Deal Abstract

https://www.loopnet.com/Listing/2528-2534-Noble-Rd-Cleveland-Heights-OH/34701352/

Large multifamily in need of massive renovation at scale for sale. Property came under contract while underwriting but broker knows the other CLE multifamilies I've underwritten. Would be curious to see what the seller achieves with this property.

Part 1. The Basics

| Question | Notes |

|---|---|

| 1. Property Name: | Noble Villa |

| 2. Property Full Address: | 2528-2534 Noble Rd, Cleveland Heights OH, 44121 |

| 3. Property Listing URL: | https://www.loopnet.com/Listing/2528-2534-Noble-Rd-Cleveland-Heights-OH/34701352/ |

| 4. Property Year Built: | 1924 |

| 5. Property Number of Units/Doors: | 22 |

Part 2. Quantitative, Numbers, and Financials ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Amount/Comment |

|---|---|

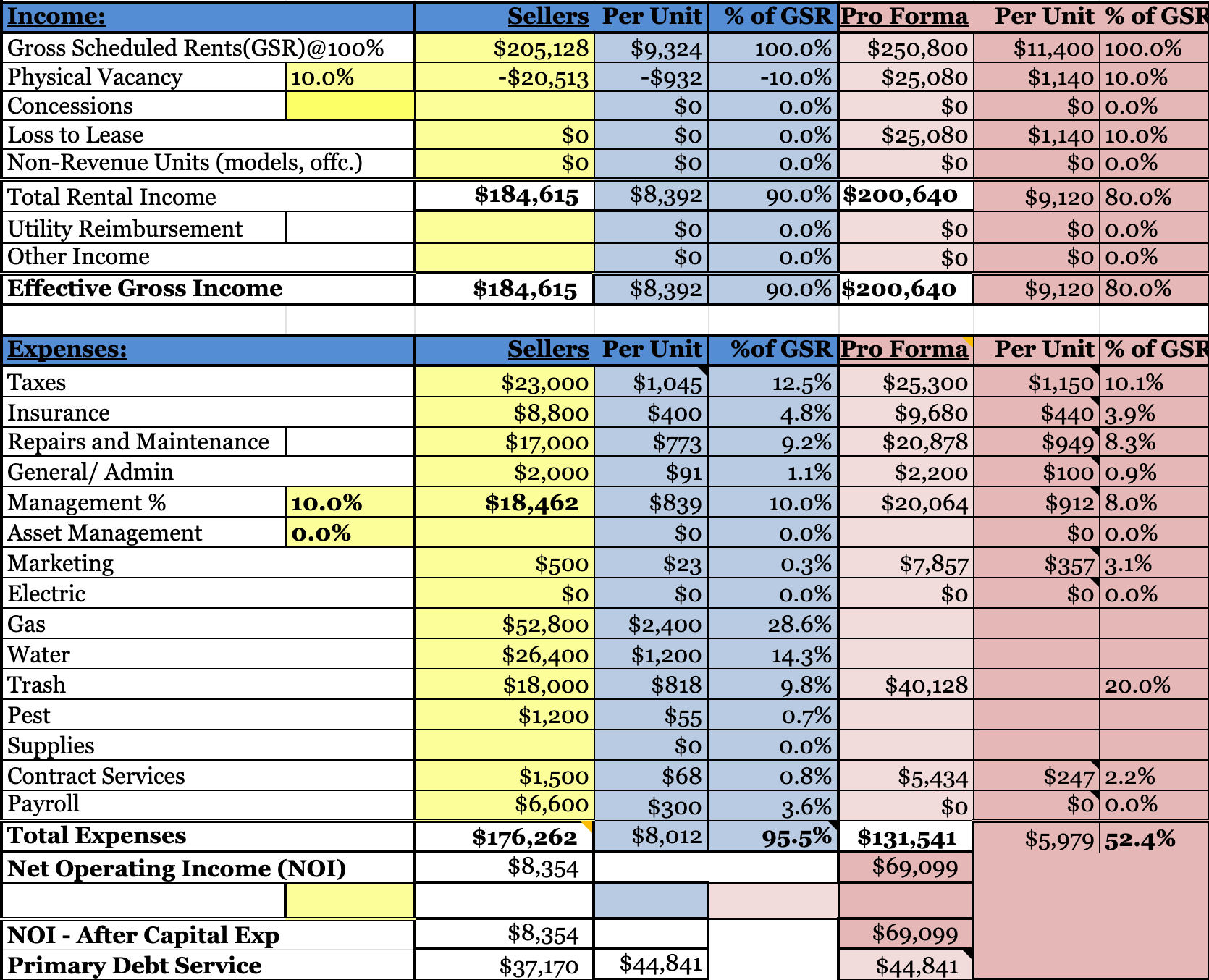

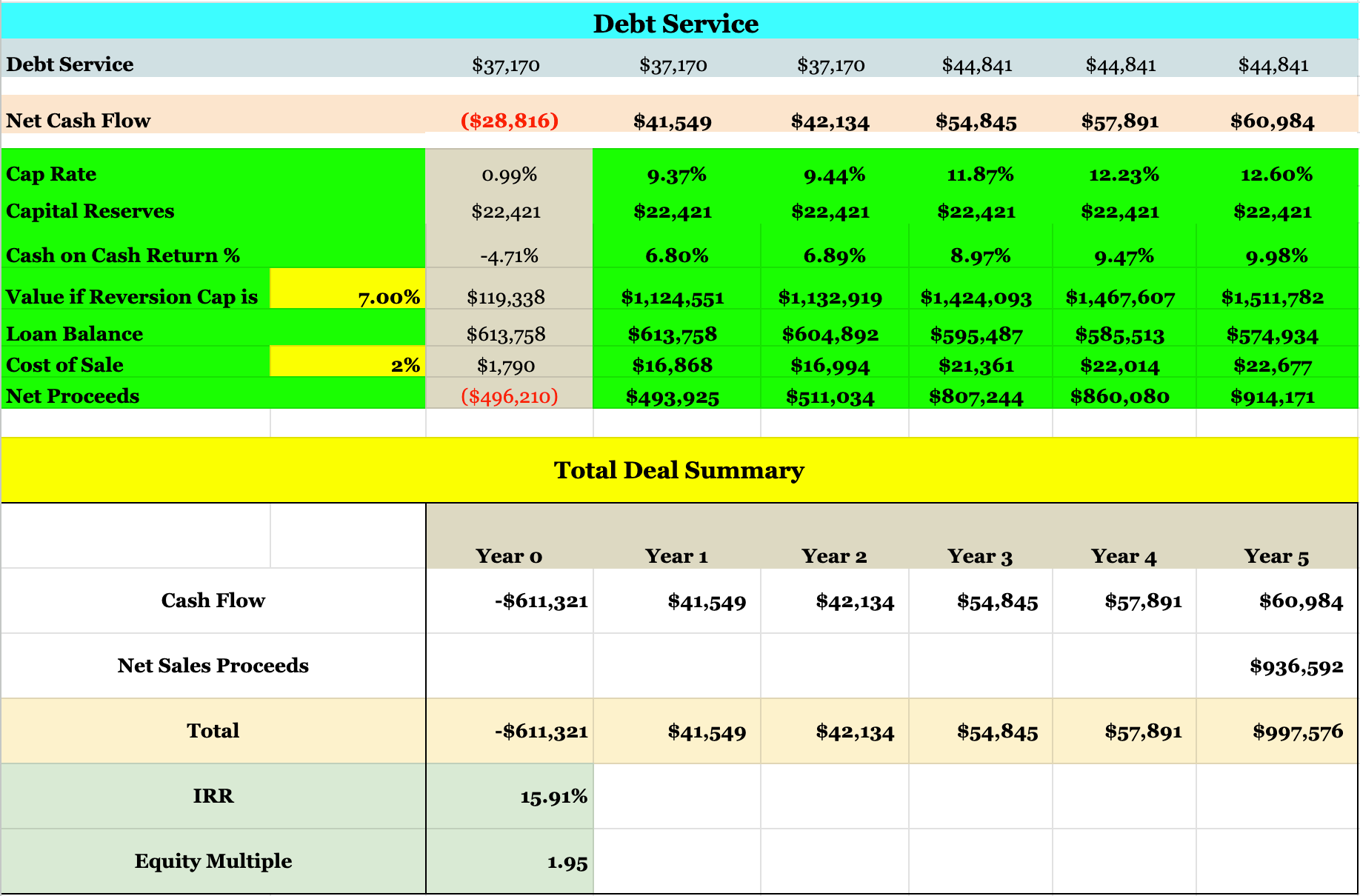

| 1. Link to Underwriting Google Sheet: | https://docs.google.com/spreadsheets/d/1PYn5KAEncgd2Q1mCGmb9xSrB6ZNsjDz0Zmg3bOGjfVM/edit?usp=sharing: UNDERWRITING COMMENT |

| 2. Asking Price: | $1050000: PRICE COMMENT |

| 3. FFEIC Median Income: | $85311: INCOME COMMENT |

