Deal Abstract

Indian team of strivers wants to create a super education platform to allow the children of strivers get more entrepreneurial resume experience for getting into elite colleges. Reminds me of Open English Junior for children.

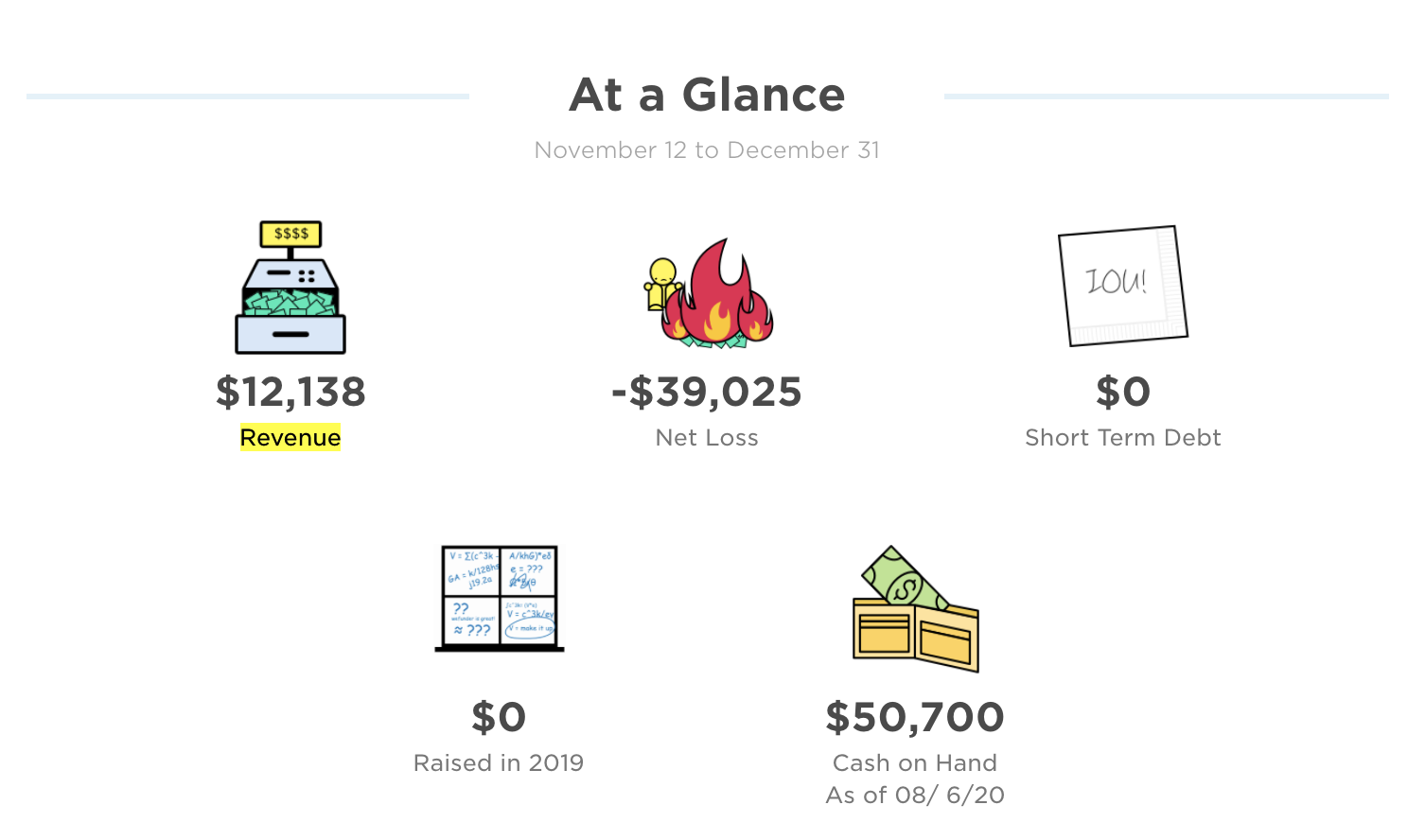

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$1m|

|2. Fundraised So Far?|$134k|

|3. Pre-Money Valuation?|$6m|

|4. Previous Year's Annual Revenue |$12k|

|5. Previous Year's Annual Burn |~$39k|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | Yes: San Jose, CA |

| 2. Has at least 2 founders? | Yes: Three |

| 3. Has product in the market? | Yes: |

| 4. 6 months of continuous user growth or 6 months of revenue? | Yes |

| 5. Notable investors? | No |

| 6. Post-funding, will have 18 months of runway? | Yes If they can raise the entire round |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Need to trial the product (tinyurl.com/msjtrial), but honestly this sounds like a platform play like Open English Junior, a kids EdTech platform I helped build in 2017. |

| 2. Timing? | 3 | Good, EdTech platforms is a good time |

| 3. Monopoly? | 2 | Seems like a lot of Indian funders/enthusiasm from Indian youth on the platform |

| 4. People? | 2 | Entrepreneurial but no one with a background in EdTech. |

| 5. Distribution? | 2 | Lots of B2C and trying to get parents to pay. |

| 6. Durability? | 3 | If they can build a credible brand, very good. |

| 7. Secret? | 4 | In the vein of parents spending lavish amounts of money prepping their kids for college, there is demand for an outcome based entrepreneurship academy. |

What has to go right for the startup to return money on investment:

- Helps Kids Get Into Fancy Colleges

- Stay a Premium Brand

- At One Point Probs Upsell More Premium Services

What the Risks Are

- Market Risk

- Nice-to-have vs. Must-have

- Operational Costs Have Been high

Bonus Muhan's Notes

Watching the video reminded me of my time working for Open English in Miami as well as Andrew Yang's pitch about young people no longer starting businesses. Will be curious to engage founders in discussion.

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.