Recommended for Startup Investors?

Yes

Why

Although I like things light and positive, sometimes it's really important for investors to know what fraud/the worst of VC/SV/startups looks like at the highest levels. Carreyrou and his highly principled sources withstood intimidation and harassment to break the story of Theranos' total and abject failure. Theranos burned $900m, a third of which was burned on legal intimidation and fees, raised off its all time high valuation of $8bn.

Takeaways include: 1) please, please, PLEASE don't invest in any founder that purports to be the second coming of Steve Jobs (at a minimum, please read Isaacson's biography, as well as Bob Iger and Ed Catsmull's biographies to fact check,) 2) don't invest in any company that won't explain its technology to you (ideas are free,) and 3) smart people at the highest of every level can still be deceived, so look for primary evidence, write deal memos, and be obstinate about relying on your own thinking.

My Notes By Chapter

- 5: Holmes came from an esteemed family, but her parents weren't loaded by any stretch of the imagination. Putting in the $30k they had for her Stanford tuition into Theranos represented a significant decision.

- 7: Despite the 2008 financial crisis, low interest rates were pumping money into VC.

- 65 y.o. Philadelphia, Dr. J, Jay Rosen, worked with Walgreens innovation team. Conshohocken, Take Care Health Systems.

- 8: Nepotistic hiring of undergrads who copy pasted ESPN articles into emails to pretend to work, this is why hiring processes with clear standards and mechanisms for team based self-verification are important.

- 9: Safeway, Steven Burd, with analysts who dial in to company quarterly earning calls.

- 12: Ian Gibbons, English blood work expert. 2005-2010, Theranos leader with Gary Frenzel. Was originally senior, but got flipped with his report. Nerdy scientist to a T, copious notes to leisure time, avid reader, list of every single book he read, including Marcel Proust Remembrance of Things Past, all seven volumes. Ian and wife met at Berkeley in the 70s. Ian also liked opera and photography.

- Folie a Deux: Holmes and Ramesh 'Sunni' Balwani.

- 15: Theranos had grown from $40m (2006) to $6bn (2013), Uber raised $361m at $5bn, Spotify 250m on $4bn

- Theranos kept poaching Board of Directors members from Stanford Hoover Institute fellowship.

- 18: Pathology Blawg, the source that, Adam Clapper, used to tip off Carreyrou. This is the power of distributed, self-verifying expert intelligence.

- 23: Marc Andreessen came to defend Holmes, as his wife had just profiled her in "5 revolutionary visionaries changing the world."

- Epilogue: Theranos burned through most of $900m, much on legal expenses. Around $250m were spent on legal services.

- Credits: Will Damron was the audiobook narrator, who also narrated "The Man Who Solved the Market."

Bonus Resources

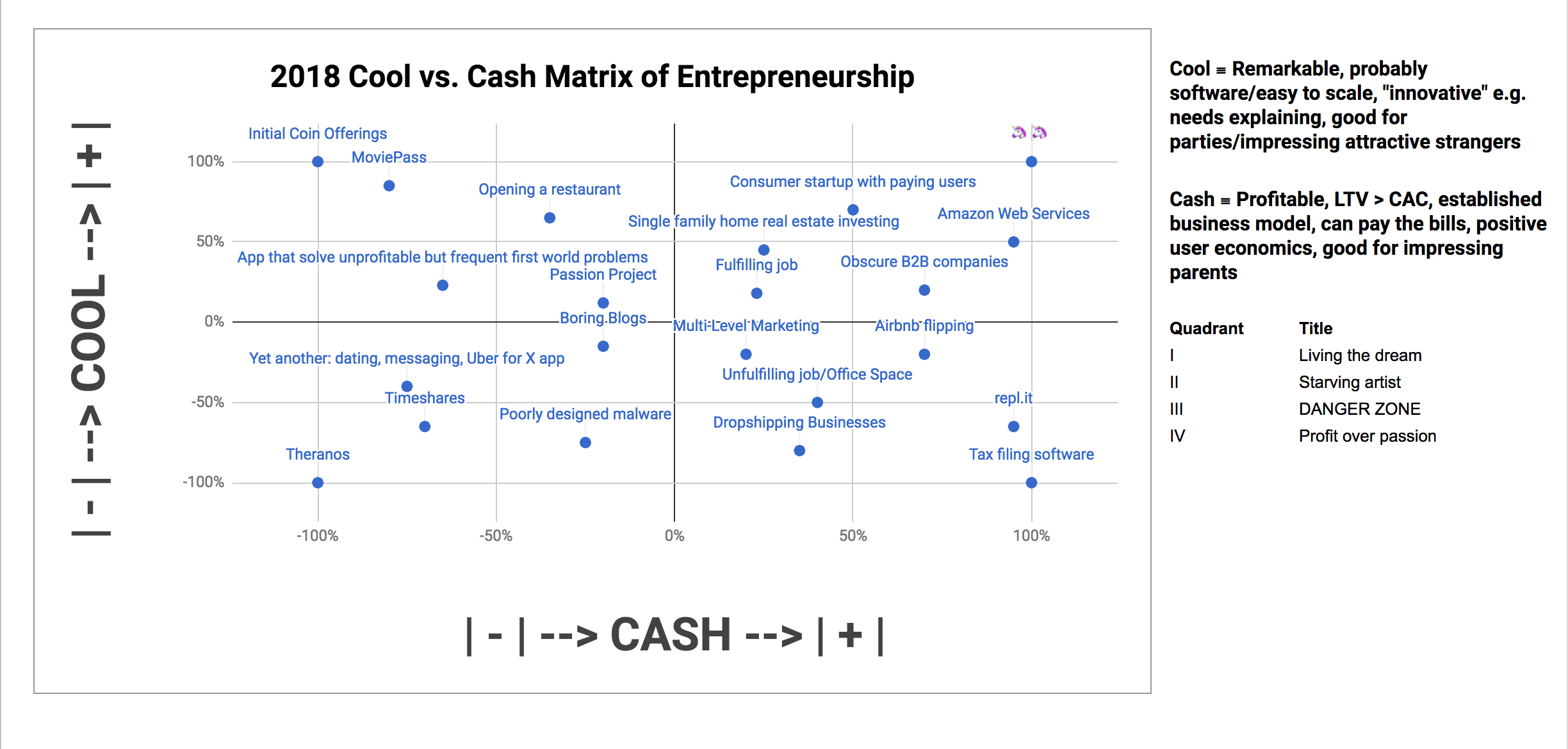

For fun, here's a picture of the Cool vs. Cash Spectrum chart I made in 2018. Notice Theranos at the bottom left for being neither cool (fraud) nor cash (bankrupt.)