Deal Abstract

https://www.seedinvest.com/jassby/seed

Splitwise/Venmo/Payroll/Shopping portal for families. Has burned several million to build a platform for parents to assign tasks, compensate kids with chores, then capture revenue from teenagers shopping. Asks interesting questions about the business models of companies like Overtime, Mint, Splitwise, and Venmo.

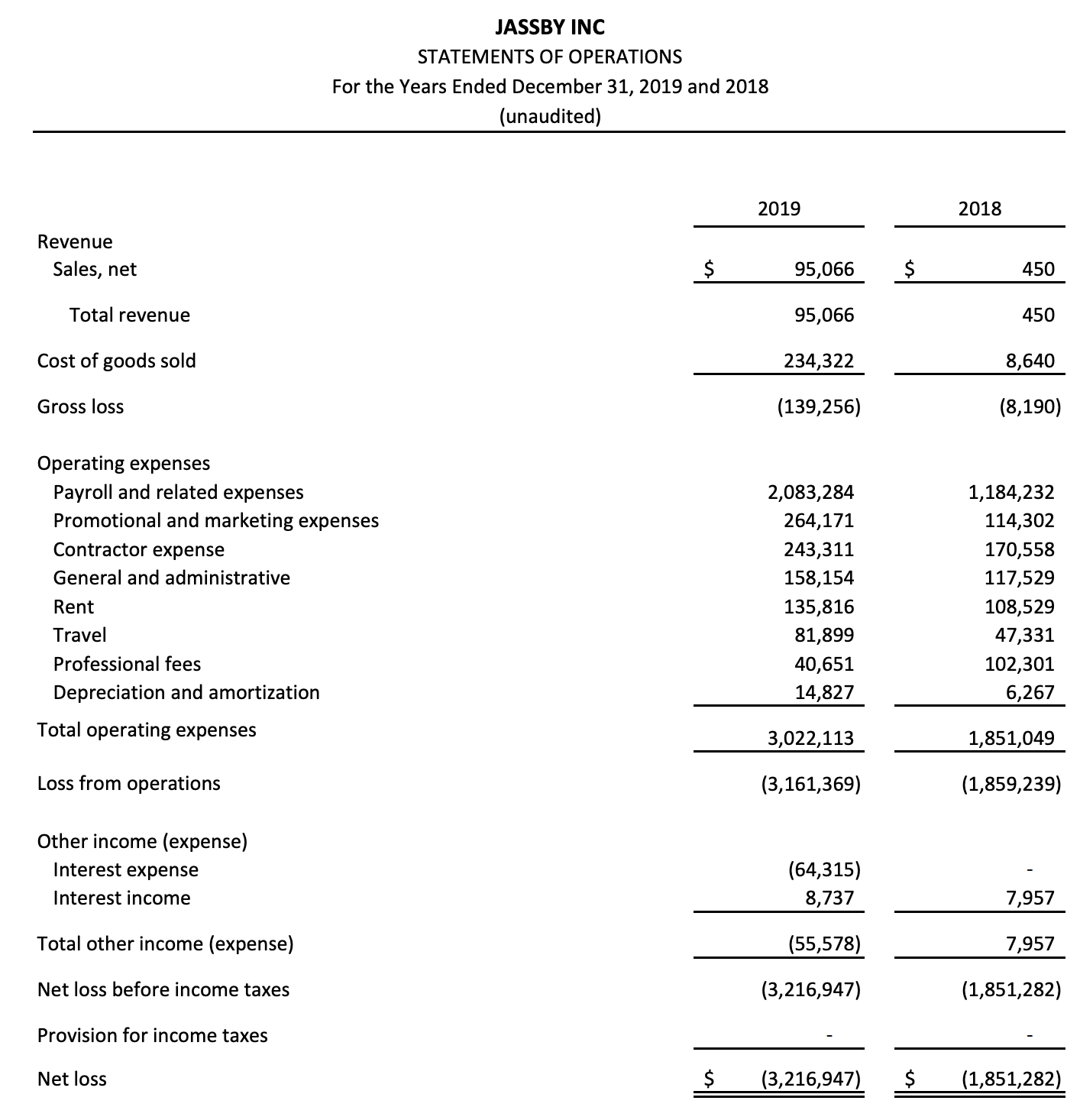

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$6m|

|2. Fundraised So Far?|$2m|

|3. Pre-Money Valuation?|$26m|

|4. Previous Year's Annual Revenue |$95k|

|5. Previous Year's Annual Burn |~$3.1m|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | No: Waltham, MA |

