Deal Abstract

Algae farming for cost-competitive, eco-friendly crude oil replacement. Has a founder that has operational and academic experience. Needs to figure out how to solve distribution, go-to-market, and scaling risk if they want to become a billion dollar company.

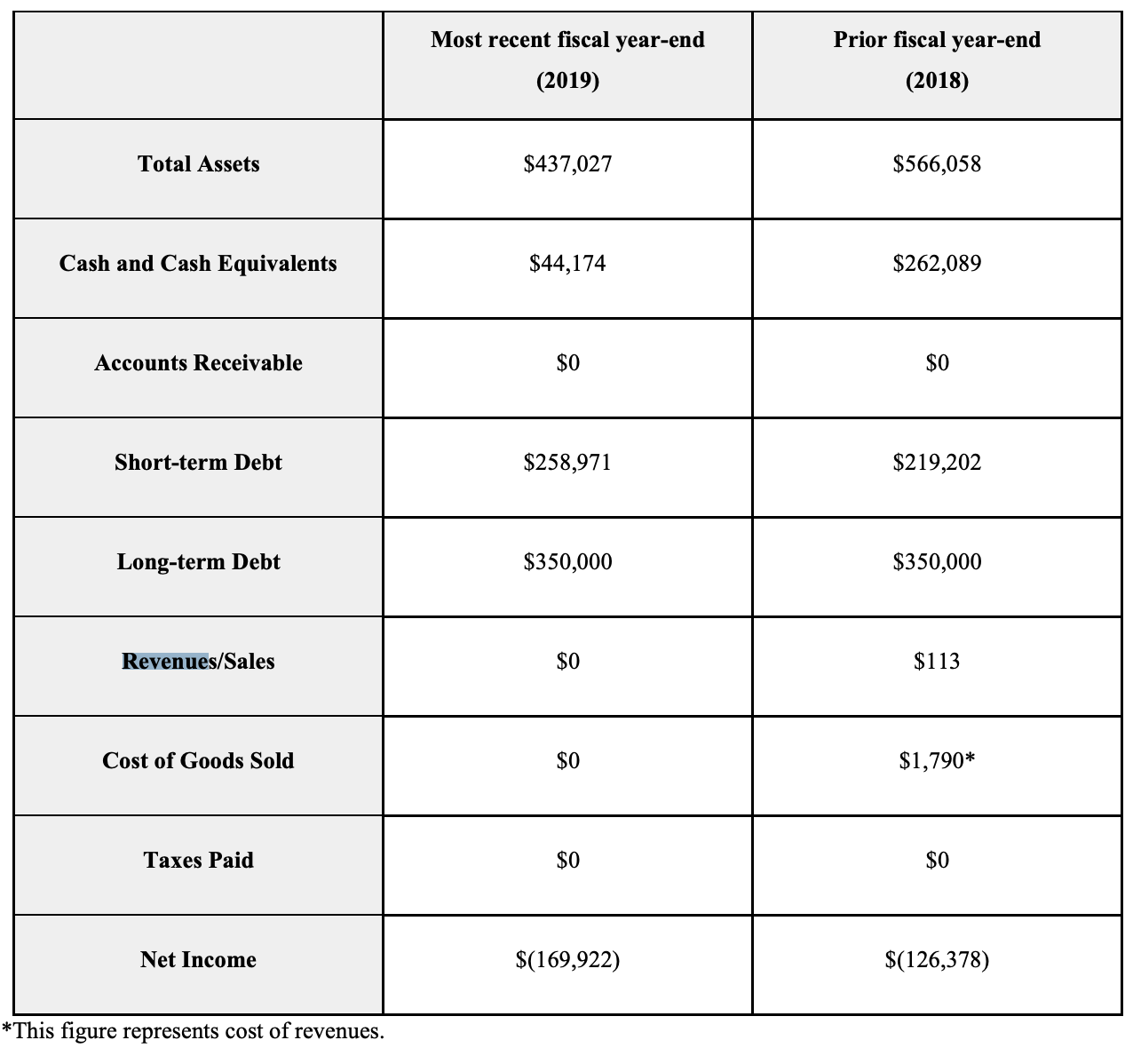

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$1m|

|2. Fundraised So Far?|$135k|

|3. Pre-Money Valuation?|$6m|

|4. Previous Year's Annual Revenue |$0|

|5. Previous Year's Annual Burn |~$169k|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | No: Owings Mill, MD |

| 2. Has at least 2 founders? | No: One CEO founder, and co-founder who is now advisor |

| 3. Has product in the market? | No |

| 4. 6 months of continuous user growth or 6 months of revenue? | No |

| 5. Notable investors? | Yes: US DOE grant, State of Maryland, etc. |

| 6. Post-funding, will have 18 months of runway? | Yes: Likely but costs may go up when trying to bring product to market. |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

