Deal Abstract

WeWork for van life has arrived. Former Intersection/Sidewalk Labs alum is starting a network of physical sites for van life participants to get all the benefits of fixed housing and supplies with all the mobility of van life.

Financials (VRB)

| Question | Notes |

|---|---|

| 1. Fundraising Target? | $1070000 |

| 2. Fundraised So Far? | $456428 |

| 3. Pre-Money Valuation? | $15000000 |

| 4. Previous Year's Annual Revenue | $0 |

| 5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) | ~$-62261 |

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | True: San Francisco, CA |

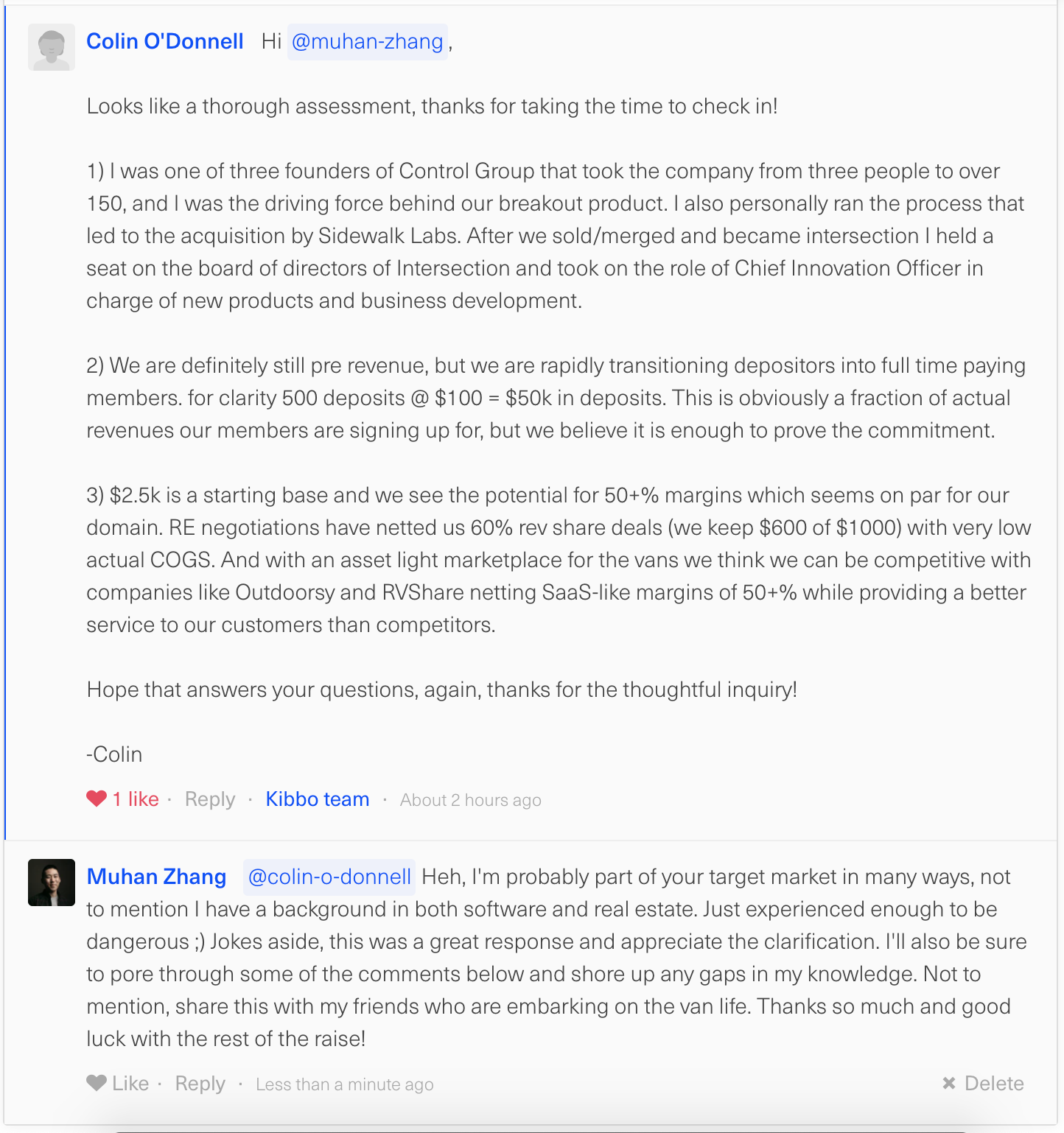

| 2. Has at least 2 founders? | False: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: 500 paying member deposits, if the monthly cost is $2500, that's $1m in rev? |

| 5. Notable investors? | True: Balaji Srinivasan, the former COO of Hustle (political texting technology), |

| 6. Post-funding, will have 18 months of runway? | True: Very little burn |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 3 | Definitely impressive, taking van life and giving it physical infrastructure via refueling sites |

