Deal Abstract

Marketplace for sellers and buyers of real estate financial instruments. Has nearly $1 million in revenue as of 2019 and in a good position to grow. Valuation at $40mm means I’m auto-out of the deal, but not a bad growth investment for those who like real estate.

Shout out to reader and fellow investor Peter for forwarding me the deal!

Interested in startup investing? Subscribe to my premium newsletter, Startup Investing, to receive exclusively weekly content, tailored for the startup investor.

The 6 Calacanis Characteristics (91 161 18)

| Check | Yes/No |

| 1. A startup that is based in SV | Yes: San Francisco, CA |

| 2. Has at least 2 founders | No: One |

| 3. Has product in the market | Yes |

| 4. 6 months of continuous user growth or 6 months of revenue. | Yes: 2018 revenue was $126k, 2019 was $922k |

| 5. Notable investors? | Yes: Y-Combinator, Social Capital (and 2018 scandal,) and others. |

| 6. Post-funding, will have 18 months of runway | No: Burned $3mm in 2019, raised only $500k. |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Good: this market exists and is indeed very fragmented.

- The Timing question:

- Good: managed marketplaces for the win.

- The monopoly question:

- Good: Look at that revenue. But I will say, regulatory may slow it down.

- The people question:

- Good: Team seems well positioned to execute. Interesting that founder found and sold RealtyShares. Not sure how the company was, but an exit’s an exit.

- The distribution question:

- Good: Hobnobbing with finance bros.

- The durability question:

- Good: Solid.

- *What is the hopeful secret?:

- Not much secret, there’s definitely a market for digitizing the purchase and selling of digital real estate financial instruments.

What has to go right for the startup to return money on investment:

- Pretty certain this will return money on investment.

What the Risks Are

- Capital Risk: Only raised $502k, which is two months of burn.

Muhan’s Bonus Notes

I think this company will make money. But to put it into perspective, let’s say you put $25k into financing this company. If you invested that same amount of capital in 10 companies at a $4 million valuation, you’d be potentially looking at tripling your money instead of 50%-75%.

Also happy bonus that Lesley Brice from Groundfloor gave them a positive review!

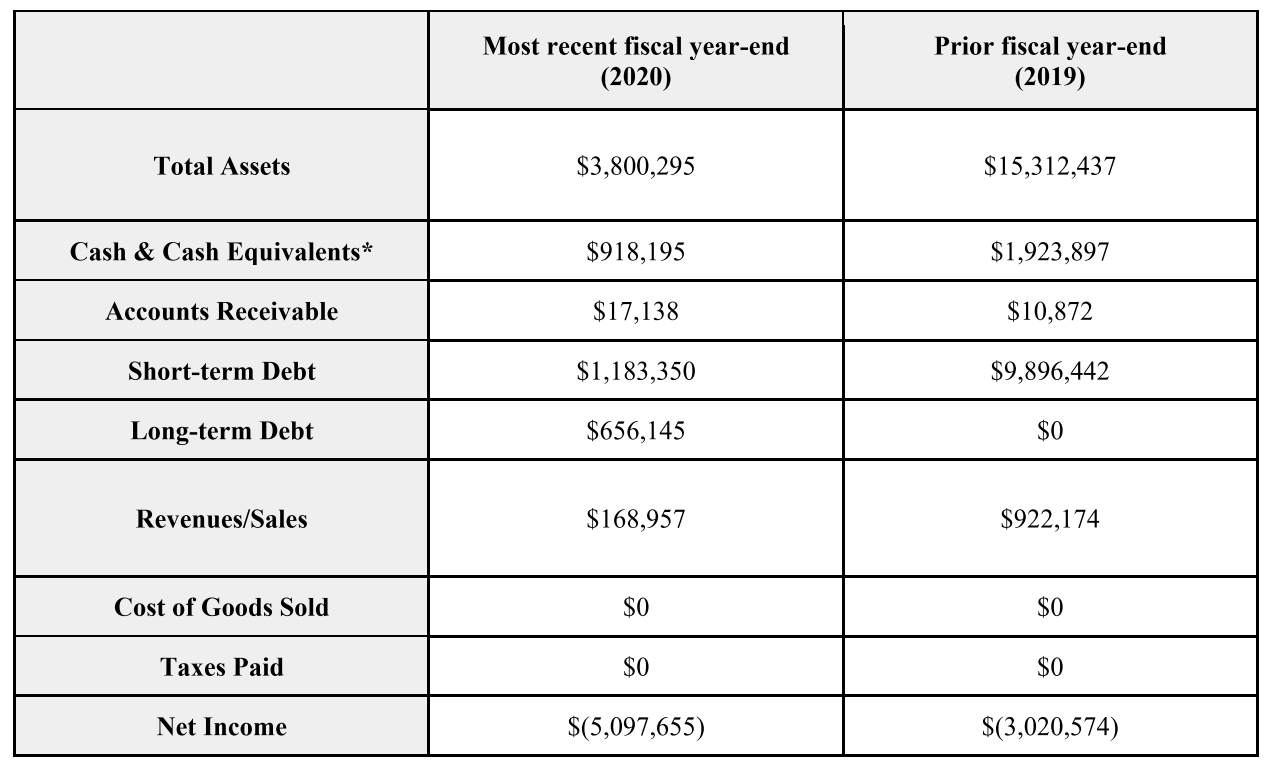

Financials (References)

