Deal Abstract

Battery and charging company wants to be the one company to build charging stations for school buses.

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$1070000|

|2. Fundraised So Far?|$1001096|

|3. Pre-Money Valuation?|$19200000|

|4. Previous Year's Annual Revenue |$847042|

|5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) |~$-129299|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: Santa Barbara, CA |

| 2. Has at least 2 founders? | False: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | False: $813k to $847k from 2018 to 2019 which is essentially no growth |

| 5. Notable investors? | False: Absence of confirmation in this case is as good as confirmation of absence |

| 6. Post-funding, will have 18 months of runway? | True: At this point has a year of runway and then some. |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 3 | Builds charging docs for electric vehicles, 'Our Unique Product: Our patented HYDRA-RX is the only charger controller on the market that can work with maximum output AC chargers for electric vans and buses at one-tenth of the cost of a typical DC Fast Charger.' |

| 2. Timing? | 2 | Good time for electric vehicles but why is now a good time to install these? |

| 3. Monopoly? | 2 | Small business like market penetration but no winner take all of micro market perceived |

| 4. People? | 2 | Competent old professionals but mainly a bunch of nerds trying to make a product make money |

| 5. Distribution? | 1 | Has to go B2B with very slow inertia orgs |

| 6. Durability? | 2 | Not sure why someone would keep using LAT after install, they seem just like any other provider |

| 7. Secret? | 1 | Applying mostly commodity technology to a unique vertical (school buses) is the way to get a billion dollars |

What has to go right for the startup to return money on investment:

1. Consistently identify the champion who is going to lobby this technology inside their org; 2. Troubleshoot the stalling in growth; 3. Get really good at fast deployment and probably team up with vendor companies to do mass installations

