Deal Abstract

Integrated scheduling/job board solution for pharmacies. Has run rate in 2020 of $900k ARR at a $4m valuation. Is Canada healthcare innovation superior to U.S. healthcare innovation??

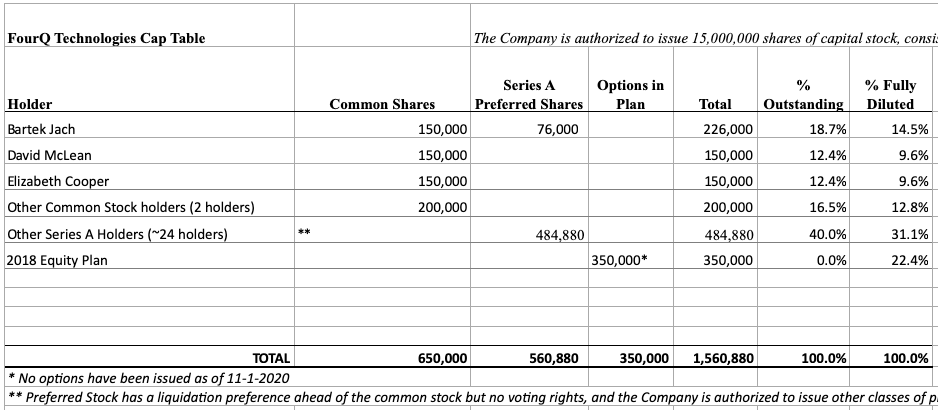

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$2500000|

|2. Fundraised So Far?|$1532500|

|3. Pre-Money Valuation?|$4000000|

|4. Previous Year's Annual Revenue |$37464|

|5. Previous Year's Annual Burn |~$-684543|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | ****: Stillwater, MN |

| 2. Has at least 2 founders? | True: Two |

| 3. Has product in the market? | True: |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: 'Monthly revenue grew 60% from May to June 2020, and is up 80% from July to August 2020 (unaudited), growing during and after the economic slowdown due to the pandemic...We are just over 300K annual revenue with an 8-900K run rate as of this month.. Thanks Moe for asxking. ' |

| 5. Notable investors? | ****: Pat Fry who is an angel investor |

| 6. Post-funding, will have 18 months of runway? | True: Already has 18 months of runway at present |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Not sure this is breakthrough technology, but that's not necessarily bad. |

| 2. Timing? | 4 | COVID has shown how important healthcare timing and coordination is. |

| 3. Monopoly? | 4 | Canada! ('ShiftPosts current users are from many of the major Rx networks in Canada') |

| 4. People? | 2 | Sparse info on all team members but can't argue with results. |

| 5. Distribution? | 3 | See People comment. |

| 6. Durability? | 4 | B2B SaaS-y |

| 7. Secret? | 3 | Incubating an integrated scheduling/job board solution was more efficient in Canada, then enter the U.S. market. |

What has to go right for the startup to return money on investment:

