Deal Abstract

OwnUp.com for commercial real estate financing. Fundraising $1m on a $20m valuation. Has revenues of $531k from network of websites that drive traffic to them. Profitable. Strangely, claims to have a team of 20 (full-time? part-time?) on a burn of only ~$376k or something. I tested the product and didn't get a response.

Thank you to Krishna and Giuseppe for sending me the deal!

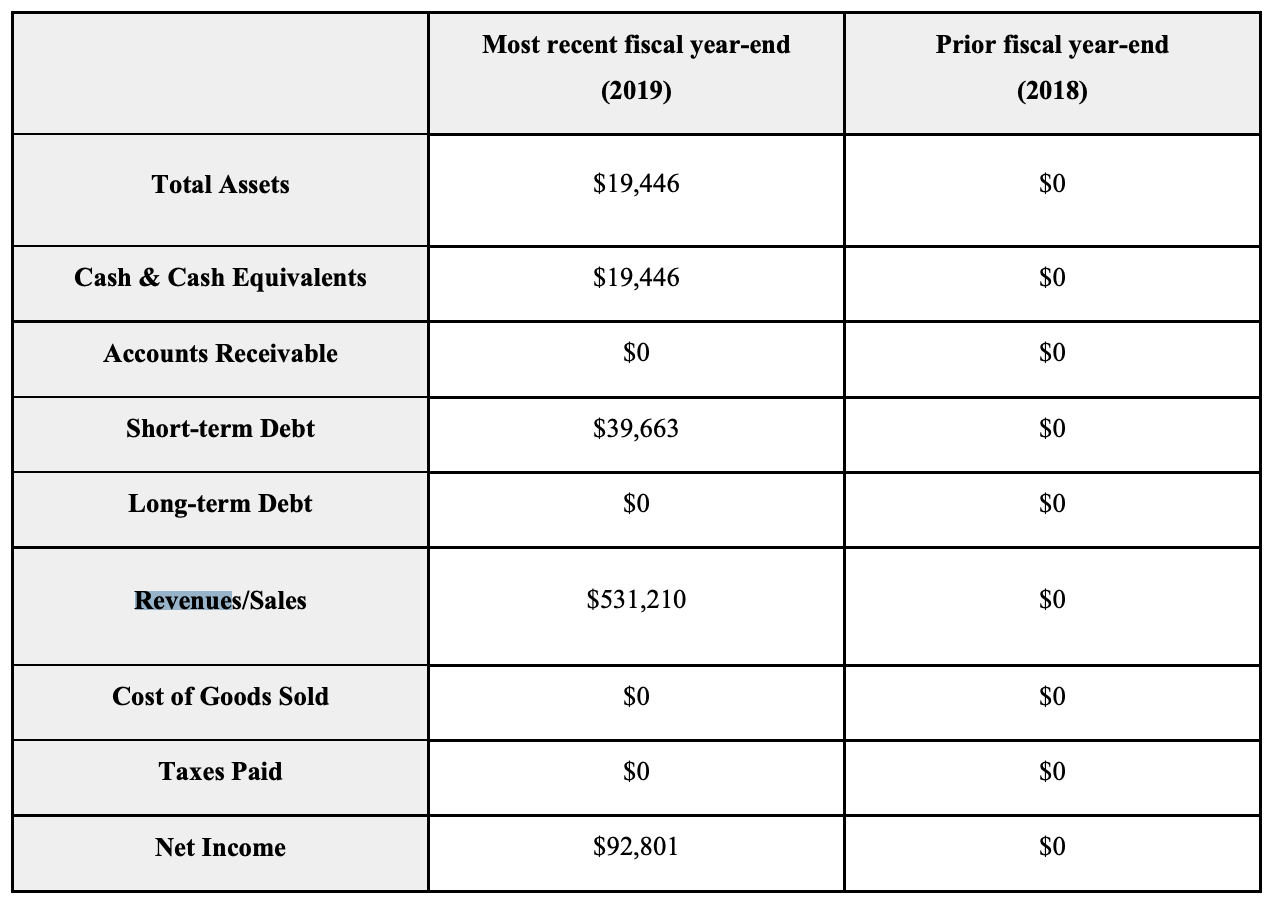

Financials (VRB)

