Deal

Smilelove

Direct-to-consumer clear aligner treatment for straightening teeth.

Decision

Yes.

Why Investing

- Hard to argue with a business that went from $0 to $1MM in revenue in a year.

- Super boring business model that I understand.

- Lean team and great margins.

Bonus

I figured out how to add highlights in Gutenberg via HTML:

<ul>

<li>

<span style="background-color: rgb(232, 234, 235);">

<b><i>Good: </i></b>

<i>Smile Direct Club raised $380 million at a valuation of $3.2 billion in October 2018.</i>

</span>

</li>

</ul>Master Checklist

| Check | Pass/Fail |

| 1. Ssyndicate lead has >5 years investing and >1 unicorn investment | Fail |

| 2. A startup that is based in SV | Fail (Holladay/Salt Lake City, Utah) |

| 3. Has at least 2 founders | Pass |

| 4. Has product in the market | Pass: Yes |

| 5. 6 months of continuous user growth or revenue. | Pass: Revenue grew from $0 to $1MM in 2018 |

| 6. Notable investors? | Fail: Bootstrapped, heck yeah |

| 7. Post-funding, will have 18 months of runway | Pass: Yes, incurred 113k in second half of 2017, so 226k annual, raised $738k. |

| 8. Proprietary technology? | Fail |

| 9. Network effects? | Fail |

| 10. Economies of scale? | Pass |

| 11. Great branding? | Pass: (Huzzah for UX cofounder) |

Seven Questions

- The Engineering question: Bad: betting on the kiosk

- The Timing question: Good: Smile Direct Club raised $380 million at a valuation of $3.2 billion in October 2018.

- The monopoly question: Bad: not sure why this would be a winner-take-all market. Should be a fairly profitable and straightforward e-commerce play.

- The people question: Good: Startup professionals who were both reasonably senior at exit to start this company. Bootstrapped.

- The distribution question: Good (with a catch): Smile Love is making a big bet on these kiosks. Uncertain what a growth channel this will be. Otherwise, online economics are good.

- The durability question: Bad (by default): not sure how much innovation is going on in the teeth aligning space. Unless someone comes out with a radically cheaper and/or better solution. should be durable.

- The secret question: Bad (by default): people want great teeth, and apparently InvisAlign (Smile Direct Club) is not the best solution.

What has to go right for the startup to return money on investment:

- Growth of this market continues.

- Either proprietary technology is developed or the company develops something more defensible. Somewhat skeptical about this kiosk, but certainly gaining a unique brand and distribution channel would be key.

- This company is less of a venture investment and more of a play in e-commerce. I’m 100% fine with that, but good to clear expectations. There are plenty of lucrative e-commerce plays (Chewy.com, Dollar Shave Club, Bonobos)

What the Risks Are

- Competition: will Smile Direct Club take its gigantic war chest to choke its competitors a la Amazon and Diapers.com?

- Technology: whoever Smile Love’s supplier is, what’s to stop another firm from licensing the technology and doing what Smile Love is doing?

- Ambition: this business looks like an amazing lifestyle business, and given the governance structure, unsure what the liquidity event would be.

Updates

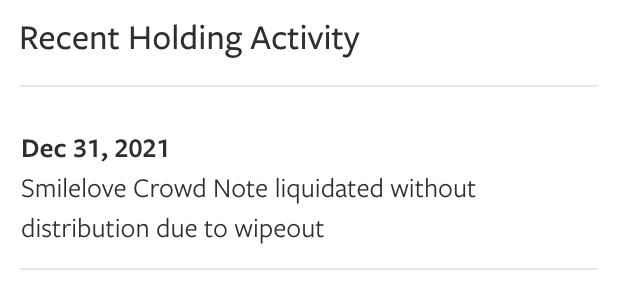

02/16/22: Just saw this in my SeedInvest holding account

An Up-To-Date Smilelove Review: What You Need to Know (2021) - Smile Prep

Smilelove was a service that shipped custom invisible aligners to your door, but they are now out of business.

What Happened to Smilelove? (2022 Update) - Smile Prep

If Smilelove’s recent crash left you with a thousand questions, you’re not alone. This guide will provide some insight into why Smilelove ceased operations, and what to expect going forward.