Deal Abstract

Female entrepreneur brings back Buckwheat superfood culture from Australia to the U.S. Working with the Hatchery in Chicago.

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$250000|

|2. Fundraised So Far?|$56000|

|3. Pre-Money Valuation?|$4000000|

|4. Previous Year's Annual Revenue |$25522|

|5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) |~$-46919|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: Trout Valley, IL |

| 2. Has at least 2 founders? | False: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: Revenue increased from 2018 to 2019 |

| 5. Notable investors? | True: Sort of: https://thehatcherychicago.org/ |

| 6. Post-funding, will have 18 months of runway? | True: Call it $75k to have 1.5 years, very close |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 1 | Not an engineering innovation, just application of existing technology |

| 2. Timing? | 1 | Not sure why buck superfoods at this point is about to be venture backable |

| 3. Monopoly? | 1 | Don't know anyone eating it |

| 4. People? | 2 | Good founder but would have preferred more experience in food innovation |

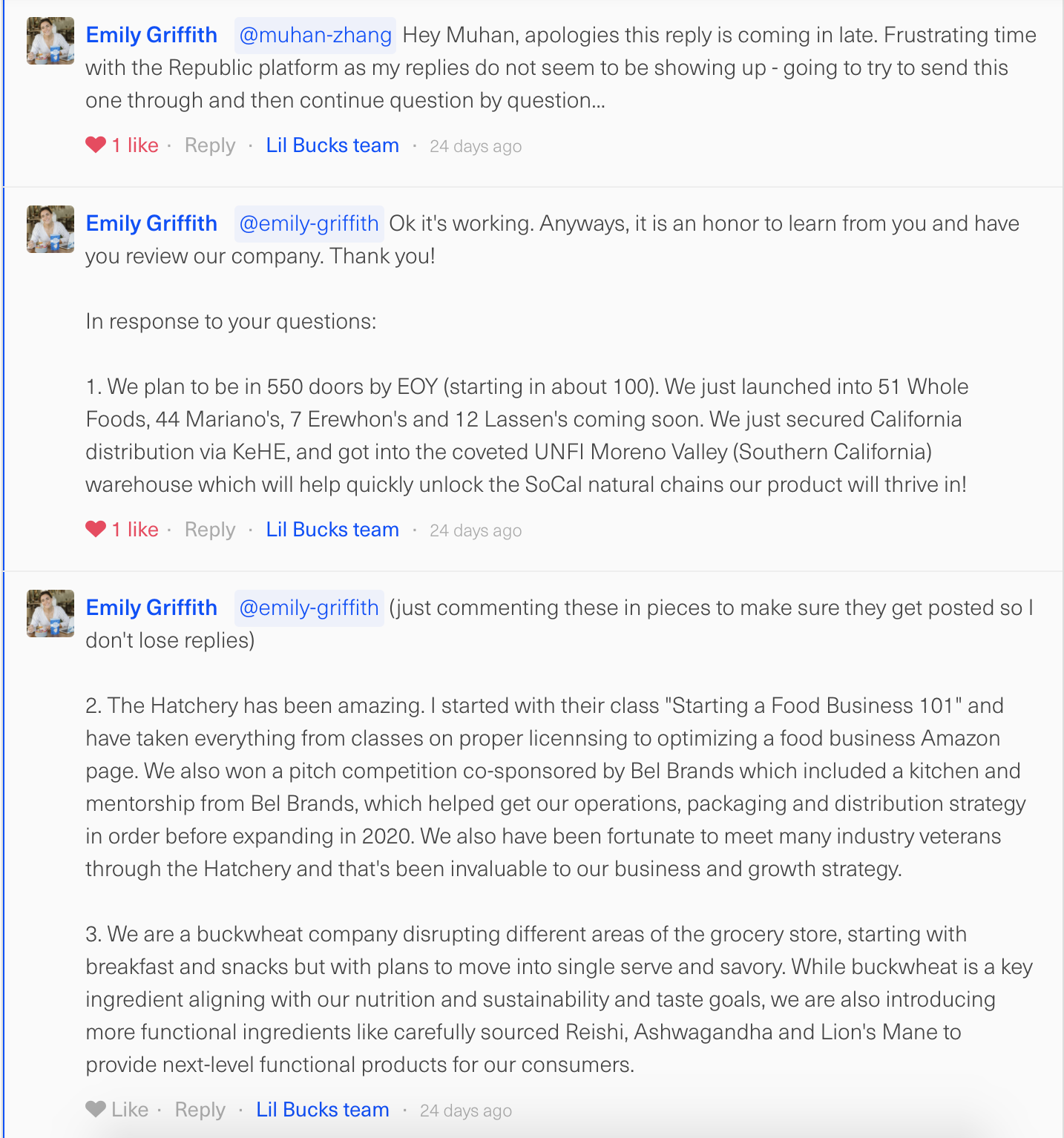

| 5. Distribution? | 1 | eCommerce is nice but getting into the retailers will be a pain |

| 6. Durability? | 1 | Not sure what is durable about this |

| 7. Secret? | 2 | Starting with buck foods is a beachhead for building a super food company |