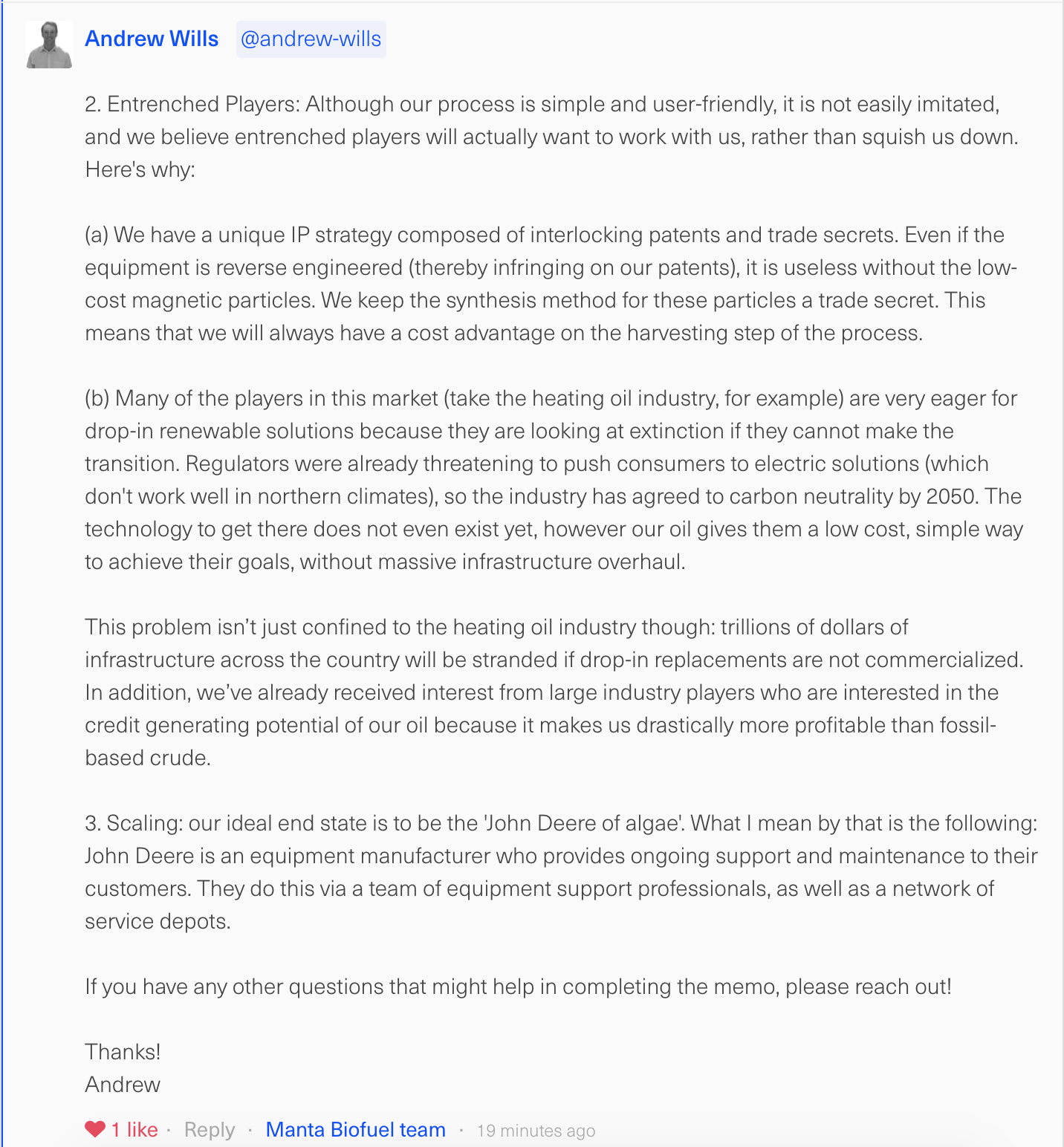

| 1. Engineering? | 4 | Though I'm not that prepared to evaluate the engineering product, it claims to be better. |

| 2. Timing? | 2 | Good in that the world is more eco-conscious, negative points in that it may be wrong timing as world transitions to EVs. |

| 3. Monopoly? | 1 | No, only sold to beta customers. |

| 4. People? | 3 | Founder has good practical and academic experience, but will be curious if he can commercialize the tech with team. |

