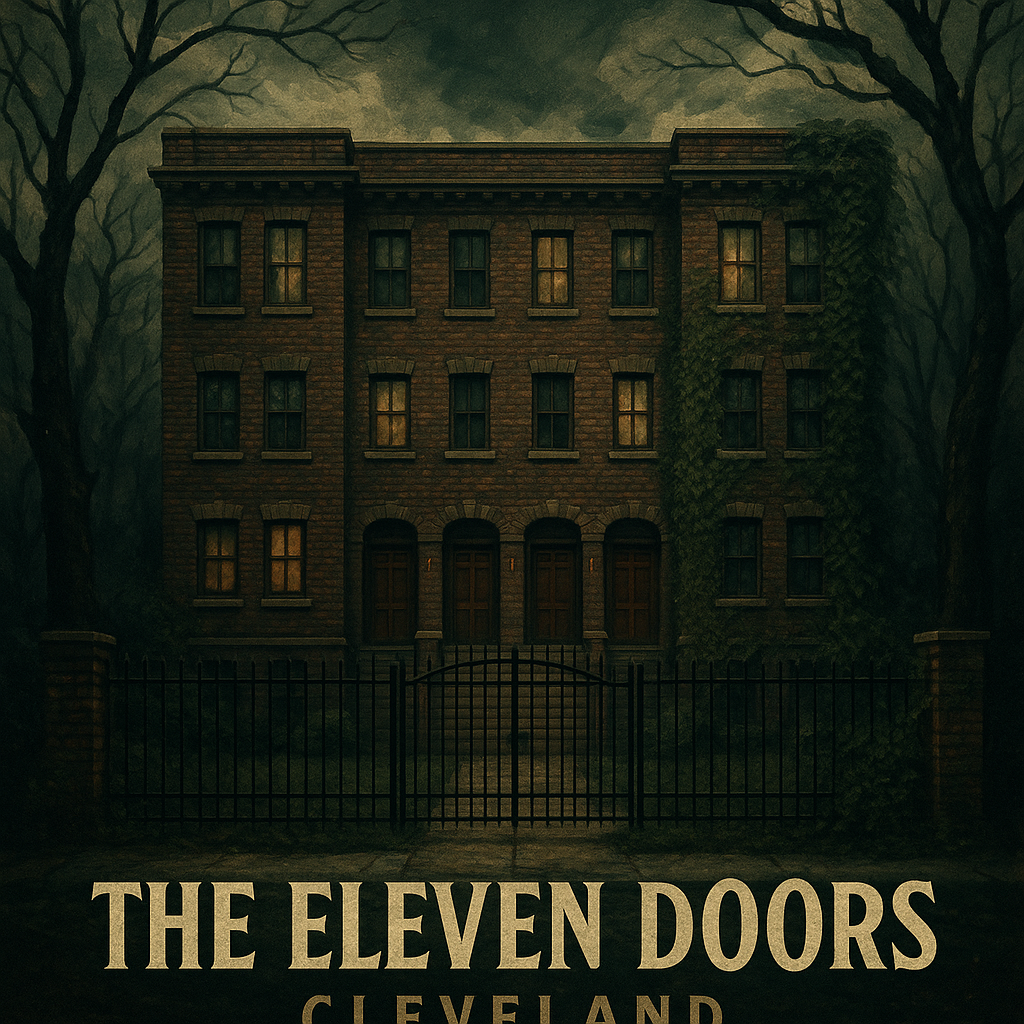

Deal Abstract

Off-Market Deal~

Parkng more notes for premium readers, subscribe to see discussion.

Total value add 11 unit of 1/1's need some TLC to be restored to its glory. Rents are super low, yearly cashflow as well, but what is the realistic ARV and return post reno?

Part 1. The Basics

| Question | Notes |

|---|---|

| 1. Property Name: | |

| 2. Property Full Address: | |

| 3. Property Listing URL: | Off-Market Deal~ |

| 4. Property Year Built: | |

| 5. Property Number of Units/Doors: | 11 |

Part 2. Quantitative, Numbers, and Financials ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Amount/Comment |

|---|---|

| 1. Link to Underwriting Google Sheet: | https://docs.google.com/spreadsheets/d/1drQxSzvmGf4tHPayTWCAXuEN-dgHK4A0NPt2v0_Q9XE/edit?usp=sharing: UNDERWRITING COMMENT |

| 2. Asking Price: | $85652: PRICE COMMENT |

| 3. FFEIC Median Income: | $1: INCOME COMMENT |

| 4. Last Year's Annual Rent: | $34200: RENT COMMENT |

| 5. Last Year's Annual Expense: | $-27347: EXPENSE COMMENT |

| 6. Last Year's Net Operating Income (NOI): | $6852.13: NOI COMMENT |

| 7. 5 Year Internal Rate of Return (IRR): | 11.56: IRR COMMENT |

| 8. Yearly Cash on Cash (CoC) Rate of Return: | 6.7: COC COMMENT |

| 9. Debt Service Coverage Ratio (DSCR): | 1.68: DSCR COMMENT |

Part 3. Qualitative, Pre-Mortem, and Investor Fit (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Why is the seller now? | TIMING SCORE | Very little cash flow, probably doesn't want to operate it anymore |

| 2. Am I the right buyer for this deal? | FIT SCORE | Heavy value add, commercial BRRRR. Rents are limited and units are small, but neighborhood is next to Shaker (though still in city of CLE proper) and very real opportunity to BRRRR all equity out with solid cash flowing units. |

| 3. What has to go right for this deal to work out? | Right Rating | |

| 4. People? | ||

| 5. Distribution? | ||

| 6. Durability? | ||

| 7. Secret? |

What has to go right for the startup to return money on investment:

1. Turn all units and make sure tenants are long term fits, 2. Property benefits from proximity to Shaker, 3. Units nearby also get improved

What the Risks Are

1. Neighboring buildings are not looking good; 2. Being on the wrong side of the tracks; 3. Units are limited in their rent potential

Bonus Muhan's Notes

So enamored by this deal but am I thinking too small?

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.