What the Risks Are

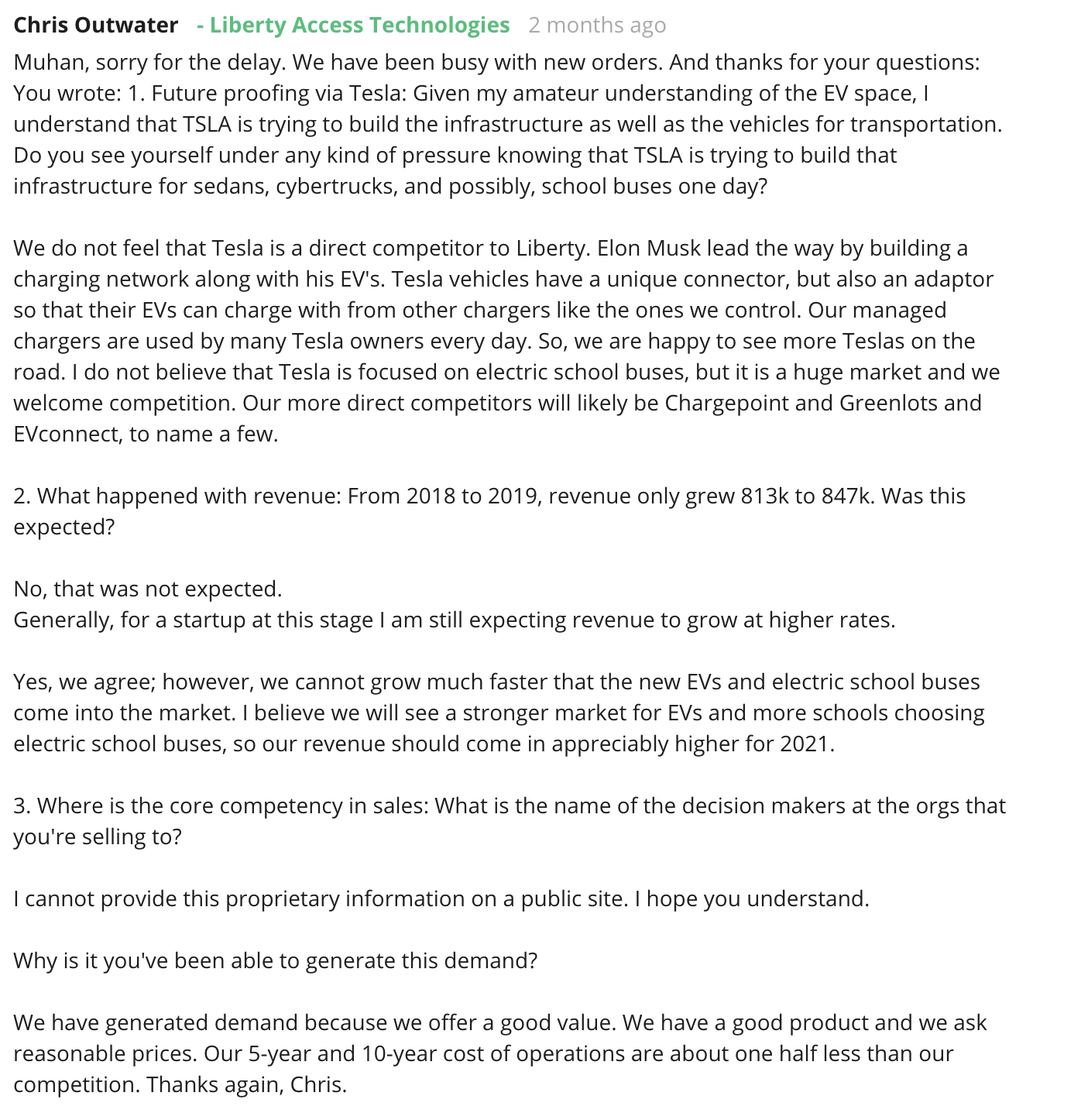

1. This is a hardware technology business and follows a small business growth more than venture growth; 2. Revenue stalled from 2018 to 2019; 3. What happens when Tesla makes a self driving school bus

Bonus Muhan's Notes

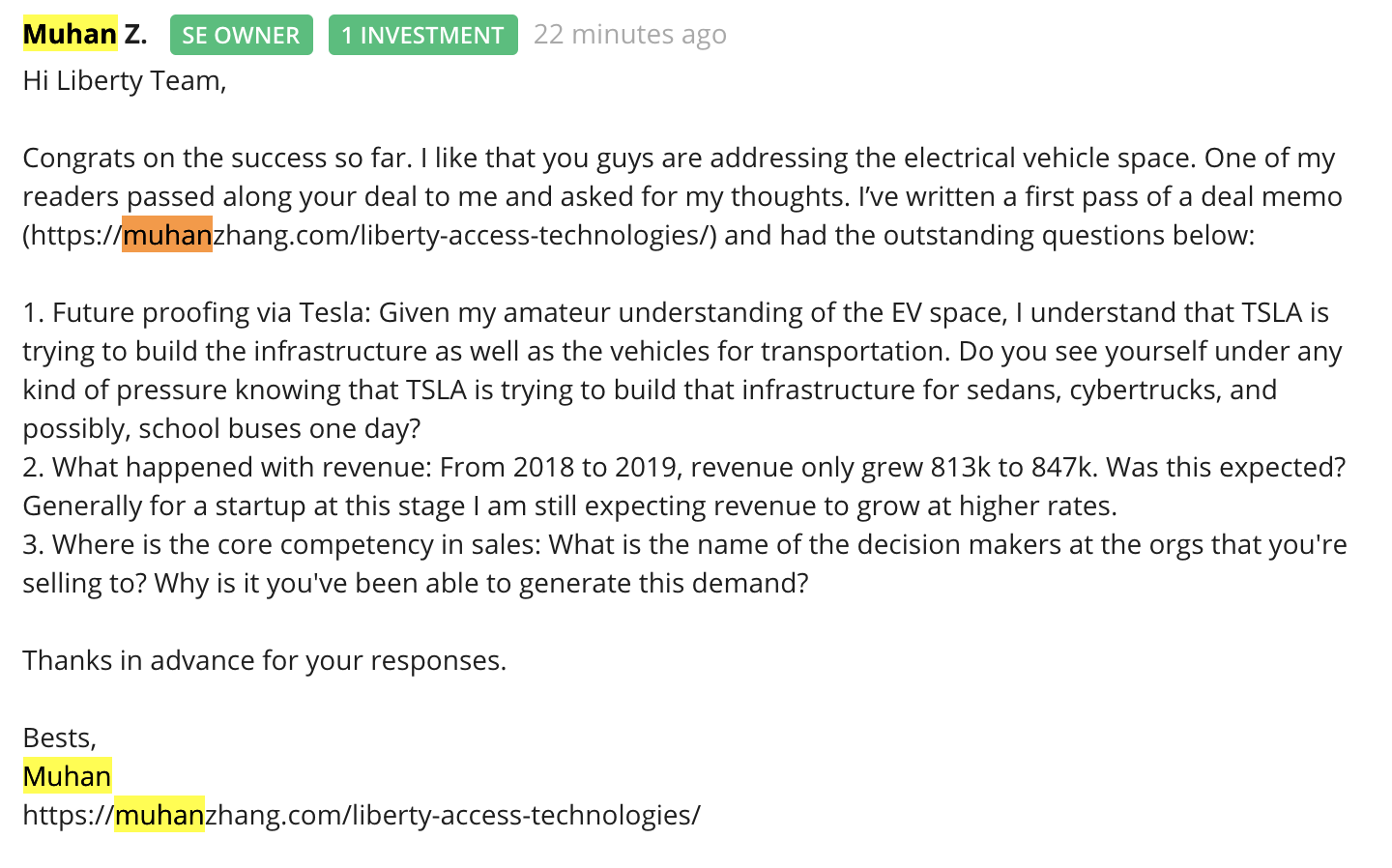

Cool company, will be curious to ask questions and get clarity.

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.