Deal Abstract

https://netcapital.com/companies/genesisai

Marketplace for artificial intelligence development work. Pre-product and pre-revenue. Raised $908k on a $7.5M valuation. In addition to addressing lacks, I also articulate three concrete factors I look for in entrepreneurs that are looking to monetize new markets.

Building a startup portfolio? Subscribe to my premium newsletter, Startup Investing, to receive exclusively weekly content, tailored for startup investors.

The 6 Calacanis Characteristics (91 161 18)

| Check | Yes/No |

| 1. A startup that is based in SV | No: Boston, MA |

| 2. Has at least 2 founders | Yes: Yes |

| 3. Has product in the market | No |

| 4. 6 months of continuous user growth or 6 months of revenue. | No |

| 5. Notable investors? | No |

| 6. Post-funding, will have 18 months of runway | No: Raised $908k on $56k annual burn, which is 16 months of burn. |

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Bad: Not convinced there’s a market for buying other peoples artificial intelligence work. Could be like real estate, where people would rather pay money for completed transaction (even if broker fees are painful,) rather than on dealflow.

- The Timing question:

- Ambiguous: AI is being talked about all the time now, but not convinced that now is the time where people will start monetizing AI development services.

- The monopoly question:

- Bad: If this is really what AI developers want, why would they also not go on generic platforms like Thumbtack/job boards first?

- The people question:

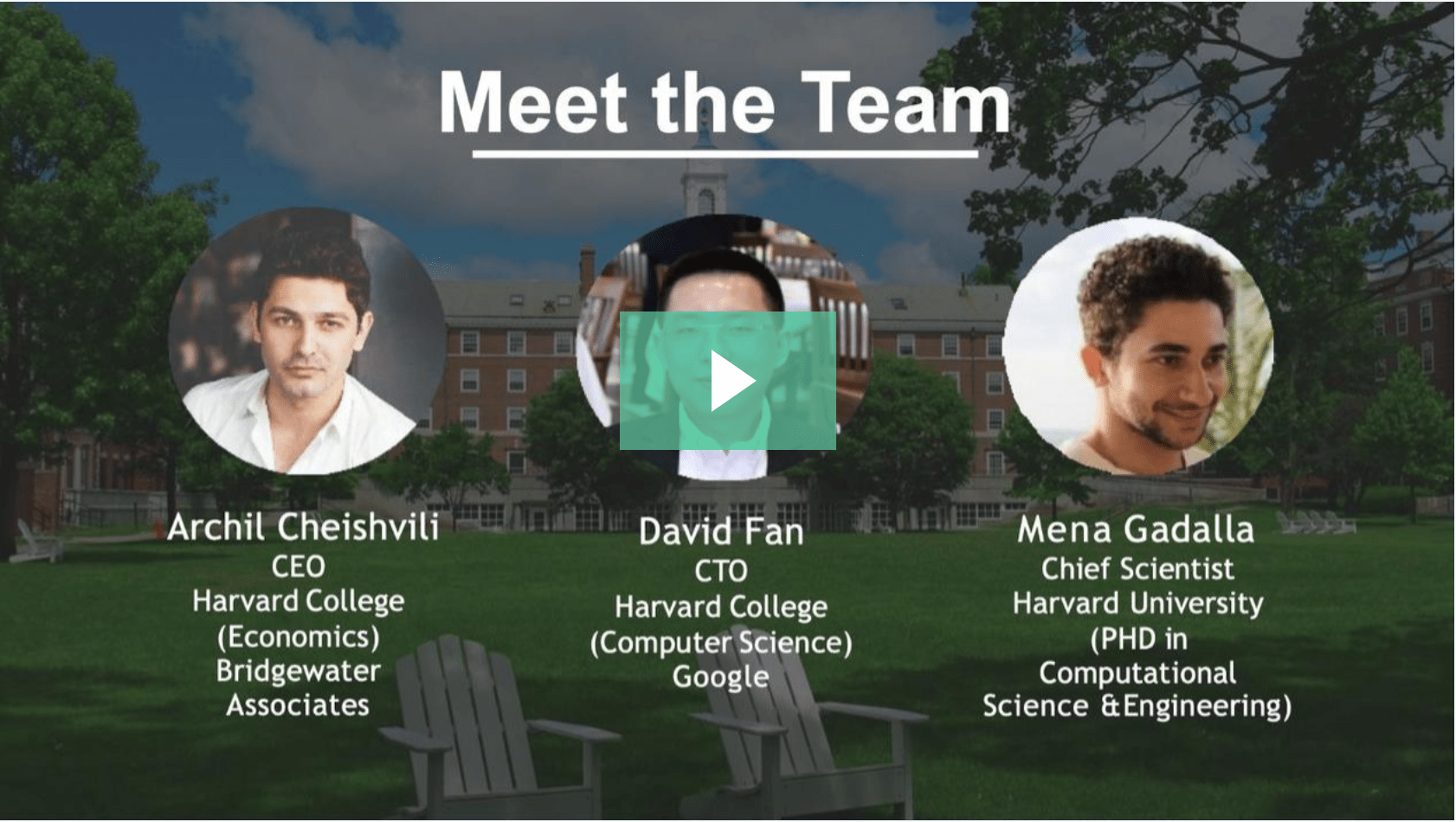

- Bad: The team has star-studded credentials, but markets don’t care. For me, entrepreneurs that create new markets are the exception, not the rule. Those entrepreneurs who are talented enough to create new markets need to have: 1) Large amounts of wealth/market share, minimum 36 months of runway, 2) experience in previous exits, especially in large B2B sales, and 3) connections/investors from the old world who are invested in the transition to the future.

- The distribution question:

- Bad: not seeing an unfair advantage to either side of this marketplace.

- The durability question:

- Good: If this business was built, could be fine.

- *What is the hopeful secret?:

- This is the decade where companies will pay for external developers artificial intelligence code and work.

What has to go right for the startup to return money on investment:

- N/A

What the Risks Are

- N/A

Muhan’s Bonus Notes

Investment came in from SeedInvest’s Auto Invest, hence the deal memo opting out.

Financials (References)

- Current Fundraised: $1.67M

- Valuation: ~$4.75MM

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

I regret not asking “how much money do you anticipate burning and how much time will it be till you have revenue?” but he had the courtesy of responding so I’ll let it be. Will post this screenshot to my deal memo.

7/15/21: New round closing in 2 days at a $47m valuation: https://netcapital.com/companies/genesisai. CTO now gone, still no revenue.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.