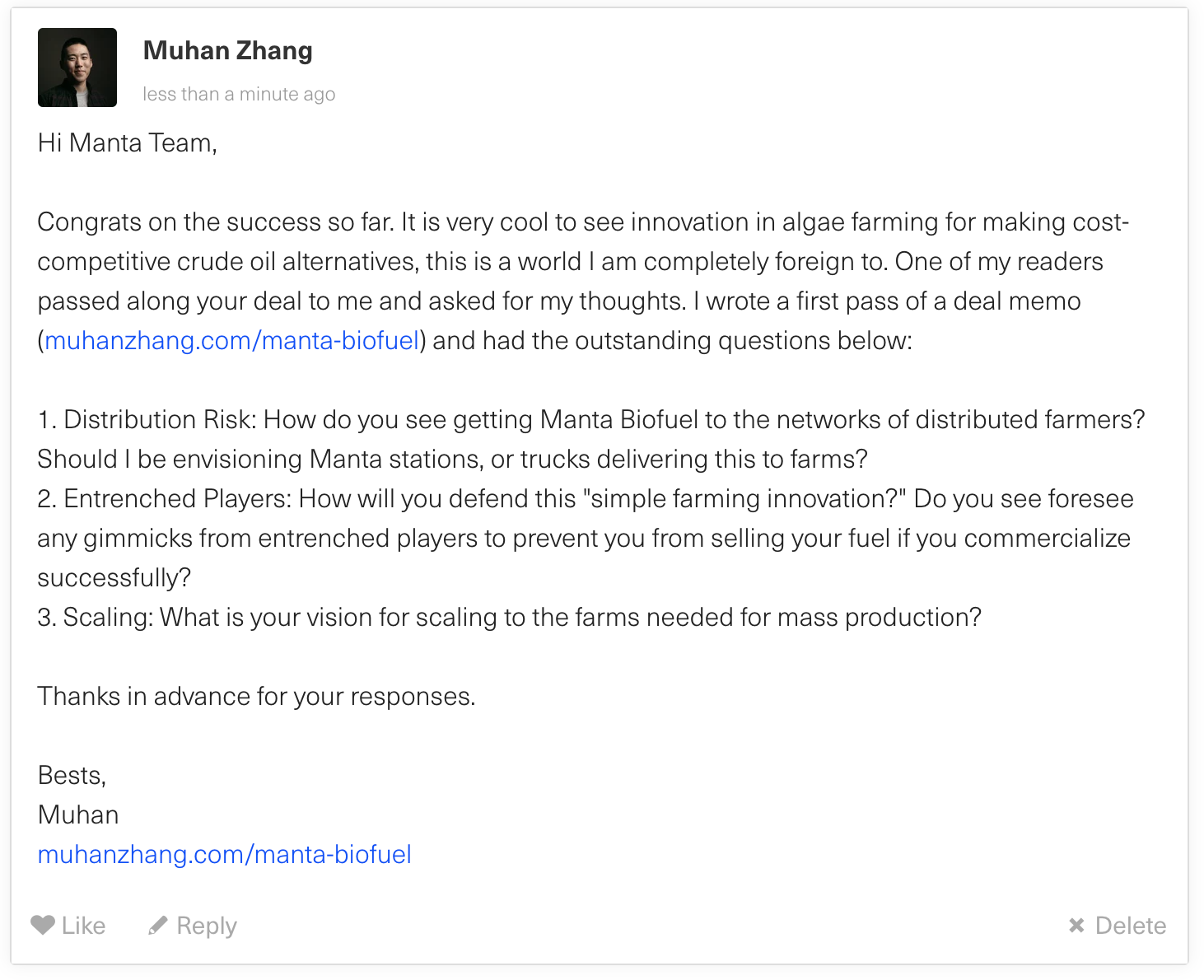

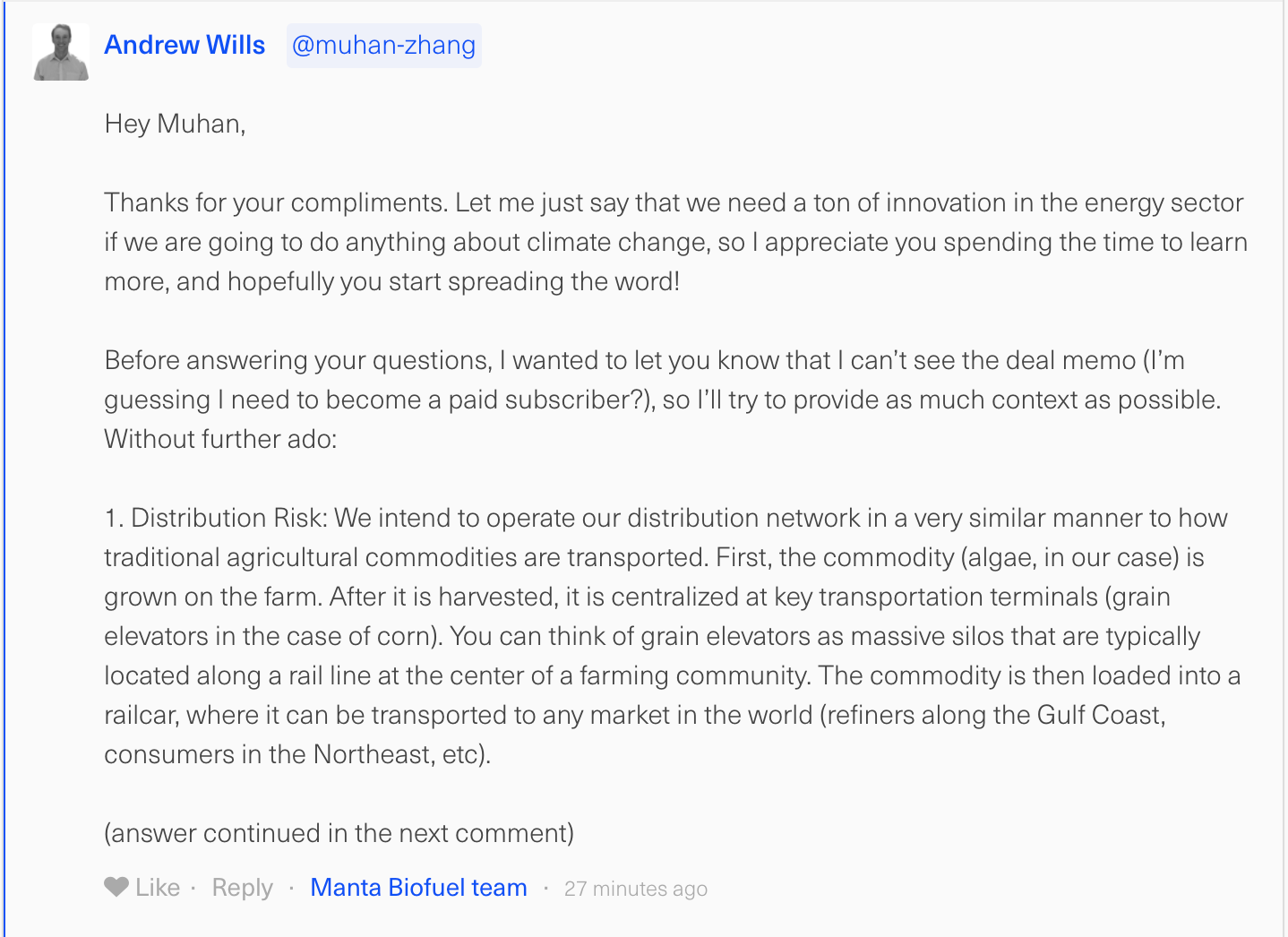

| 5. Distribution? | 2 | Not bad, not great. How do you distribute fuel like this? Fuel stations? Wholesale? |

| 6. Durability? | 2 | If they can build it, the technology is proprietary, but then asks questions what happens if someone comes up with another fuel. |

| 7. Secret? | 2 | The timing is not right for full consolidation into EVs yet, and the remaining market will be serviced by more green friendly energy sources. |

What has to go right for the startup to return money on investment:

- Bring Product to Market: Selling to one customer good, but still need to get recurring purchases of products from a market.

- Scale and Go Industrial: Producing in small batches one thing, mass production something else.

- Find Niche Applications not EV-able: EV is disrupting natural fuels for consumer vehicles, needs to find where companies aren't doing this and build a defensible distribution channel.

What the Risks Are

- Too Small: Selling an alternative fuel for niche applications may not be a billion dollar business.

- Wrong Thesis: In addition, what happens if the technology for EV gets better so that even niche applications of any noteworthy size don't use fuel?

- Distribution Risk: Do they have to build Manta fuel stations to distribute this?

Bonus Muhan's Notes

Algae and sustainable fuel, who would've thought!

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.