| 4. Last Year's Annual Rent: | $184615: RENT COMMENT |

| 5. Last Year's Annual Expense: | $-176262: EXPENSE COMMENT |

| 6. Last Year's Net Operating Income (NOI): | $8354: NOI COMMENT |

| 7. 5 Year Internal Rate of Return (IRR): | 15.91: IRR COMMENT |

| 8. Yearly Cash on Cash (CoC) Rate of Return: | 4: COC COMMENT |

| 9. Debt Service Coverage Ratio (DSCR): | 1.54: DSCR COMMENT |

Part 3. Qualitative, Pre-Mortem, and Investor Fit (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Why is the seller now? | TIMING SCORE | While underwriting, deal went under contract |

| 2. Am I the right buyer for this deal? | FIT SCORE | 1. Reasonable purchase price, 2. huge value add, 3. solid neighborhood with decent incomes |

| 3. What has to go right for this deal to work out? | Right Rating | |

| 4. People? | ||

| 5. Distribution? | ||

| 6. Durability? | ||

| 7. Secret? |

What has to go right for the startup to return money on investment:

1. Renovate at scale, 2. Drop OPEX down, 3. Rent to higher income tenants

What the Risks Are

1. Scale of reno is massive; 2. Rents are capped at less than $1k/mth/door; 3. Old building delayed maintenance

Bonus Muhan's Notes

Fun

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.