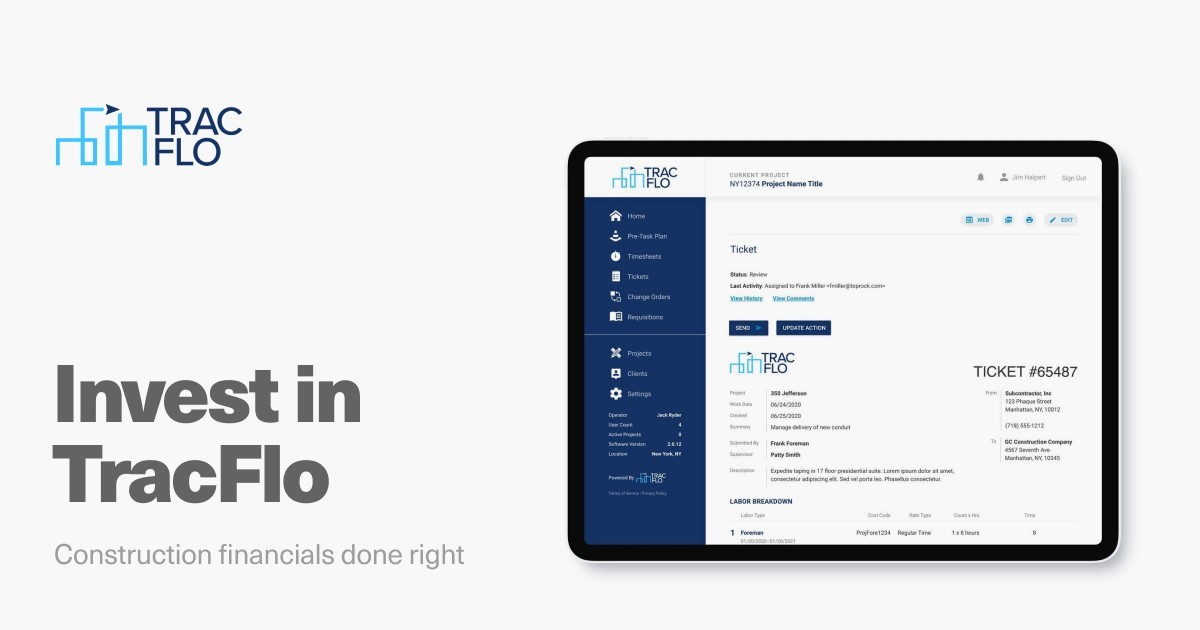

Deal Abstract

Another proptech company trying to digitize the construction industry. This one has solid revenue on a fair valuation with a suitable CEO, but can it break through where others have not?

Financials (VRB)

| Question | Notes |

|---|---|

| 1. Fundraising Target? | $1070000 |

| 2. Fundraised So Far? | $80700 |

| 3. Pre-Money Valuation? | $6500000 |

| 4. Previous Year's Annual Revenue | $57000 |

| 5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) | ~$-75878 |

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: New York City |

| 2. Has at least 2 founders? | True: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: Grew from 2019 to 2020 |

| 5. Notable investors? | True: Metaprop.vc, MIT sandbox fund |

| 6. Post-funding, will have 18 months of runway? | True: Needs ~$100k and has already exceeded that comfortably |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 3 | Not sure this is a 10x better solution, need to clarify |

| 2. Timing? | 2 | Construction is super resistant to innovation |

| 3. Monopoly? | 2 | Good revenue but hardly a monopoly |

| 4. People? | 4 | Strong team, esp CEO with carpenter, civil engineer, and construction background |

| 5. Distribution? | 3 | This will be the key question |

| 6. Durability? | 4 | If it can be built, very durable |

| 7. Secret? | 2 | TracFlo can incentivize adoption via unfair advantages CEO has in selling this |

What has to go right for the startup to return money on investment:

1. Become 'Construction Payment Platform Like venmo for construction', 2. Scale sales and continue to have key decision makers buy into value prop; 3. Overcome challenges that other proptech companies have had e.g. PlanGrid, DigiBuild, etc.

What the Risks Are

1. Adoption; 2. Market growth is not venture speed; 3. Differentiation

Bonus Muhan's Notes

$57k on $6.5mm valuation for a company is a solid ratio and team seems promising. Need to do more due diligence.

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.