Deal Abstract

https://www.seedinvest.com/elly/pre.seed/investor_perks

Google Assistant backed startup company that could be the Calm.com aka the video library for all audio assisted treatment for hospitals. Has a product but pre-revenue. Risks include founders who have no notable exits before, lack of big hospital connections, and painkiller value of product.

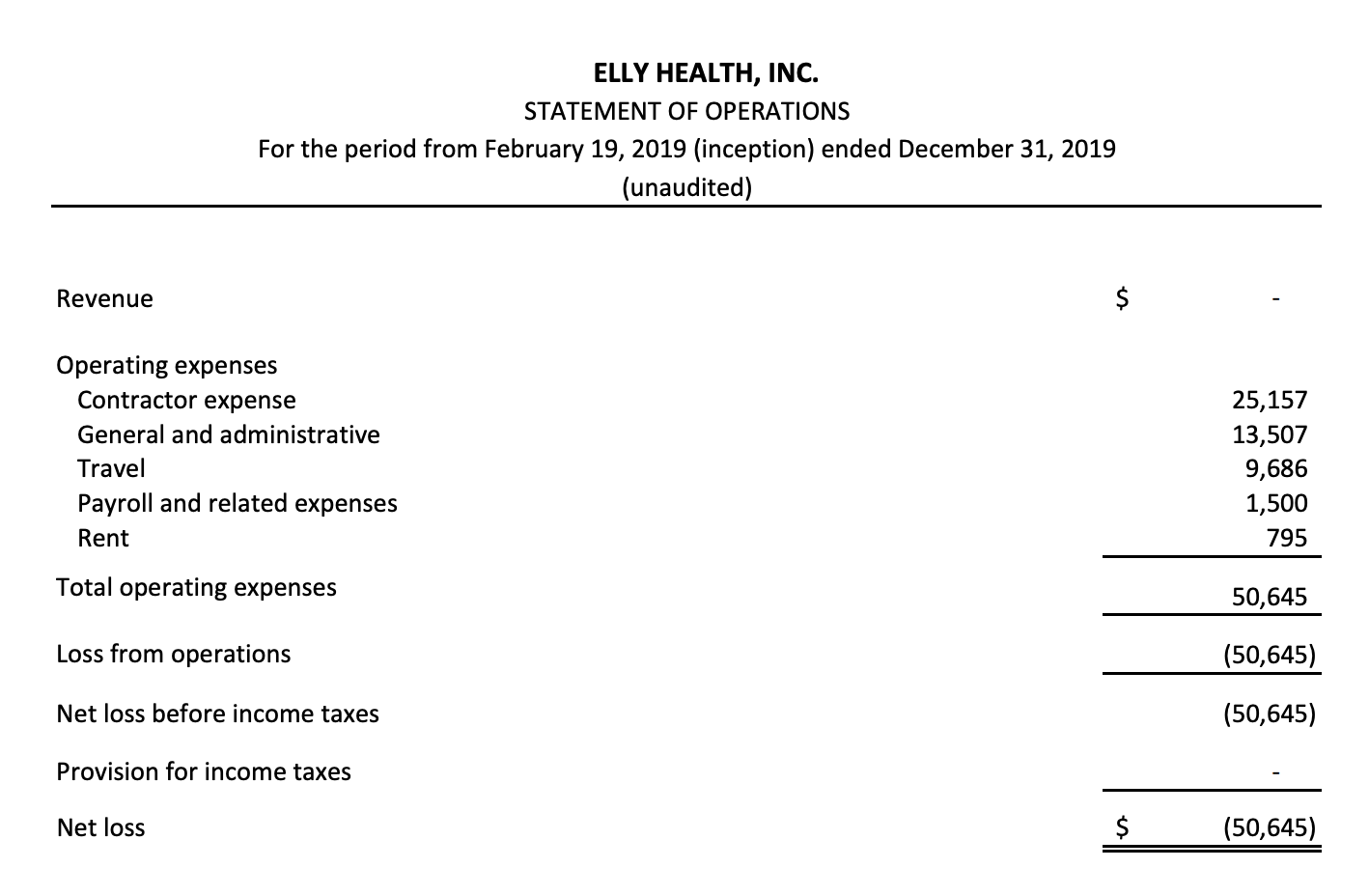

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$1m|

|2. Fundraised So Far?|$342k|

|3. Pre-Money Valuation?|$5m|

|4. Previous Year's Annual Revenue |$0|

|5. Previous Year's Annual Burn |~$50k|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | No: Los Angeles, CA |

| 2. Has at least 2 founders? | Yes: Two founders |

| 3. Has product in the market? | Yes |

| 4. 6 months of continuous user growth or 6 months of revenue? | No: still in beta and hasn't gone big on marketing. |

| 5. Notable investors? | Yes: Google Assistant Investments. |

| 6. Post-funding, will have 18 months of runway? | Yes: At $1m they'd have 20 years of runway. |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Technology meh, but this isn't a tech play, it's a content play |

| 2. Timing? | 2 | Unsure, not seeing anything in oncology that may make this thing blow up. |

| 3. Monopoly? | 2 | Sure but I really don't know other audio companions to oncology patients. Spotify podcasts? |

| 4. People? | 2 | No notable exits from either founder, LinkedIn still shows them being present on some old companies. |

| 5. Distribution? | 2 | Not bad, not great. No doctor who can push this product on hospital systems. |

| 6. Durability? | 3 | Good, content library. |

| 7. Secret? | 2 | This is going to be the Calm.com of audio-assisted treatments. |

What has to go right for the startup to return money on investment:

- Generate Revenue: 'Nuff said.

- Schmooze, Sell, Scale: Hospitals pay for this? Founders need to become very buddy buddy with hospital systems.

- Calm.com for Audio-Assisted Treatments: Rinse lather repeat and become content library.

What the Risks Are

- Vitamin: I know the company is trying to prove its value, but do the clinical studies convince the hospitals?

- Tiny Markets: There's only been 100 users. How many total addressable users are there, and how many hospitals are willing to pay for this?

- B2B vs. B2C: Calm.com went the route of d2c and was profitable after Calacanis invested. This company has to climb the hill of B2B which is no easy feat.

Bonus Muhan's Notes

Got to ask my doctor friends if this thing has legs. Could be the Calm.com of audio assisted therapy. Could also be Hypersciences/2020 Genesystems.

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.