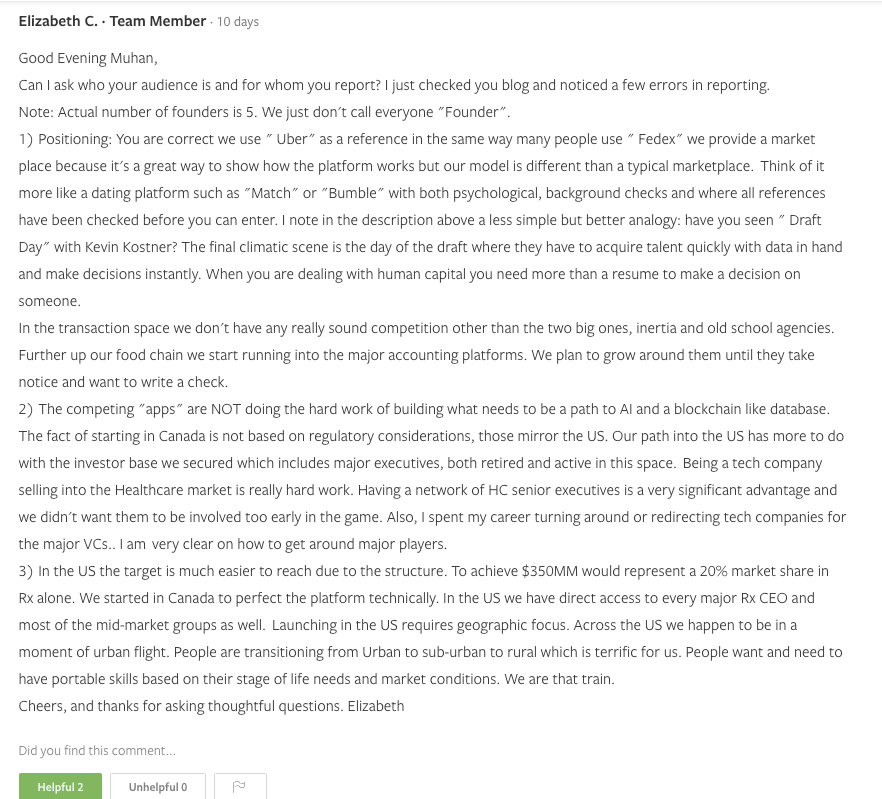

1. Enter the US: successfully and grow position like Canada;

2. Build out the Jobs Function: Why has another generic scheduling startup not eaten this lunch? Is it because of regulation e.g. HIPAA? Or is it that this cannot fail because healthcare so expensive? In which case, really back up the job supply portion;

3. Pharmacies vs. Healthcare: How many pharmacies are there? At what point does this become a scheduling/jobs board for other non-doctor healthcare providers (RNs? NPs? etc.)

What the Risks Are

1. International Risk: Canada might have been a good place to incubate, will see if they can pull of a US entry;

2. Candidate Sourcing: The scheduling software seems generic, but the network of medical professionals who can take shifts seems very valuable and defensible. Building this network out for other locations and practices will be challenging;

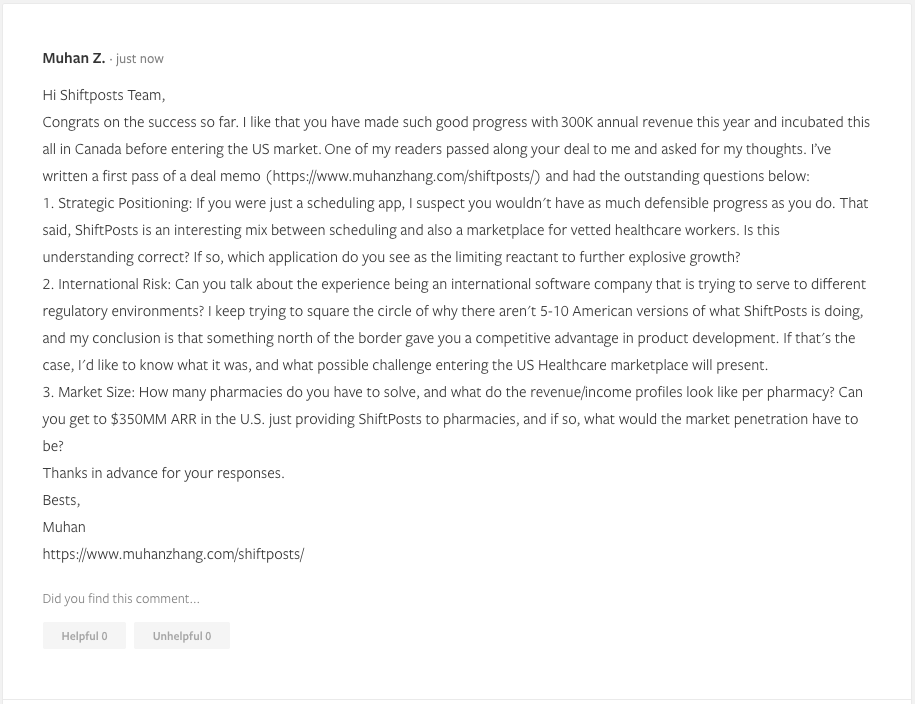

3. Market Size: to get to $350 ARR, how many pharmacies would there have to be?

Bonus Muhan's Notes

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.