What has to go right for the startup to return money on investment:

1. Get into retailers; 2. sell sell sell; 3. expand into other superfoods and not just be a one product company

What the Risks Are

1. Food doesn't scale fast; 2. Concerned about defensibility; 3. Ongoing R&D costs of new superfood procurement

Bonus Muhan's Notes

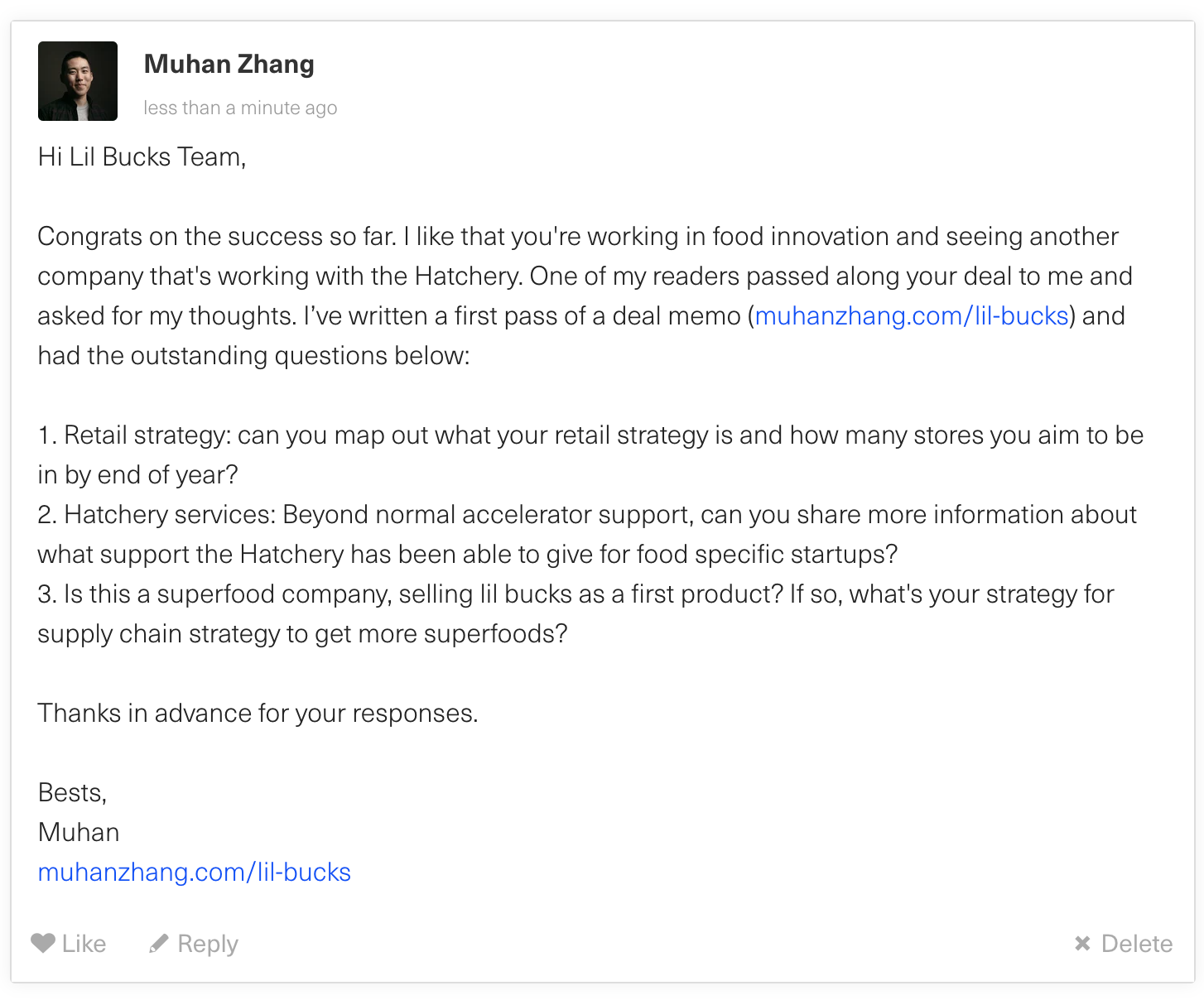

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.