Deal Abstract

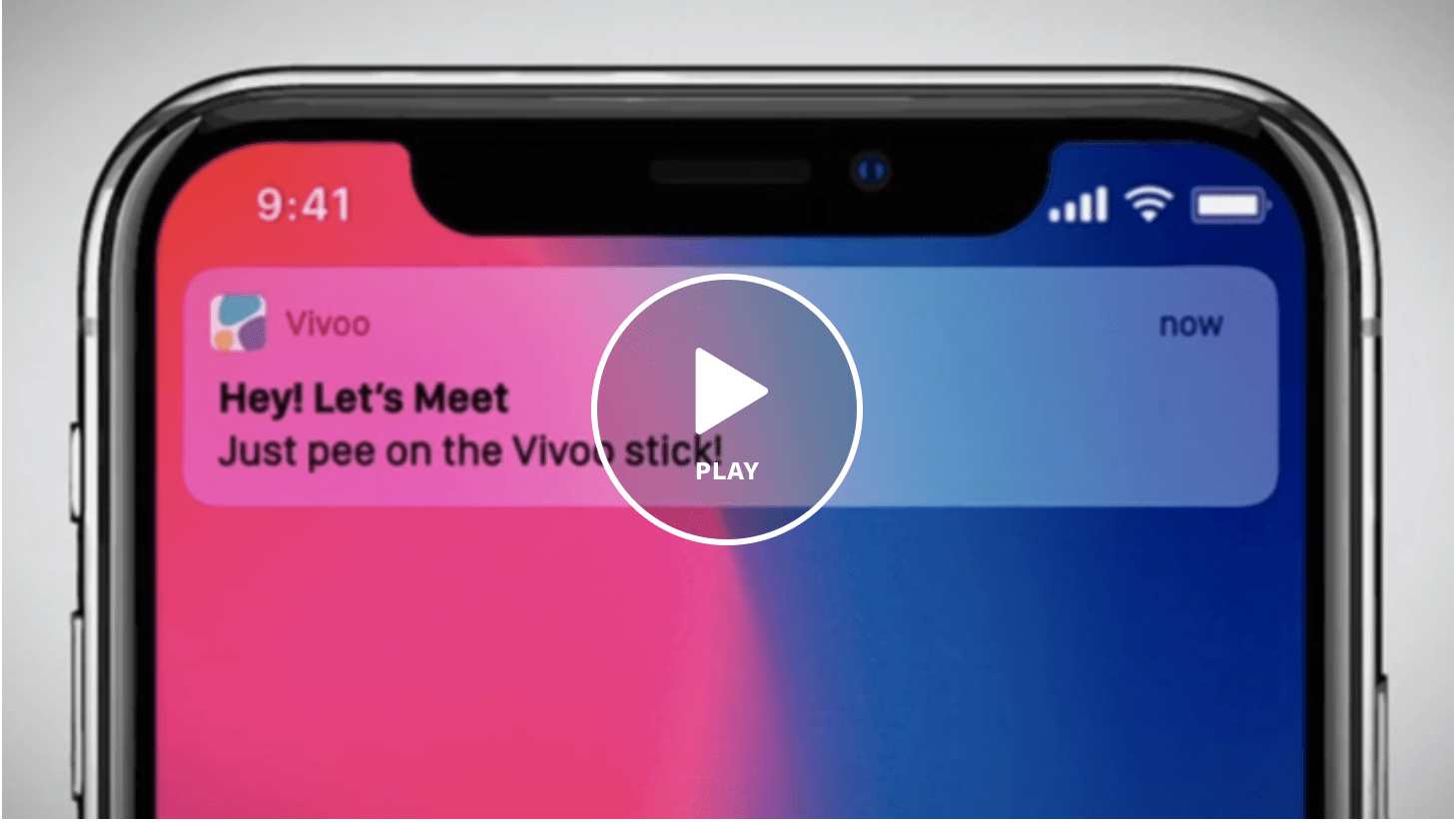

Urine test strip integrated with smartphone for immediate results on eight biometrics: liver functions, ketone, water consumption, pH/nutrition, kidney functions, general health, urinary tract infection, immunity. Tripled subscriptions in the last half year.

Shoutout to G.L. for the tip!

Decision

Pass.