| 2. Timing? | 3 | Definitely the right time to start this business, so many people who plan on Vanning |

| 3. Monopoly? | 2 | No revenue, good deposits, need to learn more |

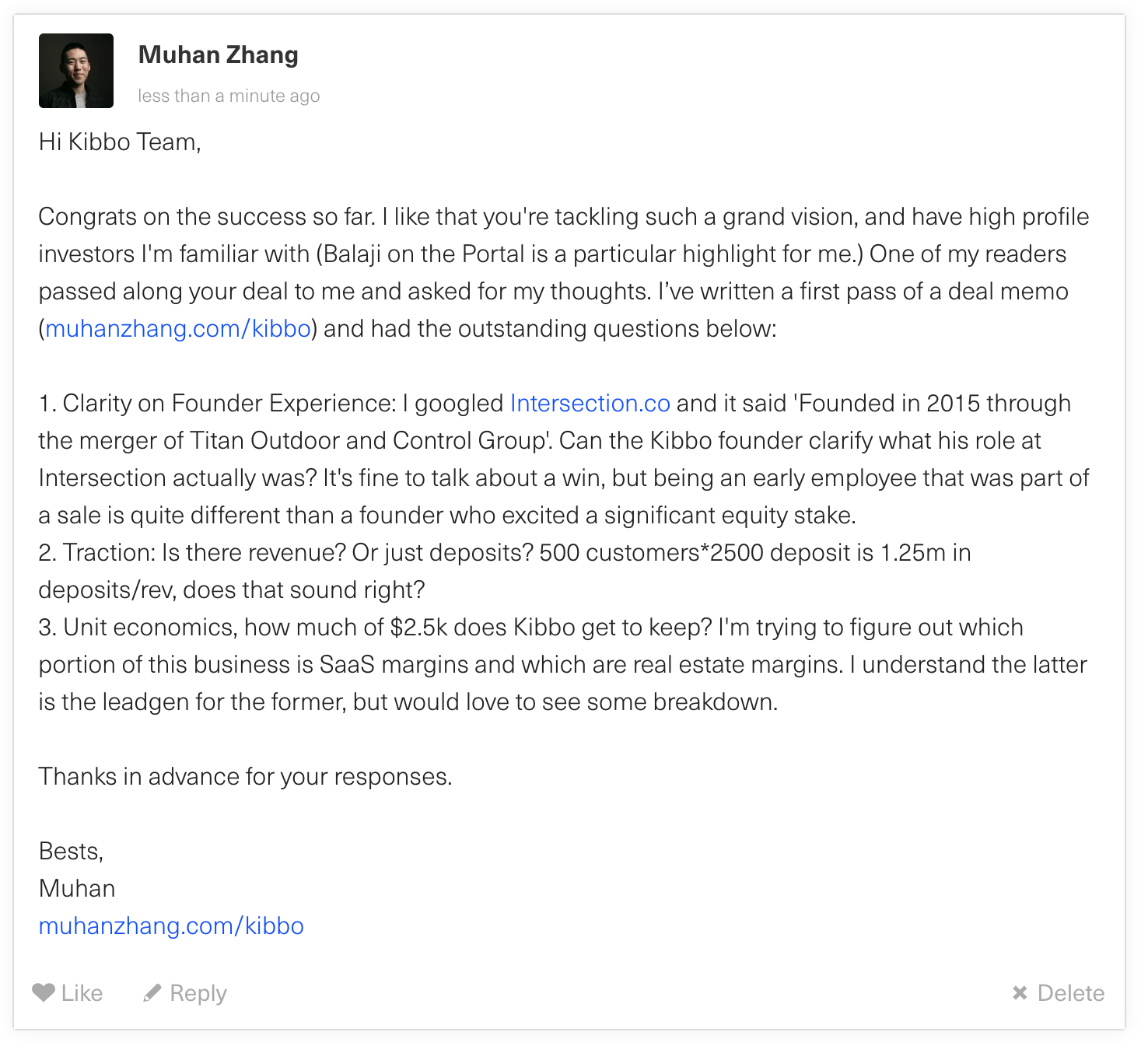

| 4. People? | 2 | Potentially right people, but need to dig into CEO and ask his 'company' Intersection sale to Alphabet |

| 5. Distribution? | 3 | Definitely has access to desirable young professional taste maker market |

| 6. Durability? | 3 | Especially with the sites and physical location, quite defensible |

| 7. Secret? | 3 | The future of society is going to have an explosion of van life people who want community/reload sites |

What has to go right for the startup to return money on investment:

1. Take product to market; 2. Keep operating costs low; 3. Scale like technology marketplace/not WeWork real estate company

What the Risks Are

1. Niche product/maybe Van life stays fringe and fancy for a long time; 2. Real estate/site management costs; 3. How does this business get to $250mm ARR?

Bonus Muhan's Notes

Possibly one of the most ambitious businesses I've seen in a while

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.