|Question|Notes|

|---|---|---|

|1. Fundraising Target? |$25k-$1070k|

|2. Fundraised So Far?|$449k|

|3. Pre-Money Valuation?|$20m|

|4. Previous Year's Annual Revenue |$531k|

|5. Previous Year's Annual Burn |~(-)$92k|

The 6 Calacanis Characteristics ("Sow Passion, Not easy mediocrity", or S2 P6 N18)

| Criteria | Yes/No |

|---|---|

| 1. A startup that is based in SV? | No: Boca Raton, FL |

| 2. Has at least 2 founders? | No: One CEO, bootstrapped |

| 3. Has product in the market? | Yes |

| 4. 6 months of continuous user growth or 6 months of revenue? | Yes: 2018 revenue to 2019 revenue increased from $0 to $500k. |

| 5. Notable investors? | No: Bootstrapped. |

| 6. Post-funding, will have 18 months of runway? | Yes: Profitable, so can reun in perpetuity by default. |

The 7 Thiel Questions (Every Time Man Profits, Don't Dismiss Serendipity)

| Question | Score | Notes |

|---|---|---|

| 1. Engineering? | 2 | Using a platform to bridge marketplace, nothing revolutionary |

| 2. Timing? | 2 | Good, this is the commercial version of OwnUp.com, but not sure if the market of B2B is as amenable to commoditization. |

| 3. Monopoly? | 2 | Never heard of Janover before this deal. Commercial financing is very fractured. |

| 4. People? | 2 | One founder seems fine, but not seeing other C-suite leadership. Also, somewhat suspect that they only spent $376k in 2019 and appear to employ 20 full-time people. Even at $50k a year that should be $1mm in salaries alone. |

| 5. Distribution? | 3 | Good, distribution is this company's edge. |

| 6. Durability? | 3 | Good, as two sided network places and trust would imply flywheel effect. |

| 7. Secret? | 2 | Using digital platforms and marketplace dynamics, Janover can help more lenders and borrowers collaborate for commercial financing, in addition to driving efficiency on due diligence and processing. |

What has to go right for the startup to return money on investment:

- Pent Up Commercial Financing Demand: how much additional demand can Janover unlock by improving the UI/UX service in seeking commercial financing?

- Build a Trustworthy Brand: all the site brands that Janover introduced so far are somewhat sketchy. In order to facilitate large quantity of business transactions, Janover has to feel more established.

- Self-Service Matching Technology: being an advisor is nice, but ultimately, not a scalable business. Needs to verify lenders/borrowers enough where each can self service.

What the Risks Are

- Market Risk: mortgage brokers are fine, as are technology enabled mortgage brokers. That said, you can have the best technology in the world, but if the market prefers consolidation due to commercial real estate working with relationships and backroom deals, then this business will be stillborn.