Why Investing/Passing

- Vitamin vs. Painkiller: still concerned that the product is a nice to have, not a need to have. That said, founder made a good pitch for ‘market awareness’ and the numbers back it.

- Weak Unit Economics: I was expecting $15/mth per subscription for $22.5k/mth in revenue, but more looking like $10k/mth in revenue.

- Checked with Friends in Space, They Weren’t Impressed: I spoke to two millennial friends with experience in the healthspace and they weren’t impressed with the app’s health suggestions.

That said, the founder had great responses to questions. See responses here.

The 6 Calacanis Characteristics (91 161 18)

| Check | Pass/Fail |

| 1. A startup that is based in SV | Pass: San Francisco, CA |

| 2. Has at least 2 founders | Pass: 4 |

| 3. Has product in the market | Pass |

| 4. 6 months of continuous user growth or 6 months of revenue. | Pass: Subscriptions have tripled since January this year. |

| 5. Notable investors? | Pass: Tim Draper through his TV show Meet the Drapers |

| 6. Post-funding, will have 18 months of runway | Unknown: Will ask. Monthly burn is $40k. MRR estimating to be $10k/mth. |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Uncertain: Possibly better than old urine tests, but the accuracy of the photo comparison makes me wonder.

- The Timing question:

- Fine: Home testing and more personalized health.

- The monopoly question:

- Good: Could scale quickly, and with the app, would have a good defensive moat.

- The people question:

- Good: Seems like a primarily Turkish team with requisite degrees/expertise coming to US to fight for marketshare.

- The distribution question:

- Good: D2C which means having to fight for Amazon marketshare and such

- The durability question:

- Good: If they can build a network of people who are spending dollars on preventative home maintenance of health, definitely a valuable network of customers

- *What is the hopeful secret?:

- The technology is good enough now to make a 10x improvement in speed of urine test in a variety of diagnoses.

Pricing & Unit Economics

I hope my LTV, is greater than, CAC.

“We will launch our referral campaign soon, our CAC for various channels are different but has an average of $10. LTV is around $80 currently and it increases with the time.”

Miray Tayfun, Vivoo CEO.

Subscription: $7.99 for 12 months or $15.99 for 3 months. Vivoo offers our customers a variety of ways to purchase our product. The first is subscription-based, starting at $7.99 for 12 months or $15.99 for 3 months subscription. We offer subscription packages because we understand that our customers are interested in monitoring their health long term, making it easy for them to keep track of their health. People looking to just try out Vivoo can buy a one time pack at $24.90 to see if Vivoo works for them.

Retention?

- 100k strips distributed to date (30k strips in the previous campaign)

- 20k unique users, 30k community (6k and 10k in the previous campaign)

- 1500+ paying subscribers (500 in the previous campaign), over 1M data point, 22.5k/mth in revenue?

- 30% MoM growth since launch, $122B+ mobile health market

What has to go right for the startup to return money on investment:

- Clarity of Unit Economics: Not sure how much money each customer brings in and what the cost of acquisition is.

- Retention: How many customers are converting to recurring subscription versus one-time purchases? Seems like the business last raised in January, so fundraising again in half a year.

- Identify Key Growth Lever: Is it sales of kits? Does that mean referral programs? Is it access to the nutritionists? If the business is at its core a B2C company with additional services, how to get the customers who love the product to get more people to use it? Similarly, getting more partnerships with health influencers.

What the Risks Are

- Pee Test versus Blood Test/Other Metrics: I’ve used pee test strips for ketone tests and they’re not as precise as blood work. With the risk of using photos for gauging colors, is the team concerned about accuracy?

- How do Customers Know It’s Driving Value: Reading the recommendations from sample pee results, it seems like all the suggestions are specific but the impacts are ambiguous e.g. this is a vitamin not a painkiller.

- Distribution and Scaling Risk: The team has done well scaling from 500 to 1500 subscriptions (22.5k/mth,) does it have operational capacity to go from 1500 to 15k (225k MRR, 2.7MM ARR?)

Muhan’s Bonus Notes

Founder did great on answering questions. I hope she and her team prove me wrong and make me eat my words.

Financials (References)

- Current Fundraised: $25k-$570k

- Valuation: 15MM

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page. Also, somewhat of a dearth of materials (whose the team? where are the comments? why are the financials so opaque?)