- Current Fundraised: $986k

- Valuation: ~$40MM

Updates

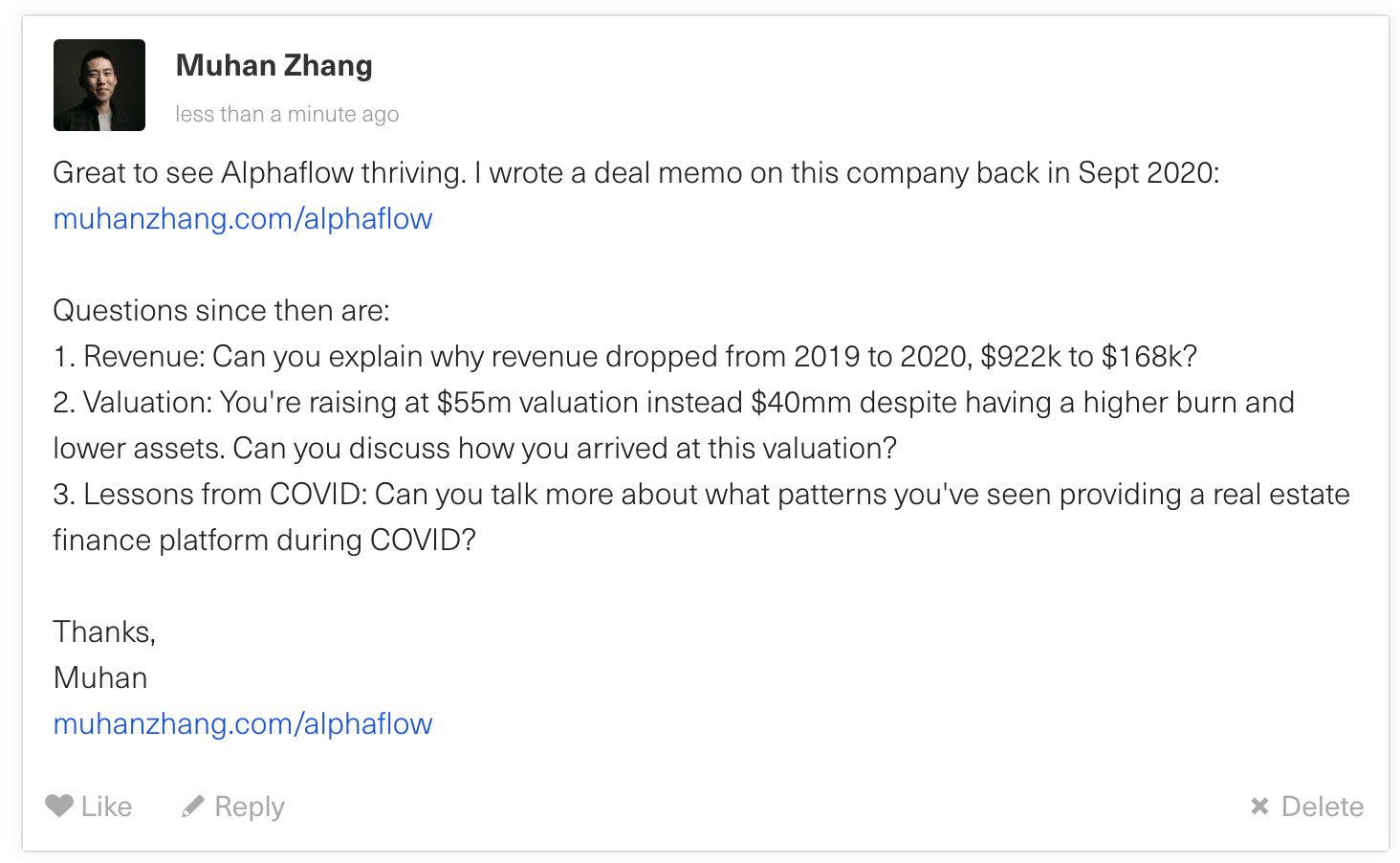

New round at $55m on May 2021, with new financials.

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.