Deal Abstract

'Earth conscious investment Product that has traction, patents, healthy growth of revenue and profitable soon. Contracts with multiple outlets already in place. Can't find a reason not to invest.'

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$1070000|

|2. Fundraised So Far?|$245906|

|3. Pre-Money Valuation?|$13000000|

|4. Previous Year's Annual Revenue |$6575838|

|5. Previous Year's Annual Burn |~$-430928|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | False: Brooklyn, NY |

| 2. Has at least 2 founders? | False: Two |

| 3. Has product in the market? | True: |

| 4. 6 months of continuous user growth or 6 months of revenue? | True: 2018 rev was $2.8m and 2019 rev was $6.6m |

| 5. Notable investors? | False: The Seed and WeWork aren't that notable as venture investors. |

| 6. Post-funding, will have 18 months of runway? | False: At present would need ~$750k for 18 months and has only raised $200k. |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Better than non-recyclables, but the folding aspect doesn't seem like a 10x improvement. |

| 2. Timing? | 2 | Good time to make eco-conscious cups, but not sure why a better timing wasn't either 5 years ago or 5 years from now. |

| 3. Monopoly? | 2 | Don't know anyone who has one, that said, good numbers. |

| 4. People? | 2 | Team seems to have some good D2C brands, but unsure what CEO's previous experience was. |

| 5. Distribution? | 2 | Good, e-commerce and teaming up with Starbucks and other partners. |

| 6. Durability? | 1 | This portion I'm the least certain about. Patents are nice, but is this really defensible? |

| 7. Secret? | 2 | Collapsible reusable thermos' and cups are an enormous untapped market that other cup/bottle makers haven't figured out yet as an enormous market. |

What has to go right for the startup to return money on investment:

1. Grow efficiently; 2. Continue to innovate on new high margin products; 3. Become a lifestyle brand that arbitrages a network of high expertise in plastic manufacturing to all forms of CPG

What the Risks Are

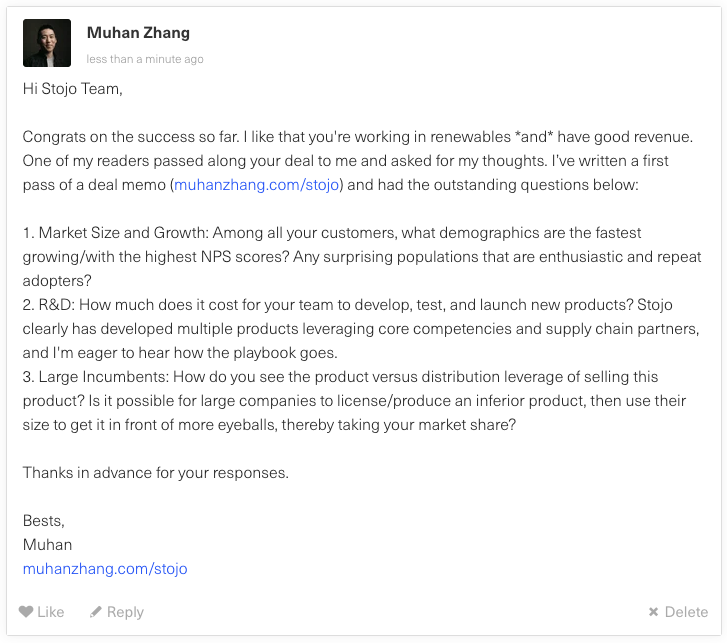

1. Market size and growth; 2. Cost and replicability of new product R&D; 3. Large incumbents catching on and becoming competitors if the market proved to be sizable enough.

Bonus Muhan's Notes

The folding function is indeed very cool! I wonder how it's washed?

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.