Deal Abstract

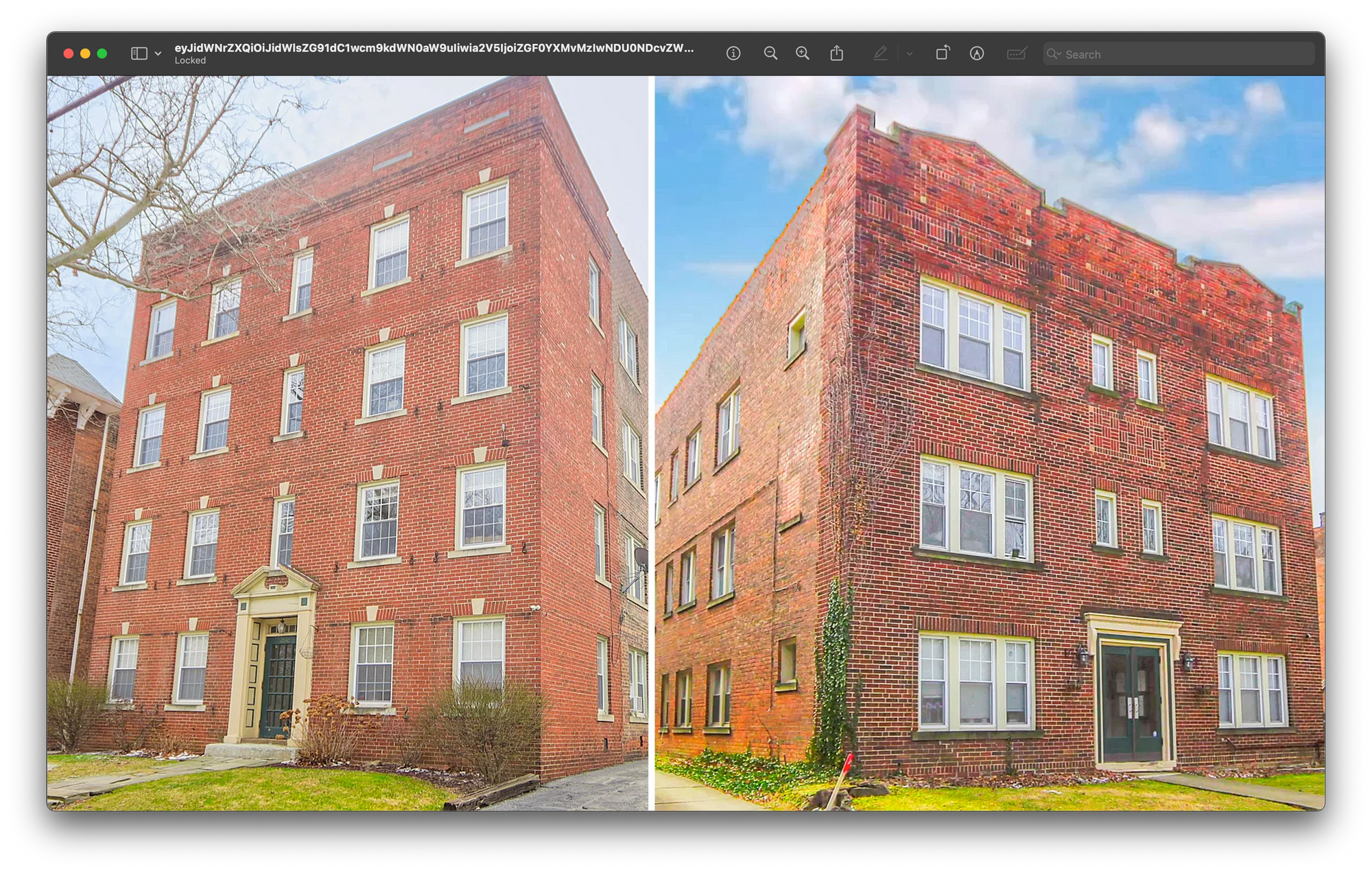

Solid 26 unit in Cleveland Heights, OH for sale with a parking lot. All apartments rented to long term tenants with modest opportunity to raise rents, though maybe more upside with nicer finishes.

Part 1. The Basics

| Question | Notes |

|---|---|

| 1. Property Name: | Mayfield 26 |

| 2. Property Full Address: | 2646 & 2660 Mayfield Rd, Cleveland Heights OH, 44106 |

| 3. Property Listing URL: | https://adamslynch.com/properties.html?propertyId=932473-sale |

| 4. Property Year Built: | |

| 5. Property Number of Units/Doors: | 26 |

Part 2. Quantitative, Numbers, and Financials ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Amount/Comment |

|---|---|

| 1. Link to Underwriting Google Sheet: | https://docs.google.com/spreadsheets/d/1Yve_GA-_iLUz_kC_ufbvVKwoDQHD5o2iOWDfyCqi_mQ/edit?usp=sharing: UNDERWRITING COMMENT |