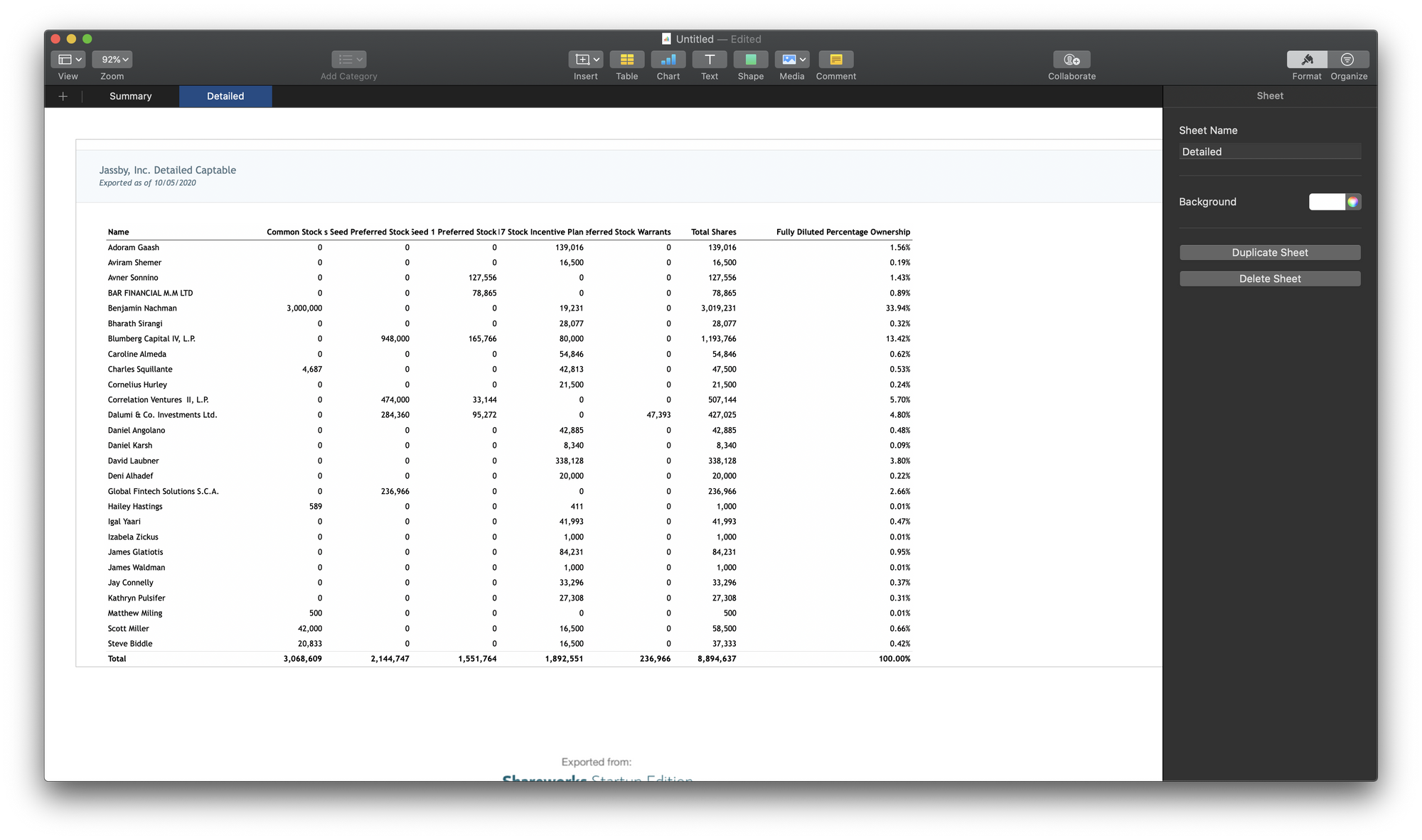

| 2. Has at least 2 founders? | No: One CEO founder, only one with 3m shares of stock |

| 3. Has product in the market? | Yes |

| 4. 6 months of continuous user growth or 6 months of revenue? | Yes: 2018 revenue to 2019 revenue increased from $450 to $95k. |

| 5. Notable investors? | No: none that I see. |

| 6. Post-funding, will have 18 months of runway? | No: Would need 4.5m for 18 mth of runway, only at 2m at present, needs to double. |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | It's like Splitwise for families, aka imo a vitamin not a painkiller |

| 2. Timing? | 2 | Theoretically good with more millenials becoming parents, but why would parents just use Venmo and Google Calendar at most?. |

| 3. Monopoly? | 2 | Downloads and such seem good, but that's a lot of value creation and not a lot of value capture. |

| 4. People? | 2 | Founder seems fine but no recognizable successes/brand affiliations. |

| 5. Distribution? | 2 | Not bad, not great. |

| 6. Durability? | 1 | Like Splitwise, this is the part I don't understand, if this becomes valuable enough why would Venmo just build these features in?. |

| 7. Secret? | 2 | Families can't use Venmo/other normal personal finance apps to coordinate chores/allowance for kids, and that targeting this side with ads like Mint.com will be a big business. PS Mint.com got acquired for $170m by Intuit in 2009. |

What has to go right for the startup to return money on investment:

- Business Model: Business model has to work. Not sure how the CPMs look like for a family media business over Mint.com

- Become Sticky for Families: Needless to say, like iSport360, this app lives/dies by being becoming a utility for families, and not just another layer of abstraction.

- Lead Gen for Full Banking Services: Ultimate where I could see the money maker being is like how Overtime is monetizing high school sports before they go to college sports, this company needs to get a spigot of fre users when they turn 18.

What the Risks Are

- Painkiller Not Vitamin: What makes this better than Venmo? And Splitwise? Even Venmo had to sell itself to BrainTree/PayPal because it had no business model.

- Creating Value not Capturing It: Ads is a faustian deal because you are no longer deriving your value directly from the people benefiting the most.

- Focus: Similar to point 2, if you don't have revenue tied to customers who drive highest value, how do you focus where to double down on in your product development? The debit card? Chores management? Shopping portal?

Bonus Muhan's Notes

Very cool to see innovation in the family personal finance space.

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.