Deal Abstract

https://wefunder.com/regrained

Innovative food company wants to take leftover grain from making beer and upcycling it into food ingredients. Business hinges on a critical patent-protected factor of being able to maintain a competitive business if vendors start chilling more for the used grain flour.

Want to invest alongside me? Subscribe to my premium newsletter, Startup Investing, to receive exclusively weekly content—including early access to what I’m investing in—tailored for startup investors.

The 6 Calacanis Characteristics (91 161 18)

| Check | Yes/No |

| 1. A startup that is based in SV | Yes: Berkeley, CA |

| 2. Has at least 2 founders | Yes (2) |

| 3. Has product in the market | Yes |

| 4. 6 months of continuous user growth or 6 months of revenue. | Yes: 2018 revenue to 2019 revenue increased from $238k to $359k. |

| 5. Notable investors? | Yes: Molson Coors (yes, like the beer,) and Barilla (yes, like the pasta.) |

| 6. Post-funding, will have 18 months of runway | No: $1.664M burn for 2019 and only raising $535k, so 4 months of runway. Somewhat concerning. (Importantly, also allegedly raised $1.5MM in private money, so $535k is only public.) |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Good, Maybe: Easily more than 10x versus not recycling anything, but not confident it’s 10x better than normal flour.

- The Timing question:

- Good: Right time for virtue brands.

- The monopoly question:

- Bad: Can’t see why other companies wouldn’t figure out a way to make other cooking ingredients from beer waste.

- The people question:

- Good: Team is good.

- The distribution question:

- Bad: Needs to get large shelf space for selling produce through commercial supermrkets.

- The durability question:

- Bad: Unconvinced other companies can’t product ‘patented’ technology to process flour.

- *What is the hopeful secret?:

- Adopting of remnant ingredients will take place ousted via culminate groups.

What has to go right for the startup to return money on investment:

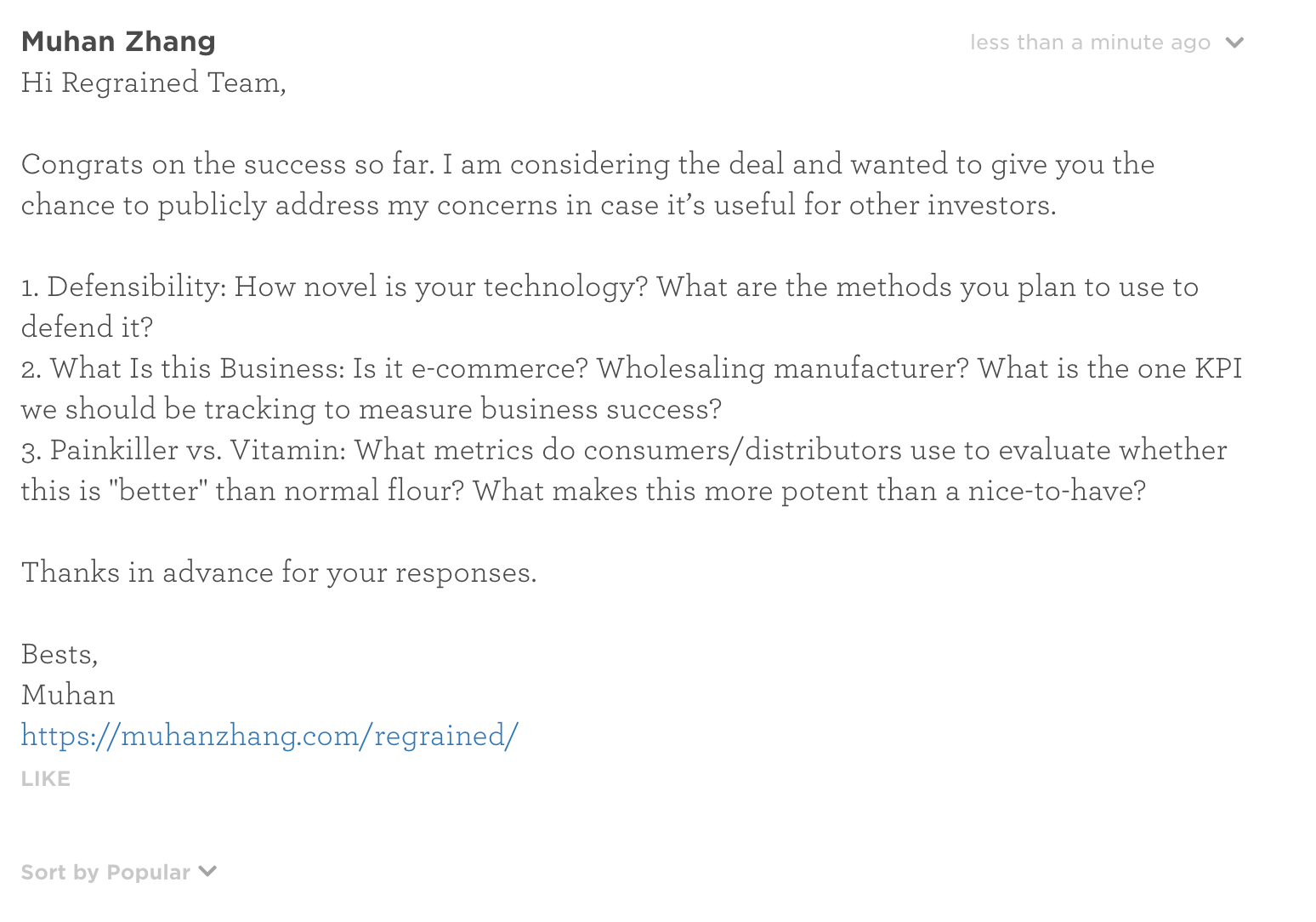

- Clarify What The Business is In

- Leverage investors and pro relationship

- Customer service has to be excellent to address questions

What the Risks Are

- Technology not that novel/not defensible

- Business gets distracted behind CPG and vendor partner status.

- Product is not that good/cheaper than normal flour, so this is a vitamin not a painkiller.

Muhan’s Bonus Notes

Overall fine business, but I don’t invest in food.

Financials (References)

- Current Fundraised: $261k

- Valuation: ~$14.5MM

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

Want to invest alongside me? Subscribe to my premium newsletter, Startup Investing, to receive exclusively weekly content—including early access to what I’m investing in—tailored for startup investors.

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.