised: $986k

- Valuation: ~$25MM

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.