Deal Abstract

B2C2B Company wants to build the next professional learning/coaching marketplace. Can it learn from Coursalytics, whom I covered in summer 2019?

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$1080000|

|2. Fundraised So Far?|$53050|

|3. Pre-Money Valuation?|$7500000|

|4. Previous Year's Annual Revenue |$43196|

|5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) |~$-144973|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: Marina del Ray, CA |

| 2. Has at least 2 founders? | False: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: Grew from 2018 |

| 5. Notable investors? | False: No one I recognize |

| 6. Post-funding, will have 18 months of runway? | True: Yes, at ~$250k will have 18 mths |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Probs better than stuff separate, but not that much better |

| 2. Timing? | 2 | Good timing to be in this sector |

| 3. Monopoly? | 1 | Not a lot of revenue comparatively |

| 4. People? | 2 | Good team but not much information on individual founders |

| 5. Distribution? | 1 | Needs business relationships to be able to sell this product |

| 6. Durability? | 2 | It's a marketplace so if built, will be defensible |

| 7. Secret? | 1 | COVID has forced the digitization of online coaching classes faster than pre-COVID times |

What has to go right for the startup to return money on investment:

1. Increase revenue; 2. Build out scalable model of acquisition; 3. Not just be a distributor/appt booker/accountability but eventually become a LMS (learning management system)

What the Risks Are

1. Modest revenue; 2. What's defensible about this product vs Coursalytics?; 3. What's the unfair advantages?

Bonus Muhan's Notes

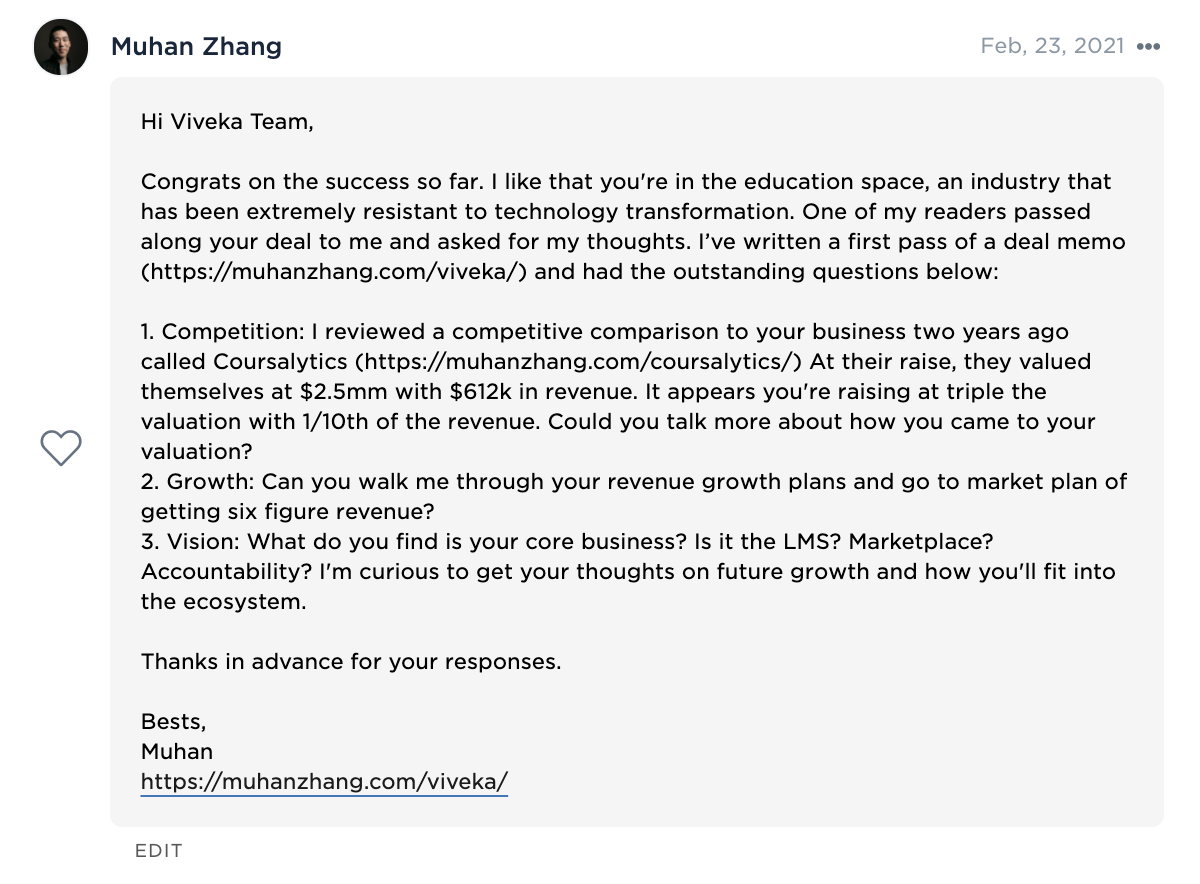

I covered a company called Coursalytics raising in June 2019 (!!!) that was raising at a $2.5m valuation cap with $168k in revenue, backed by Jason Calacanis. That company I have not seen any updates from recently. But Viveka would have to compete against a Coursalytics from a metric standpoint to catch my attention.

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.