Deal Abstract

Beautiful turnkey property in downtown Lowell, MA for sale. 51 units fully leased, close to market rents. Not sure what the value add would be on this deal (if any.) Assumable low interest rate at 2.53%.

Part 1. The Basics

| Question | Notes |

|---|---|

| 1. Property Name: | Lowell Arcade |

| 2. Property Full Address: | 24 Merrimack St, Lowell MA, 01852 |

| 3. Property Listing URL: | https://umf.com/listings/7733150 |

| 4. Property Year Built: | 1906 |

| 5. Property Number of Units/Doors: | 51 |

Part 2. Quantitative, Numbers, and Financials ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Amount/Comment |

|---|---|

| 1. Link to Underwriting Google Sheet: | https://docs.google.com/spreadsheets/d/1Py9EvHHzp_7MK2GbyvXOO2BJgIcwmSoOcV4IKWQJPNg/edit?usp=sharing: UNDERWRITING COMMENT |

| 2. Asking Price: | $: PRICE COMMENT |

| 3. FFEIC Median Income: | $54696: INCOME COMMENT |

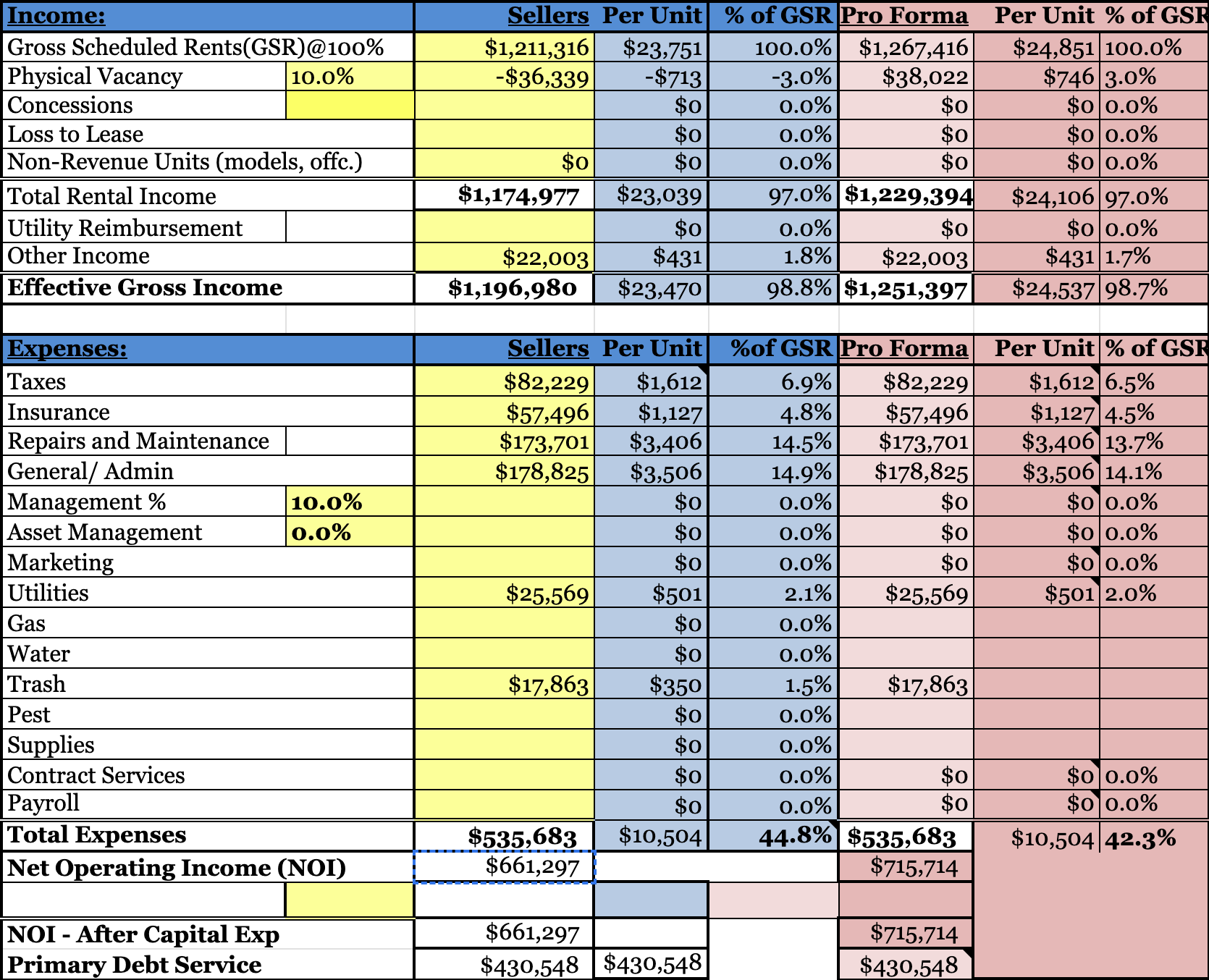

| 4. Last Year's Annual Rent: | $1196980: RENT COMMENT |

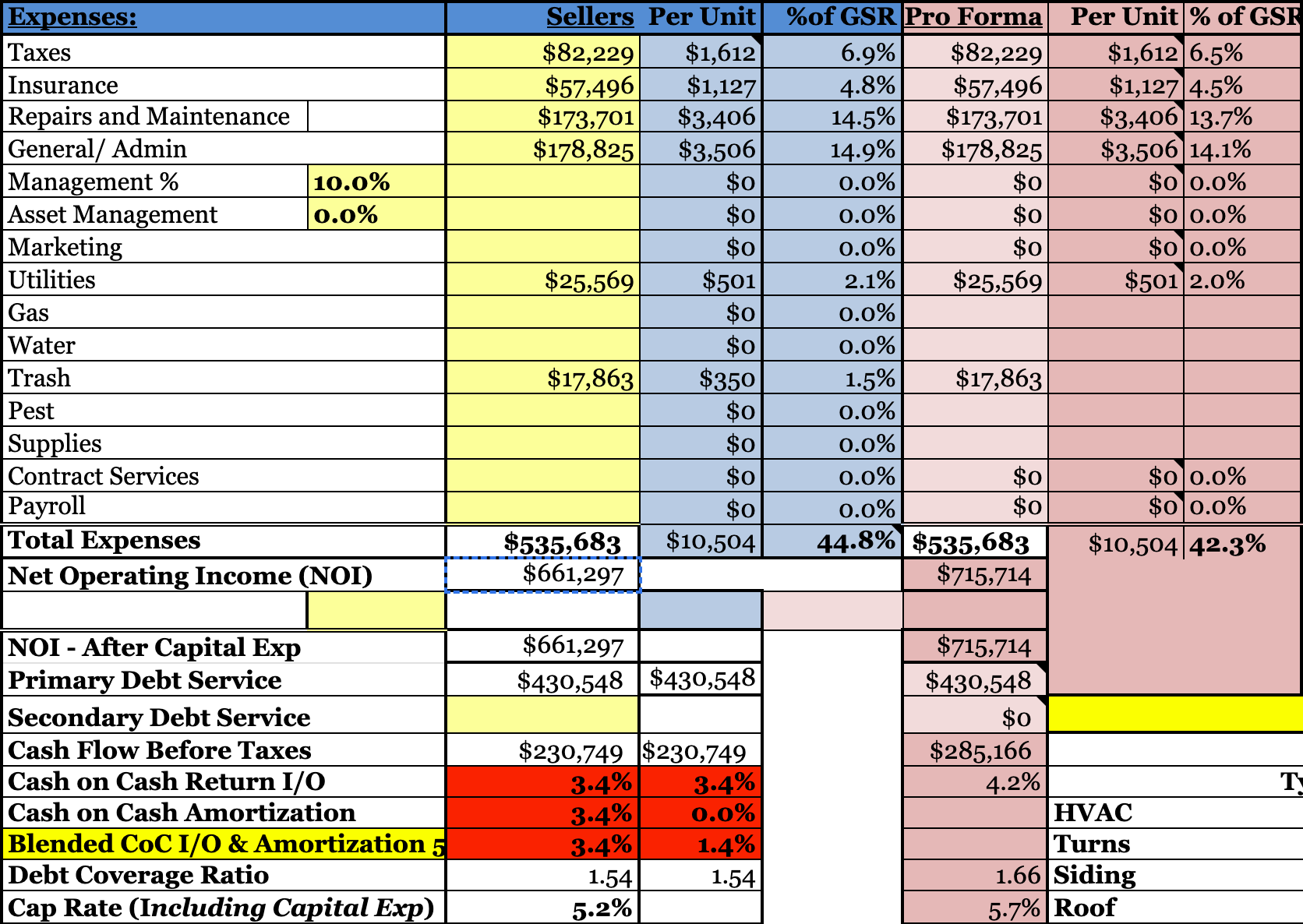

| 5. Last Year's Annual Expense: | $-535683: EXPENSE COMMENT |

| 6. Last Year's Net Operating Income (NOI): | $661297: NOI COMMENT |

| 7. 5 Year Internal Rate of Return (IRR): | 2.98: IRR COMMENT |

| 8. Yearly Cash on Cash (CoC) Rate of Return: | 4.2: COC COMMENT |

| 9. Debt Service Coverage Ratio (DSCR): | 1.66: DSCR COMMENT |

Part 3. Qualitative, Pre-Mortem, and Investor Fit (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Why is the seller now? | TIMING SCORE | Stabilized and probs looking to cycle capital |

| 2. Am I the right buyer for this deal? | FIT SCORE | Big, beautiful, fully leased in Lowell, MA. I don't think I'm the right person for it because it's capital intensive and has little room to grow. That said, very cool deal. |

| 3. What has to go right for this deal to work out? | Right Rating | |

| 4. People? | ||

| 5. Distribution? | ||

| 6. Durability? | ||

| 7. Secret? |

What has to go right for the startup to return money on investment:

1. Stable operations; 2. Fairly passive investor; 3. Massachusetts stays stable

What the Risks Are

1. Basically at capacity; 2. No room for seller to give discount on deal given their own equity in the deal likely; 3. Very little room for error given the financial model

Bonus Muhan's Notes

Very fun to underwrite, one day (with better returns)

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.