Deal Abstract

Another Janover Ventures, but with significantly better fundamentals. But is it venture backable?

Financials (VRB)

| Question | Notes |

|---|---|

| 1. Fundraising Target? | $1700000 |

| 2. Fundraised So Far? | $1551192 |

| 3. Pre-Money Valuation? | $13800000 |

| 4. Previous Year's Annual Revenue | $1219316 |

| 5. Previous Year's Annual Net Income (+ Profitable, - Burning Cash) | ~$159011 |

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: Newark, NJ |

| 2. Has at least 2 founders? | True: Two |

| 3. Has product in the market? | True: Revenue generating |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: $892k to $1219k from 2019 to 2020 |

| 5. Notable investors? | True: Backed by Techstars, Newark Venture Partners, and real estate industry executives |

| 6. Post-funding, will have 18 months of runway? | True: Appears to be profitable |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 3 | Real techies coming in to solve this problem |

| 2. Timing? | 3 | OwnUp for commercial real estate |

| 3. Monopoly? | 3 | Really strong revenue numbers |

| 4. People? | 4 | Strong techie team |

| 5. Distribution? | 2 | No crazy unfair advantage, but digital native marketing strategy |

| 6. Durability? | 3 | Big data play |

| 7. Secret? | 2 | Commercial mortgage and financing is going to go digital transformation at a venture paced speed |

What has to go right for the startup to return money on investment:

1. More real estate professionals have to go digital native; 2. Find the power users and exploit those who need constant new financing; 3. Monetize a pricing engine

What the Risks Are

1. Commercial real estate financing to digital transformation is not venture back-able development, 2. New technology for mortgage quote a nice feature but not a painkiller product; 3. Some mortgage brokers get their act together or get acquired by another fintech company and digitize their rolodexes (though I confess this last one is a stretch to me.)

Bonus Muhan's Notes

So cool. Need to ask against Janover Ventures.

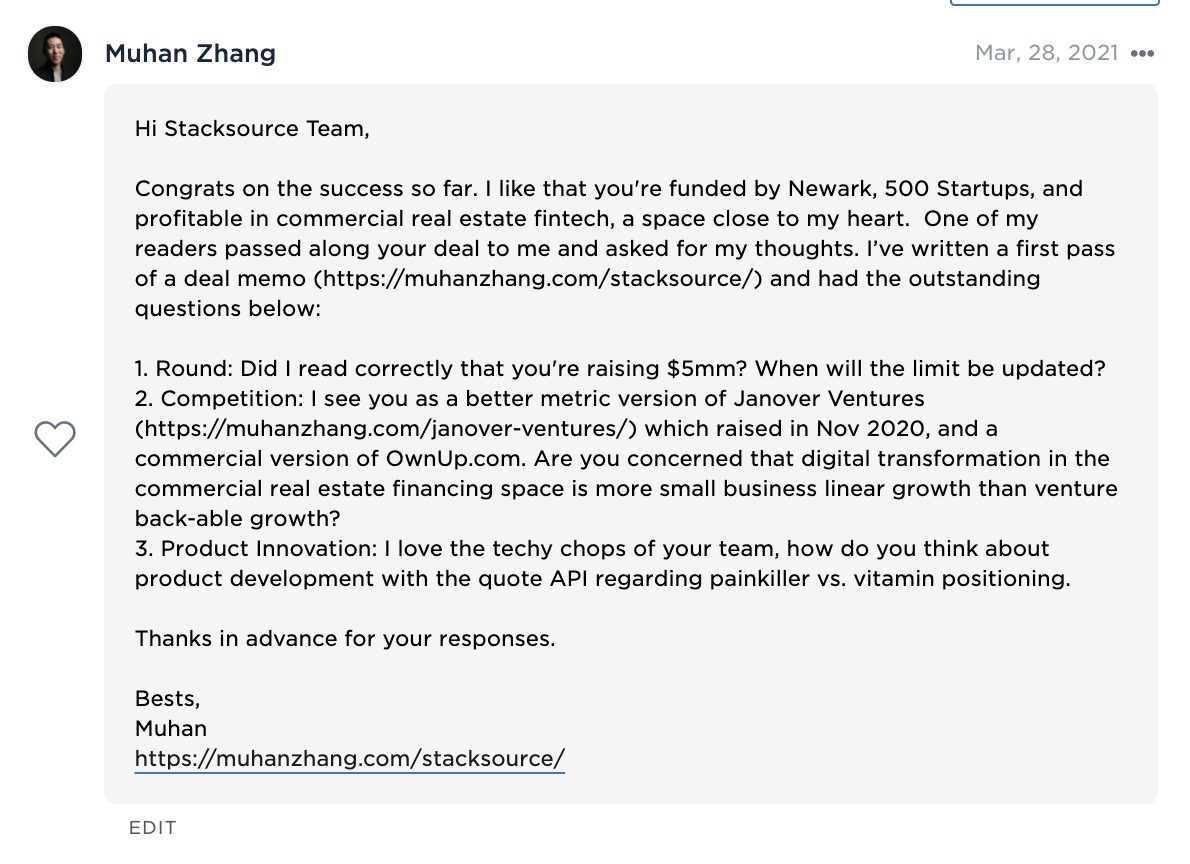

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.