Deal Abstract

Theranos 2.0 trying to go B2B to B2C first. But will their technology be commercially profitable?

Financials (VRB)

| Question | Notes |

|---|---|

| 1. Fundraising Target? | $1000070 |

| 2. Fundraised So Far? | $532773 |

| 3. Pre-Money Valuation? | $25000000 |

| 4. Previous Year's Annual Revenue | $1439995 |

| 5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) | ~$-212485 |

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: Philadelphia, PA |

| 2. Has at least 2 founders? | True: Two |

| 3. Has product in the market? | False: Raising money to launch product |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: impressive |

| 5. Notable investors? | True: Y-Combinator |

| 6. Post-funding, will have 18 months of runway? | True: Already has 4 years runway at present |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Looks better than Theranos but only marginally |

| 2. Timing? | 2 | More telemedicine |

| 3. Monopoly? | 1 | No usage in the market |

| 4. People? | 3 | Good team, but no one whose taken a biomed device to market |

| 5. Distribution? | 1 | Selling to B2B |

| 6. Durability? | 3 | If they can build it, super durable |

| 7. Secret? | 2 | By using the arm patches instead of a 'drop of blood', Innamed can make Theranos business go rihgt |

What has to go right for the startup to return money on investment:

1. Monetize well with B2B; 2. Eventually get the blood sample size down/UI simple enough to go to consumer; 3. Manufacture product at scale

What the Risks Are

1. Hardware risk/no 10x innovation; 2. Pricing and product risk; 3. Servicing costs at scale

Bonus Muhan's Notes

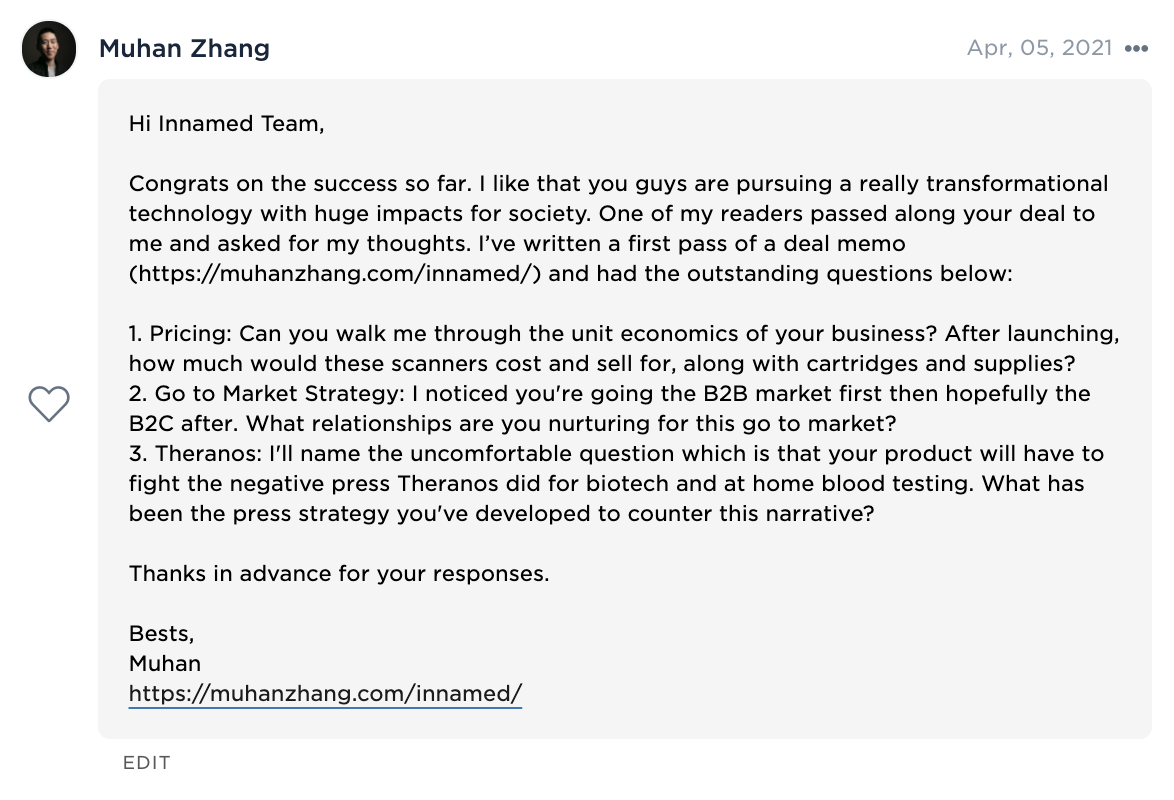

Maybe unfair, but this company would have to solve all of Theranos' problems and then some to make money. Here is notes from the investor who brought in this deal: 'Ha ha here is my kool aid. I don't think the risk is very high. But you know I'm not an expert. I'm willing to bet these guys win. My money's staying on the table. Decently priced entry point for the space, especially at $20M. Medium risk on the tech. It looks like systems integration and regulatory work left. It appears lots of stuff has been proven in the lab. They have one patent issued (a big deal) and peer reviewed novel tech. They also have a good supply chain with big companies. I like the founders, especially that they are experts and makers in their fields. Hands on pushing it forward. My understanding is they came up with the idea in school. The idea is huge. It's wild to see them have a chance of smashing it out of the park while the biotech industry is watching from the stands. They only have seven employees, seven!!! They've generated good revenue growth since the company started and managed expenses well. They have multi-year deals with pharma (a sign of lower risk on tech) - with new deals in the pipe. They have a go to market plan for rolling out the platform in the virtual clinical trial market (for post trial data analysis - so they are only collecting data) before FDA approval (Q1-Q2 2022). After FDA approval they have a plan to attack specific clinical applications. This strategy is a great way to develop and harden the platform while making money. Their IP strategy is good. A solid base biosensor and circuit system to run precise electro chemical reactions in one pass on multiple targets in variable environments - basically any target from what I can tell. For every target reaction technique they discover they can attempt to own it globally - exactly what they are doing with their novel lipid test patent. It's a fortress over the long term. I can see this being an affordable home device. Very excited in the potential for decreasing the cost and increasing the density of test cartridges using nano technologies. The platform architecture is good. It is promising that they plan for APIs and Apps to create an ecosystem. Future Apple of health care? It will be interesting to see if this is opened to developers to help grow the business and apply cartridges to various healthcare problems. I've found it really hard to find anything negative to say. LOL This is a good business building deep tech in a very smart way. Their market opportunity over the next 10-20 years looks like it could be $1T+. A lot of room to grow a multi billion dollar company, maybe > 10B. If they get FDA approval or find success with pharma in the clinical trial space, their value will increase significantly.'

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.