| 2. Asking Price: | $2025000: PRICE COMMENT |

| 3. FFEIC Median Income: | $102560: INCOME COMMENT |

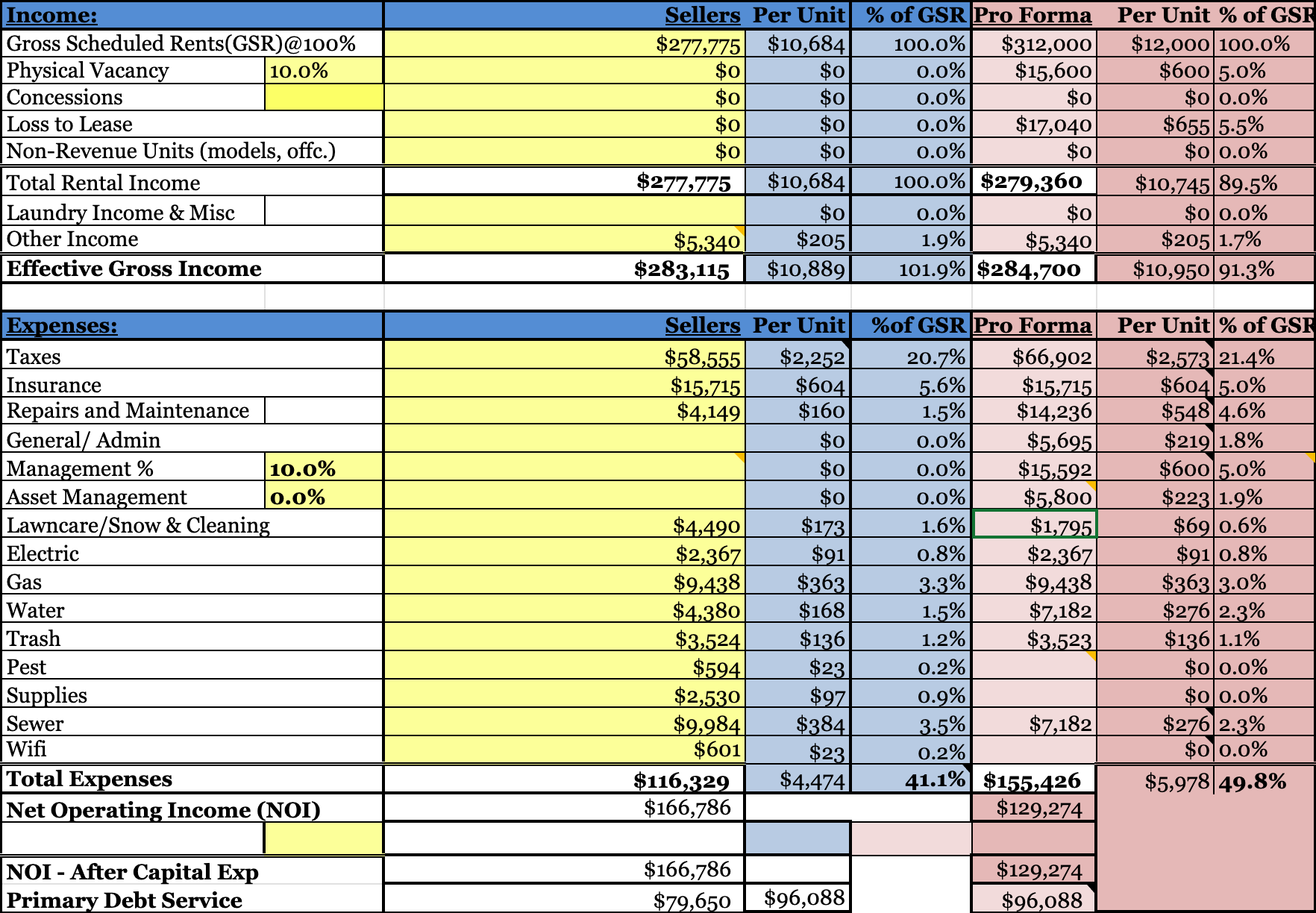

| 4. Last Year's Annual Rent: | $277775: RENT COMMENT |

| 5. Last Year's Annual Expense: | $-116329: EXPENSE COMMENT |

| 6. Last Year's Net Operating Income (NOI): | $116329: NOI COMMENT |

| 7. 5 Year Internal Rate of Return (IRR): | 6.24: IRR COMMENT |

| 8. Yearly Cash on Cash (CoC) Rate of Return: | 3.5: COC COMMENT |

| 9. Debt Service Coverage Ratio (DSCR): | 2.09: DSCR COMMENT |

Part 3. Qualitative, Pre-Mortem, and Investor Fit (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Why is the seller now? | TIMING SCORE | TBD |

| 2. Am I the right buyer for this deal? | FIT SCORE | 1. Solid size, potential value add; 2. Incomes in the tract are solid, in Cleveland Heights 3. Seems to be the right opportunity to drive efficiency |

| 3. What has to go right for this deal to work out? | Right Rating | |

| 4. People? | ||

| 5. Distribution? | ||

| 6. Durability? | ||

| 7. Secret? |

What has to go right for the startup to return money on investment:

1. Negotiate the price down lower to include capex; 2. Go higher on finishes to force appreciation; 3. Demographics on Cleveland Heights only improve

What the Risks Are

1. Asking price too high; 2. Limited upsides given they're all 1/1's mostly at market rent; 3. Operating expense very high at 40% without property management

Bonus Muhan's Notes

Wonder what the seller's motivation to sell is

Cool to recognize the two brokers, reminds me of my two other Cleveland Heights deals:

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think