Deal Abstract

Beverage company founded by MD, MBA, and Sommelier (in one person) is using plant compounds to make performance enhancement drinks. Has an interesting D2C subscription model.

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$1070000|

|2. Fundraised So Far?|$111201|

|3. Pre-Money Valuation?|$10000000|

|4. Previous Year's Annual Revenue |$448058|

|5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) |~$-2162110|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: New York, NY |

| 2. Has at least 2 founders? | False: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: Revenue from 2018 to 2019 grew from $197k to $448k |

| 5. Notable investors? | True: AJ Vaynerchuk and CircleUp |

| 6. Post-funding, will have 18 months of runway? | False: Won't even have a month at this rate |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 3 | Using plant chemicals and elements for improving performance, though nothing proprietary |

| 2. Timing? | 2 | Especially drawn to the d2c model |

| 3. Monopoly? | 2 | Good advisors and early revenue |

| 4. People? | 4 | Doctor and MBA with beverage (sommelier) background, as well as team and advisors, very strong team |

| 5. Distribution? | 4 | Love that they have 50% of customers on recurring subscription |

| 6. Durability? | 2 | Basically the barriers to entry for a competitor are capital costs and supply chain |

| 7. Secret? | 2 | Direct to consumer, plant compound focused beverages are going to take over the gatorade and other wellness drink choices |

What has to go right for the startup to return money on investment:

1. Product has to be 10x better in efficacy; 2. Support research to show why this stuff is good; 3. Develop proprietary logistics relationships like Trader Joe's

What the Risks Are

1. Risk of being a fad; 2. Just repackaging natural ingredients and nothing defensible; 3. This market isn't winner take all and will remain fragmented

Bonus Muhan's Notes

Very cool to see business model innovation in beverage

Updates

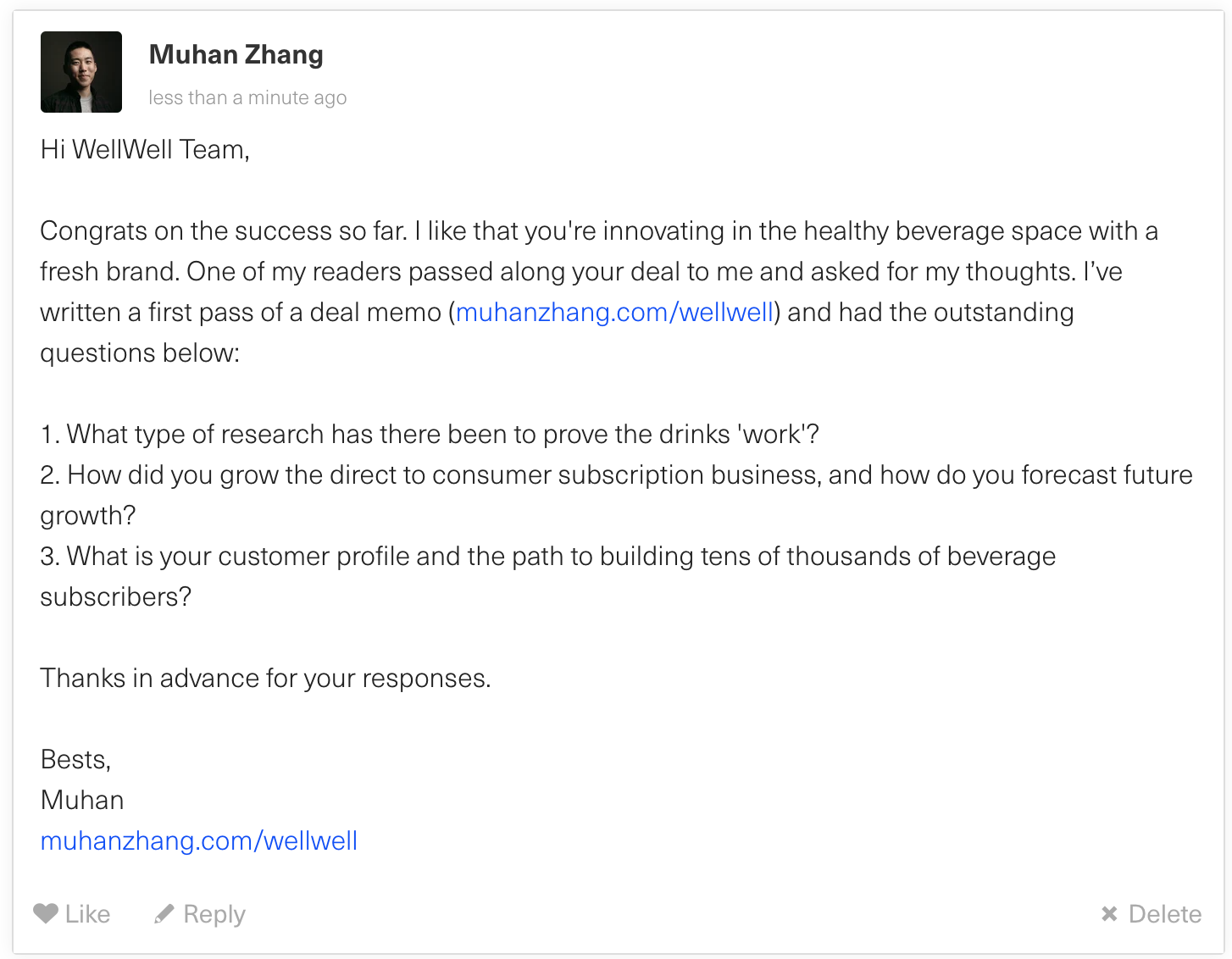

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.