Deal Abstract

https://www.startengine.com/streamlytics

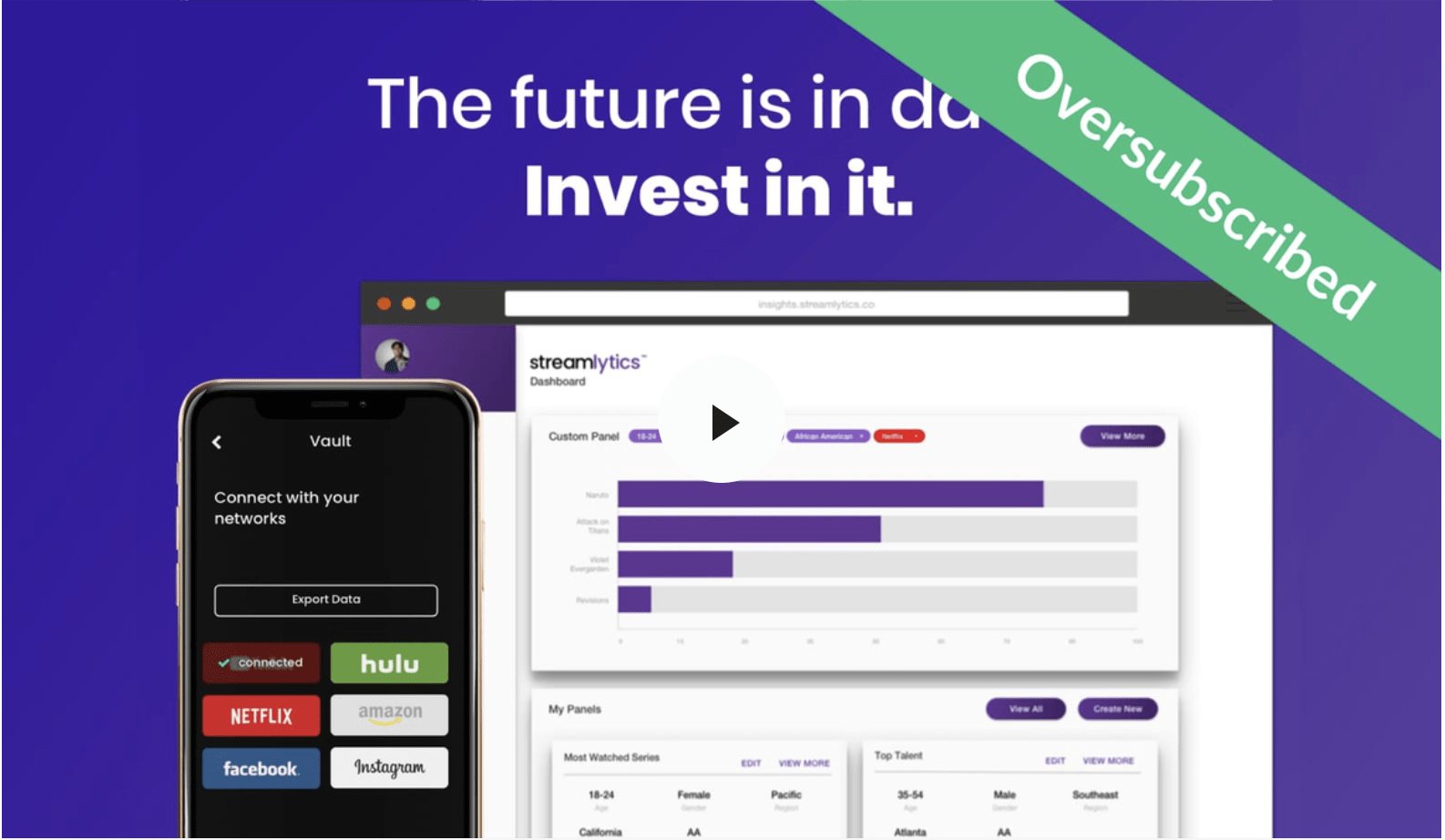

Pre-revenue data company wants to aggregate user data and give said users the ability to monetize their data. Streamlytics would sell data to companies that need it, with the users permission, while also providing more enriched data. Raised $1M on a $20MM valuation.

Interested in startup investing? Subscribe to my premium newsletter, Startup Investing, to receive weekly content, exclusively tailored to accompany investors in their venture journey.

Decision

Pass

Why Investing/Passing

- Pre-Revenue: Going to market is a lot of risk that I generally let founding teams shoulder.

- Does the Market Exist: Is this a vitamin or a painkiller?

- Timing: Not sure I see this precise moment being when consumers are going to demand compensation for their data.

The 6 Calacanis Characteristics (91 161 18)

| Check | Yes/No |

| 1. A startup that is based in SV | No: Culver City, CA (LA, thanks Jerry Tsai!) |

| 2. Has at least 2 founders | No: 1 |

| 3. Has product in the market | Yes |

| 4. 6 months of continuous user growth or 6 months of revenue. | No: pre-revenue. |

| 5. Notable investors? | No |

| 6. Post-funding, will have 18 months of runway | No: 2019 burn was $140k, raised 1,069k, only 7.6 months of runway. |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Uncertain: what’s the competition it’s being compared to?

- The Timing question:

- Uncertain: What’s making this the time for people to expect to monetize their data?

- The monopoly question:

- Good: Can scale very quickly if they figure it out.

- The people question:

- Good Not Great: Team with good startup experience, but no one has experience selling a product like this.

- The distribution question:

- Bad: Not sure where the unfair advantage of selling to consumers it is.

- The durability question:

- Good: owning all the data would make this very defensible.

- *What is the hopeful secret?:

- The market is ripe for consumers to demand compensation for their data from companies that collect it.

What has to go right for the startup to return money on investment:

- Generate Revenue: The company has not generated revenue yet.

- Change in Consumer Taste: Consumers have to change their expectations and start to expect compensation for data.

- Benefits to Corporations: What is the value add of paying for Streamlytics data versus just collecting it as Spotify?

What the Risks Are

- Too Early: Is the corporate world ready to pay for data yet?

- Vitamin Not Painkiller: Even if the corporate world was ready, why is Streamlytic’s data better than what companies can get themselves?

- Go To Market Strategy: lots of risk developing a product for a new market already.

Muhan’s Bonus Notes

Investing in a pre-revenue company worth $20 million is not a fit for my investment thesis.

Financials (References)

- Current Fundraised: $1M

- Valuation: ~20MM

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page. Also, somewhat of a dearth of materials (whose the team? where are the comments? why are the financials so opaque?)