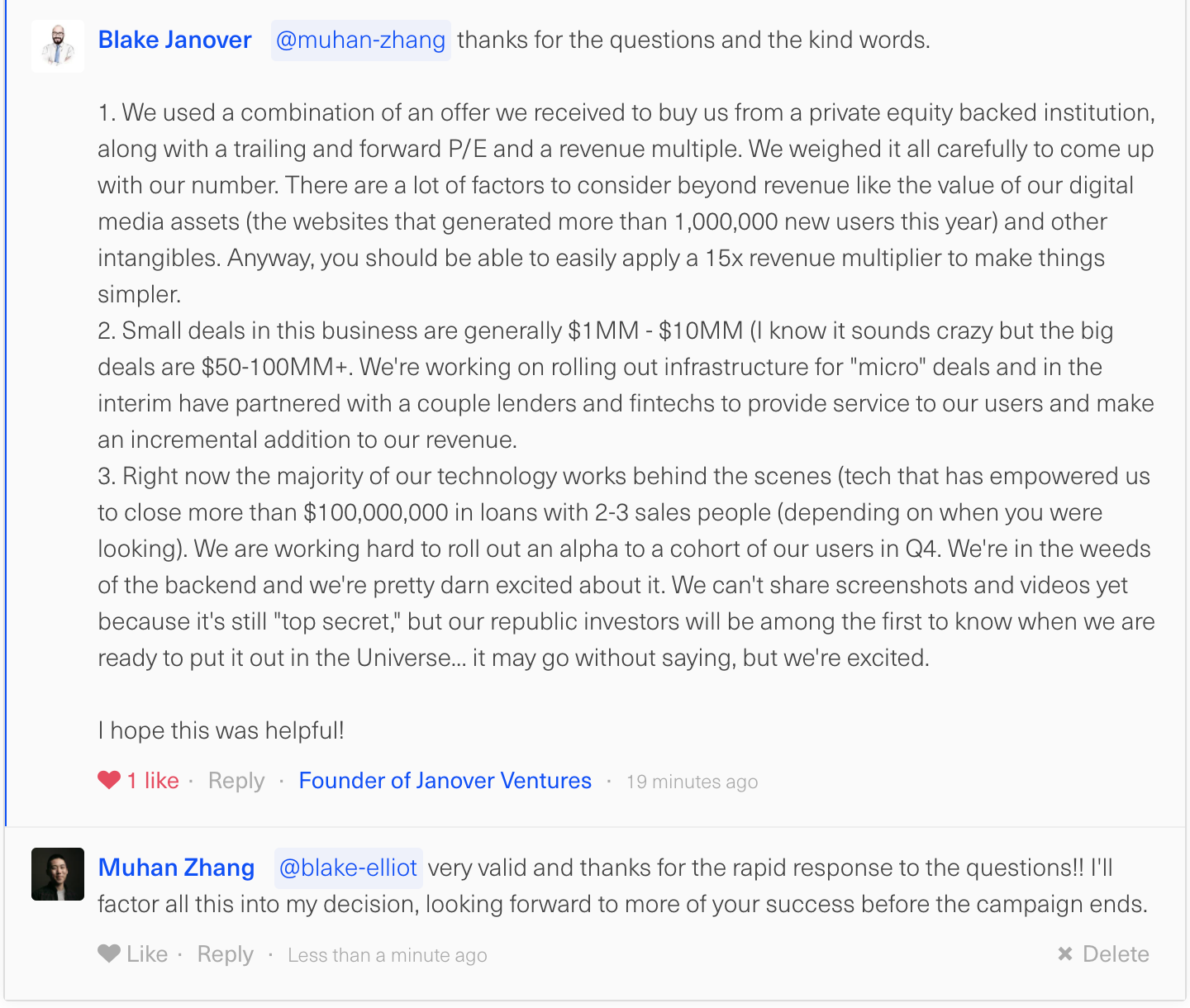

- Technology Risk: not seeing how the company is going to use technology to make things more efficient. Lots of nice videos, no screenshots or videos of the platform a la Contiq.

- Valuation Risk: $20m is a high valuation for a company only making $500k in revenue.

