Deal Abstract

HealthTech company is creating custom social networks for patients with chronic diseases, paid for by pharmaceutical companies.

Financials (VRB)

| Question | Notes |

|---|---|

| 1. Fundraising Target? | $1070000 |

| 2. Fundraised So Far? | $121 |

| 3. Pre-Money Valuation? | $4500000 |

| 4. Previous Year's Annual Revenue | $839500 |

| 5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) | ~$110153 |

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: Washington, D.C. |

| 2. Has at least 2 founders? | False: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: Grew from $0 to $800k |

| 5. Notable investors? | False: None that I recognize |

| 6. Post-funding, will have 18 months of runway? | True: Profitable |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Not fundamentally new technology, but good application |

| 2. Timing? | 2 | Niche apps is good timing, but is the market for Americans with chronic diseases growing at a venture speed |

| 3. Monopoly? | 3 | Great revenue from a small market |

| 4. People? | 2 | Founder has a healthcare background but no tech background |

| 5. Distribution? | 3 | Selling to corporations |

| 6. Durability? | 3 | Very durable as companies won't be incentivized to switch unless they have to |

| 7. Secret? | 1 | Making custom SaaS apps for patients with chronic diseases sponsored by pharmaceuticals is a venture sized opportunity |

What has to go right for the startup to return money on investment:

1. Lock down more sponsors; 2. Get really good at deploying new social networks for new diseases; 3. Build a platform that pharmaceuticals eventually have to pay for, not just think is nice to pay for

What the Risks Are

1. Feature and a nice small business, but not a big business; 2. Market is not growing fast enough; 3. The reason a startup hasn't solved this problem is because it isn't lucrative enough

Bonus Muhan's Notes

Very interesting company with great revenue to valuation ratio. The real question is whether or not they can deliver venture sized returns.

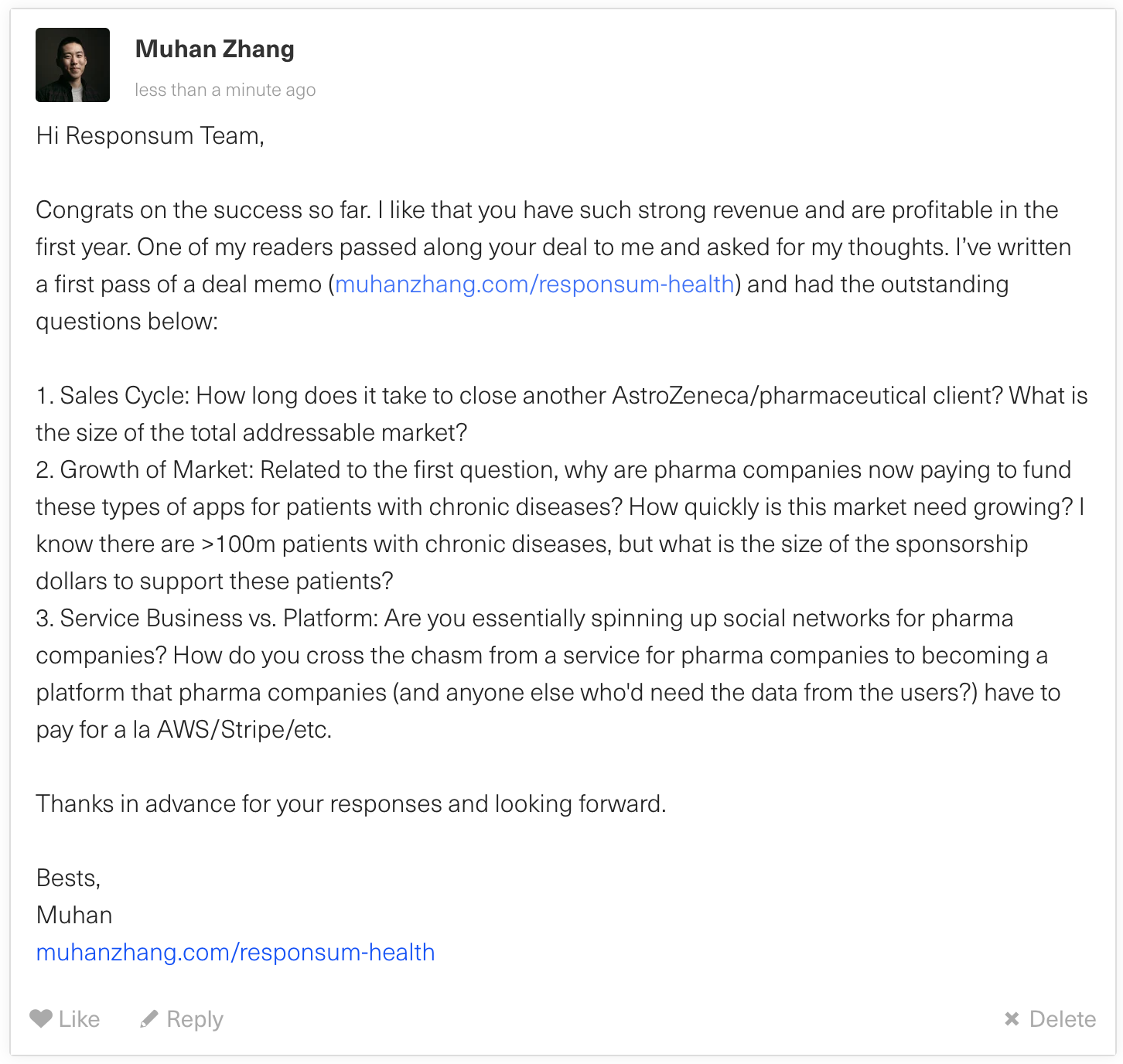

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.