Deal Abstract

https://www.loopnet.com/Listing/21-Russo-St-Providence-RI/35918376/

Younger sibling to 65 Russo is also being sold. Both properties are pretty similar financially, but are getting slammed by higher appraisals, property taxes, and insurance. Is there a commercial BRRRR hail Mary here?

Part 1. The Basics

| Question | Notes |

|---|---|

| 1. Property Name: | 21 Russo |

| 2. Property Full Address: | 21 Russo St, Providence RI, 02909 |

| 3. Property Listing URL: | https://www.loopnet.com/Listing/21-Russo-St-Providence-RI/35918376/ |

| 4. Property Year Built: | 1900 |

| 5. Property Number of Units/Doors: | 6 |

Part 2. Quantitative, Numbers, and Financials ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Amount/Comment |

|---|---|

| 1. Link to Underwriting Google Sheet: | https://docs.google.com/spreadsheets/d/152Cejb97Ub6IvkoZrL3JaLNgJoMfeTkUHVmEoO2UNto/edit?usp=sharing: UNDERWRITING COMMENT |

| 2. Asking Price: | $640000: PRICE COMMENT |

| 3. FFEIC Median Income: | $63927: INCOME COMMENT |

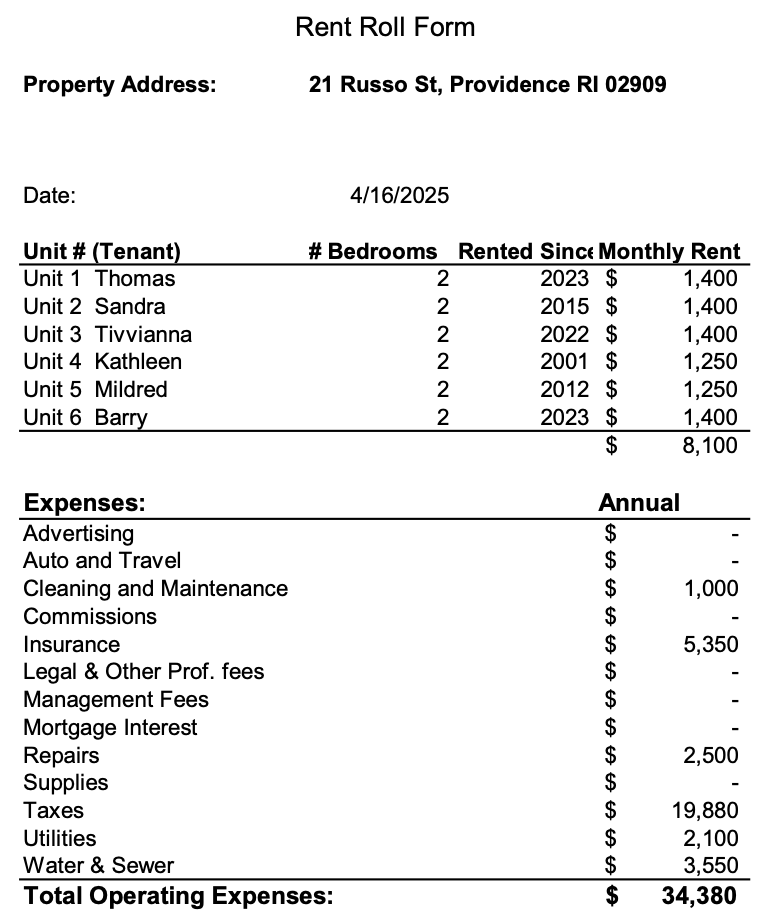

| 4. Last Year's Annual Rent: | $87480: RENT COMMENT |

| 5. Last Year's Annual Expense: | $-34380: EXPENSE COMMENT |

| 6. Last Year's Net Operating Income (NOI): | $53100: NOI COMMENT |

| 7. 5 Year Internal Rate of Return (IRR): | 10.34: IRR COMMENT |

| 8. Yearly Cash on Cash (CoC) Rate of Return: | 5.6: COC COMMENT |

| 9. Debt Service Coverage Ratio (DSCR): | 1.38: DSCR COMMENT |

| Question | Score | Notes |

|---|---|---|

| 1. Why is the seller now? | TIMING SCORE | 1. Not interested in management; 2. Sustained interest rates means no appreciation; 3. Who knows what the future holds, maybe more pain to come |

| 2. Am I the right buyer for this deal? | FIT SCORE | 1. Two 6 families in a city I know well; 2. Management problems are what I eat for breakfast; 3. Right around the numbers for my buy box |

| 3. What has to go right for this deal to work out? | Right Rating | |

| 4. People? | ||

| 5. Distribution? | ||

| 6. Durability? | ||

| 7. Secret? |

What has to go right for the startup to return money on investment:

1. Turn around the property within a year; 2. Be diligent with costs and no unexpected repairs; repeal unjustifiably higher appraisals, 3. Higher ARV next year, increased rent rolls justify the higher valuation, zero to no delinquency or loss-to-lease after stabilization

What the Risks Are

1. Hidden renovation costs that are not being factored in; 2. Vacancy, loss to lease, tenant base never improves; 3. Taxes and insurance continue to skyrocket and gouge profits

Bonus Muhan's Notes

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.