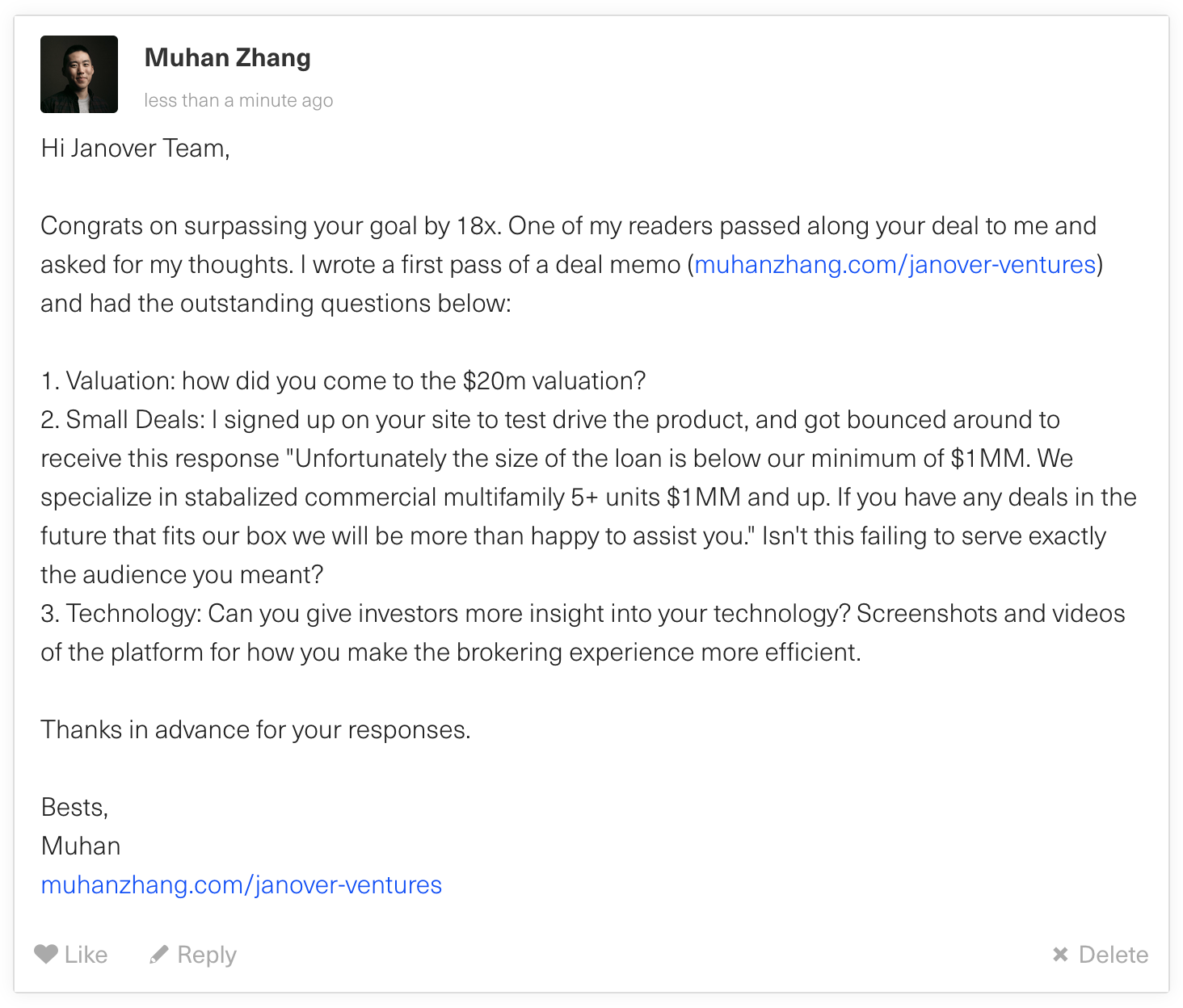

Bonus Muhan's Notes

Commercial real estate financing is something I have experience in—I filled out a lead on Janover Venture's website, and was not able to get connected to any financiers. So my ability to test the platform was limited and I can't verify the product is real.

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page.

Review these deal memos every time the startup raises a new round

Test if original thesis still applies

Notice trends in how you think

So, did I invest?

Click here to find out.Other thoughts, questions, comments, or concerns? Write me at mail@muhanzhang.com and let me know.